Fraud

Anyone’s identity can be stolen these days

1st November 2024

19th January 2022

Starling financial crime specialist, Paul Schiernecker, explains what a money mule is and how to stay safe.

Perhaps you’ve seen an ad like this before, on social media or online? Amazing opportunity, convenient employment and quick cash. But stop and have a think. Is this too good to be true?

In fact, criminals may ask to use your bank account, promising a percentage of the funds as a form of payment. Moving money through your account on behalf of someone else could mean you are committing financial crime. The consequences of such activity can be very serious.

A money mule is someone who transfers criminal proceeds between accounts, sometimes taking a small percentage as their own fee. They may themselves have no knowledge of the wider crime.

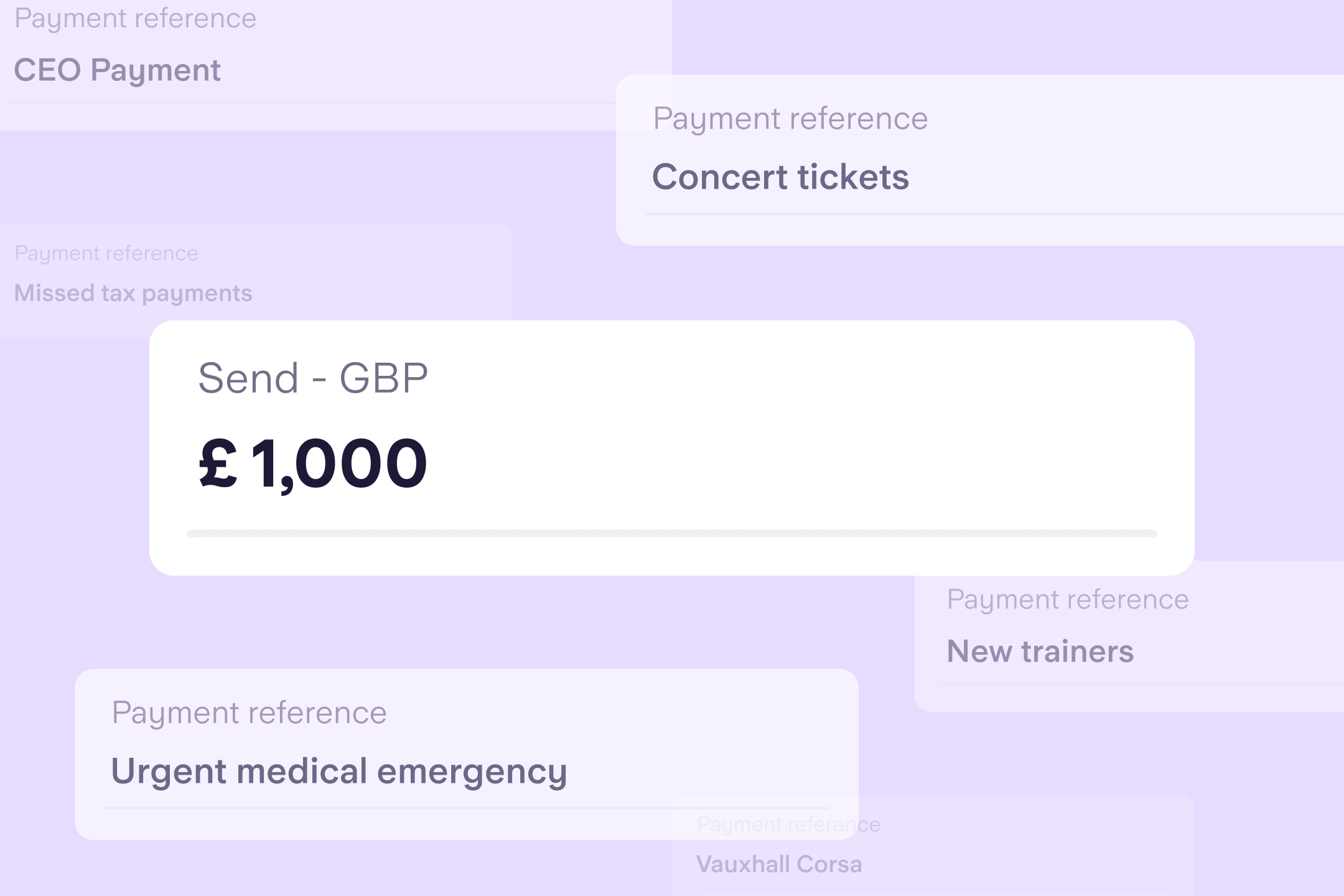

Money mules are recruited, sometimes unwittingly, by criminals to transfer illegally obtained money between different bank accounts. This may be referred to as “flipping” the money. Such activity may include a request to transfer money, withdrawing cash or providing your bank card to a third party for a percentage of the funds as “payment”. It’s also possible to act as a money mule by sharing your login details or allowing someone else to take control of your bank account.

Recruitment can take place through job offers, posted to legitimate job sites. Such “work” can mention opening a bank account specifically to receive funds, or using a different phone and SIM card to undertake any conversations in relation to the work. It’s unlikely to include meeting the employer.

Posts on social media platforms such as TikTok, Facebook, Snapchat or Instagram may offer the opportunity to “make money fast”, advertise particular banks they are willing to pay funds to and are likely to target students, young people or other vulnerable groups. Hashtags such as #moneyflipsUK, #EasyMoney and #Flipsanddeets may be included.

Cifas (the not for profit fraud prevention service) figures from 2022 state there were over 40,000 cases recorded that displayed information indicative of money mule behaviour. And these cases represent almost 70% of cases where bank accounts have been misused. Personal current accounts are the main targets for money mule activity (in 87% of cases), but there’s been a big increase in the misuse of personal savings instant/easy access accounts too.

Such activity can also include moving money as a “favour” or applying for a “loan” on behalf of someone else. There are even instances where funds are received “in error” and requested to be returned to a different bank account altogether.

By doing this, you could be helping move money linked to serious criminal activity including money laundering or terrorist financing. In doing so, you are committing a crime.

It’s often only after having moved the money that individuals discover the devastating personal and financial repercussions.

A prison sentence of up to fourteen years

Your bank account being closed and struggling to open a new one

Your details being shared with fraud prevention agencies e.g. Cifas

Being denied various forms of credit (including phone contracts and student loans)

Don't accept any job offers that ask you to use your own bank account to transfer their money. No legitimate company will ask you to do this

Familiarise yourself with the Take Five campaign and stop, challenge and protect your livelihood

Practice vigilance around international job offers. It may be harder to track their true intentions

Never give your financial details to someone you don’t know and trust

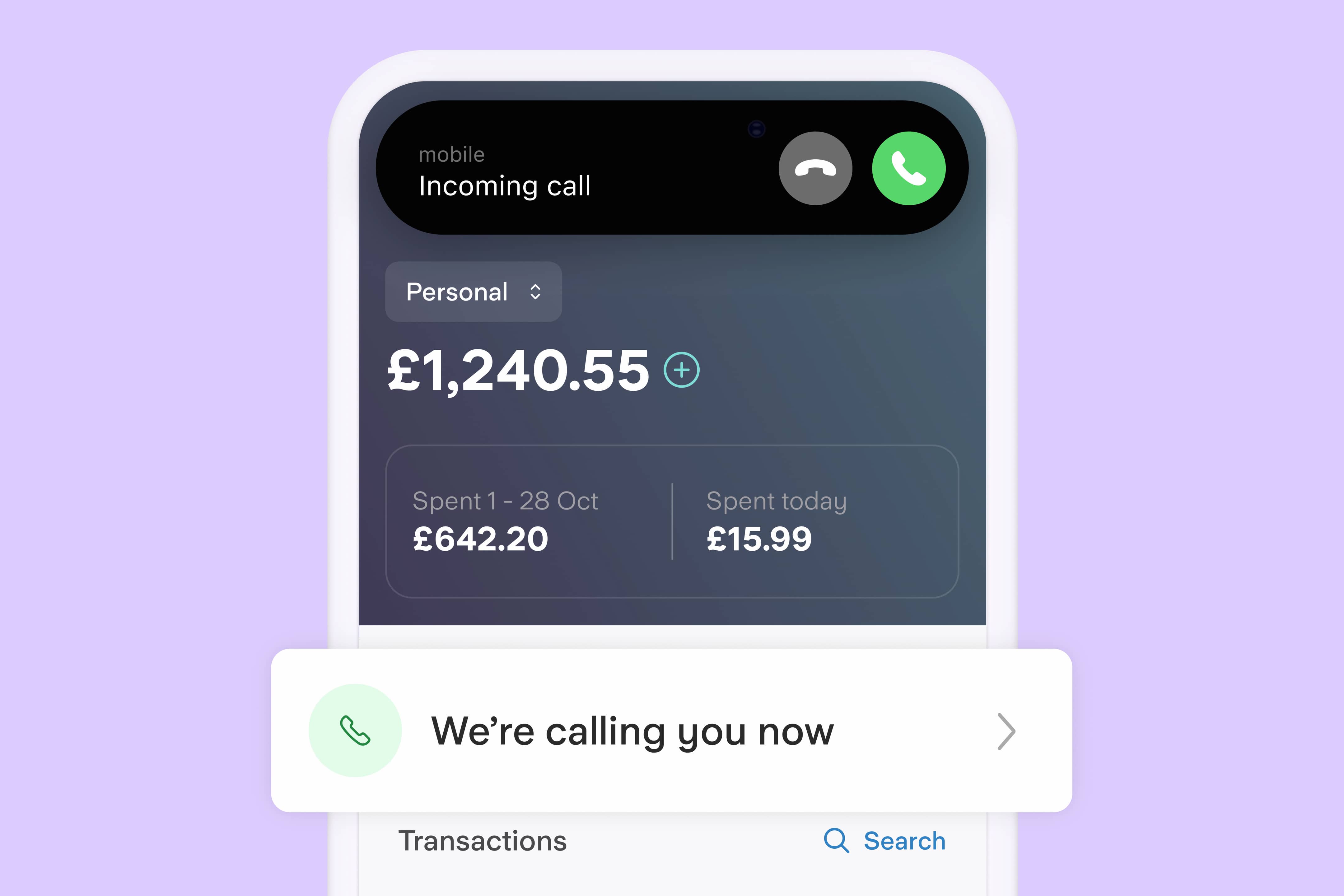

Never give anyone access to your bank account

If you have children, financial education about money muling raises awareness and encourages them from making the wrong choices. Have those conversations now

If you think you’ve been approached to be a money mule or have been caught up in a money laundering scheme, the best advice is to stop transferring money immediately and notify your bank.

You should also contact Action Fraud, the national reporting centre for fraud and cybercrime, or Police Scotland if you live in Scotland.

To find out more about money muling, further guidance is available from UK Finance.

Article updated: 5 March 2024

Fraud

1st November 2024

Fraud

1st November 2024

Fraud

4th October 2024

Money Truths

29th May 2025

Money Truths

28th May 2025

Money Truths

20th May 2025