Fighting fraud

Six tips to combat impersonation scams

By Starling Financial Crime Specialist

Fighting fraud

You might not worry much about throwing away your old bank statements or an online video of your dog Rosie doing something adorable on her birthday – but you should. Why? Because fraudsters could use this information to impersonate you – for their own benefit.

Identity theft is on the rise. According to The Global Anti-Scam Alliance, 12% of British people were targeted by identity thieves from 2023 to 2024.

With enough personal information, they can gain access to existing accounts you own (like a bank account), apply for new financial products (like a loan), or even apply for government benefits or documents, such as passports or driving licences – all in your name.

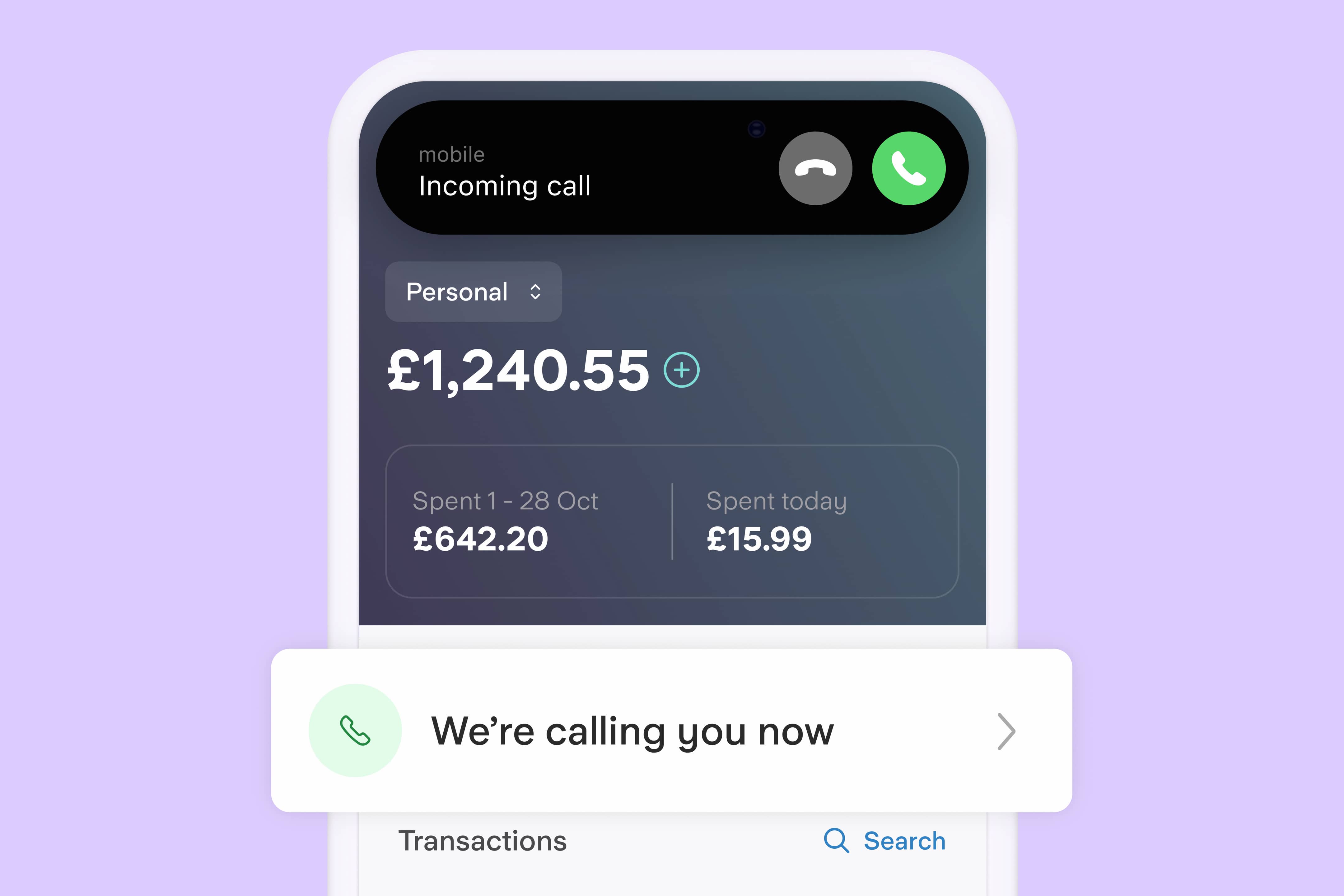

Making sure you’ve got the right measures in place to keep your information safe is key. If someone calls you saying they’re from Starling Bank, you can verify if they’re telling the truth by opening your app and checking the ‘Call status’ banner. If we’re on the phone with you, the banner will say ‘We’re calling you now’ or ‘You’re on a call with Starling’, unless you haven’t updated your app or don’t have an internet connection. If the person you’re speaking to says that the banners aren’t working or that they’re from a department that doesn’t use them, please be very careful – they could be trying to trick you.

If you think you’re speaking to a fraudster, hang up immediately and call 159 to speak directly to our fraud team.

Criminals can build up a complete profile of an individual by sourcing information through:

Social media: We post a lot about ourselves on social media, which makes it a valuable tool for fraudsters. Adjust your privacy settings and remember that comments you make on social media posts may be public (this is why you should never reply to Facebook posts which ask you to comment with your mother’s maiden name/pets name/first school).

Phishing/smishing: Phishing is when a fraudster sends an email pretending to be from a reputable company and asks for personal and/or financial information. Smishing works in the same way, using texts instead of emails.

Stolen or lost post: Many fraudsters won’t hesitate when it comes to getting their hands dirty – they’ll sift through rubbish to find bank statements and other important documents, which is why you need to be careful about what you throw away. Post that accidentally gets delivered to an old address can also be a source of information to criminals.

Data breaches/hacking: Criminals can use sophisticated techniques to steal customer or employee information, often by hacking into a company’s system. They might also gain information by hacking into your email account or a social media account.

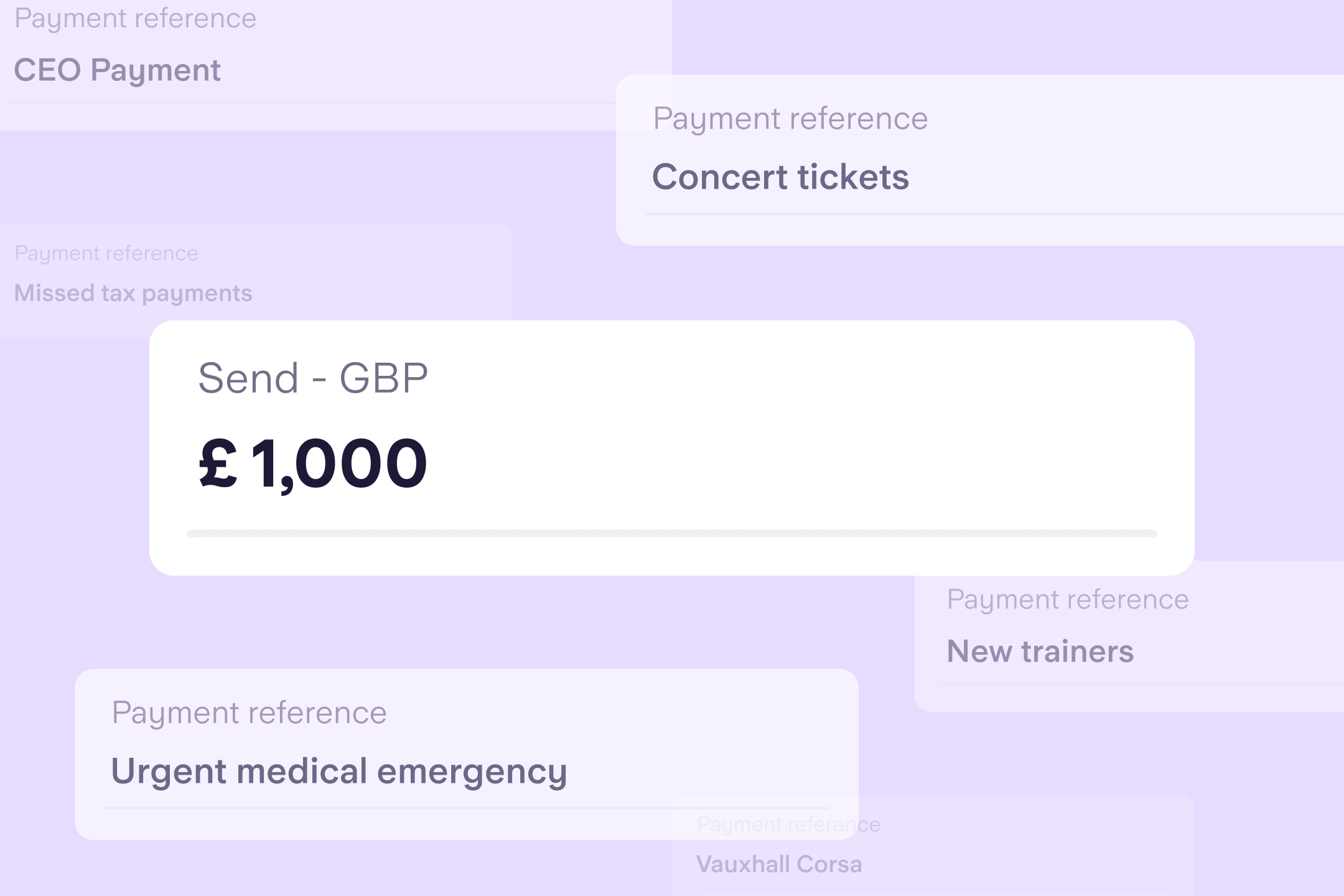

Take over existing accounts by impersonating you: If a fraudster has enough information, they could call your bank, pass security checks with the information they have and arrange for money to be moved into their account.

Apply for financial products: Applying for credit cards, mobile phone contracts, loans or government benefits are all ways a fraudster could use your data for their own financial gain, which could negatively affect your credit score.

Apply for government documents: By applying for duplicate passports or driving licences in your name, a fraudster could facilitate other types of organised crime.

Trick you into paying them money: Criminals could use what they know about you, for example your bank account number or Government Gateway user ID, to convince you they are contacting you from your bank or HMRC. This would be known as an impersonation scam. If you’re a Starling customer, you can check whether you’re really speaking to someone from our Customer Service team or Fraud team by opening your Starling app and checking the ‘Call status’ banner.

Sell information on the dark web to other criminals: The dark web is a part of the internet that is only accessible via specialised web browsers. It’s used to keep activity and messages anonymous and can be exploited by members of organised crime groups.

Be vigilant on social media: Make social media pages private and never accept friend requests from people you don’t know. Check your privacy settings across all platforms regularly and think about what data you’re giving away every time you create a new post and write a comment.

Create strong passwords: Make sure your passwords are different for all your accounts and that they contain random words and different characters (like numbers and symbols) so it’s harder to guess. Use a password manager to store your passwords – you need to make it as hard as possible for someone to access your personal information. If they find out your PIN code, will they also know the code for unlocking your phone? Don’t duplicate.

Never click on links: Don’t click on links in texts or emails without checking them first. If you’re on a laptop, you can do this by hovering over it and if you’re using your phone, you can press down and hold on the link. Don’t use those links to provide personal or financial data or login. Always go to the trusted website to ensure you’re giving your data to a genuine institution.

Do your own research: Verify anyone who asks for copies of your identity documents. For example, if you’re renting a property or starting a new job, make sure that the person asking for a copy of your passport is a legitimate employee and has a real reason to ask for your identity documents.

Get rid of documents properly: Shred or obscure any documentation containing your information before throwing it away or recycling. Destroy or wipe information from any old credit cards, sim cards, devices or hard drives before disposing of them.

Redirect mail if you need to: Use the Royal Mail’s mail redirection service to ensure your old post goes to your new address if you move house. You can arrange the service for 3, 6 or 12 months. Prices start at £39.50.

Check your credit report regularly: Make sure there aren’t any unrecognised searches or accounts on your credit report – has someone tried to take credit in your name and been rejected? The main Credit Rating Agencies, Experian, Equifax and Transunion, have an obligation to give you a copy of your credit report for free. You could also use a free app, such as ClearScore, to check your credit report. Checking your credit report won’t impact your credit score.

Keep things updated: Keep the security software on your computer, phone and other devices up to date. Software updates often include fixes that make it harder for criminals to steal your information.

Report lost or stolen items: If someone’s stolen your passport or driving licence or they’ve gone missing, report it as soon as possible.

Report any fraudulently opened credit or bank accounts by calling the credit card company or bank using the number on their website. They will be able to investigate the fraud and close any accounts that you didn’t open.

Report unsolicited credit searches to the company that carried out the search. You need to stop any applications in their tracks.

Report stolen mail to Royal Mail. Its investigation unit will be able look into it for you.

Register that you have been targeted by an identity thief with Cifas’ Protective Registration. This will add a note to a secure National Fraud Database so that registered financial institutions know to take extra precautions when receiving applications that use your details.

Change your passwords if you’re worried one of your accounts may have been compromised or hacked. You may also want to check your social media followers and remove people you don’t recognise.

For more information and advice about identity fraud, visit our friends at Take Five and Action Fraud.

How else can you protect yourself from online scams and fraudsters?

Read more guides from our fraud team

Fighting fraud

By Starling Financial Crime Specialist

Fighting fraud

By Starling Financial Crime Specialist

Fighting fraud

By James Nesbitt

Fighting fraud

By Starling Financial Crime Specialist