International bank transfers

Send money abroad

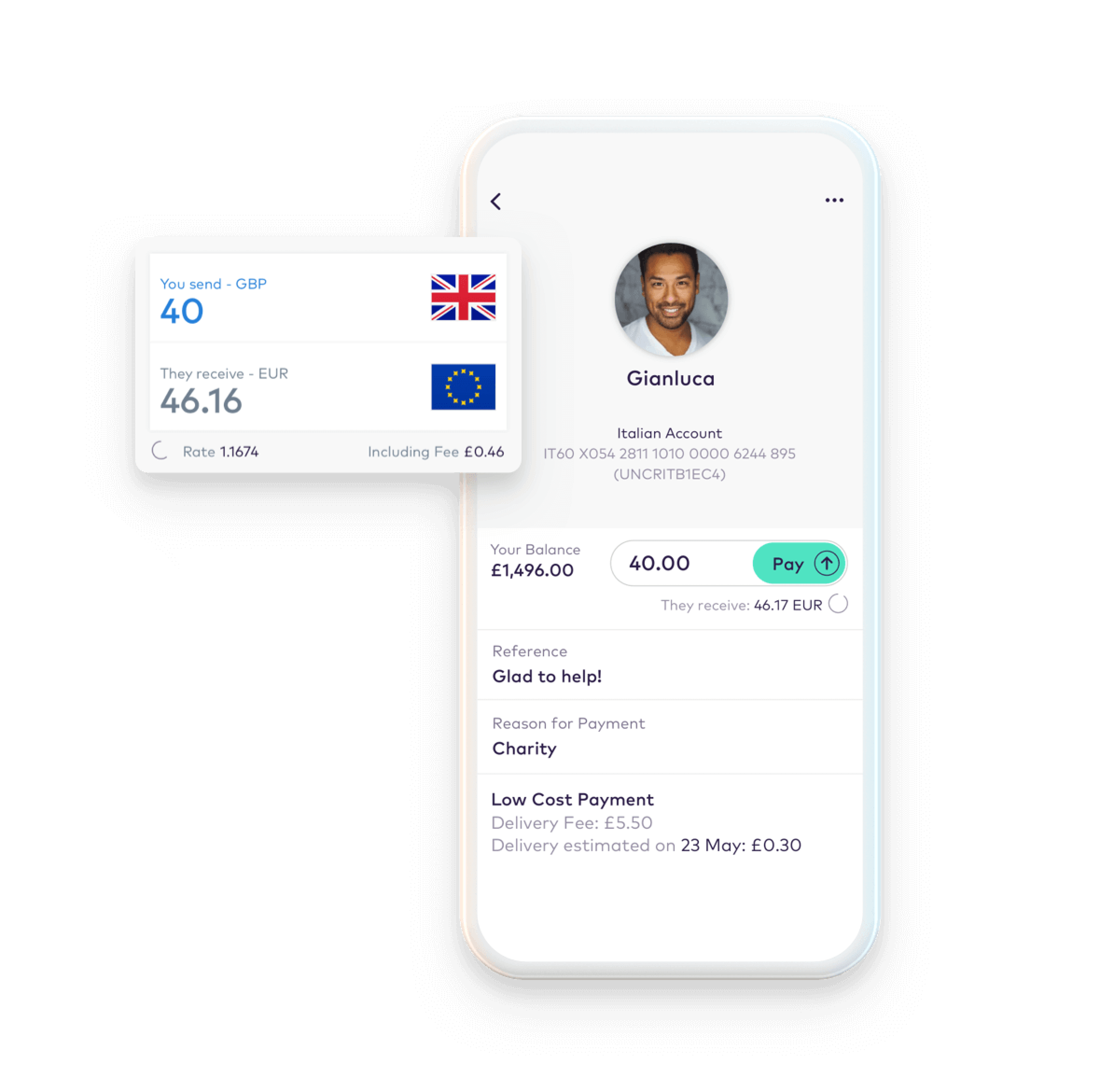

Fast and secure money transfers to bank accounts in 34 countries worldwide, with no hidden fees.

Apply for a personal accountHow to send money abroad, the easy way

Why should I send money abroad with Starling?

It’s easy. Transfer money abroad without leaving your banking app or using an extra transfer service.

It’s competitive. We keep our exchange rates and fees fair and transparent, so you always know what you’re paying.

It’s fast. Our standard send is usually speedy – but if you’re in a hurry, you can opt to make a direct SWIFT bank-to-bank transfer (for a slightly higher fee).

Plus, you can send money to 34 countries, in 17 currencies worldwide, including euro, US dollar, rand and zloty.

Just so you know: We process international payments from 02:00 Monday to 22:00 Friday. International payments are not available on weekends and bank holidays.

What if I only want to deal in euros?

If you’re all about the euro, then look no further than Starling’s euro account. You can hold, send and receive euros, all completely free of charge. Intrigued? Rightly so – take a look at the euro account.

About our fees

Our fees are always fair and transparent. We apply a 0.4% fee to the currency conversion and a small delivery fee to cover our costs.

Priority delivery with SWIFT

Need to get it there quickly? You can opt to make a direct bank-to-bank payment with SWIFT instead, for a flat delivery fee of £5.50.

Local network payment

Send your payment via a local partner – for some currencies, it can take a little longer, but prices start at just 30p per transfer.

Learn the difference between our payment options and which to choose.

Our exchange rates explained

We know how important a great exchange rate is when you’re sending money abroad. Here’s how we keep ours competitive:

No hidden fees

We’re upfront about any costs, so you’ll always know what to expect. Your money, your decision – just how it should be.

A fair rate

The exchange rate we use is the actual market rate we are charged for buying and selling currencies. Use our currency converter calculator to work out the exchange rate.

A guaranteed rate

We’ll guarantee your exchange rate for 30 seconds*, which means you’ll get the exchange rate you’ve been quoted, even if it changes. It’s only fair.

*We process international payments from 02:00 Monday to 22:00 Friday. International payments are not available on weekends and bank holidays.

Looking for help?

Head over to our help centre for further information on international payments. It’s often the quickest way to get the answers you need – from within the app or online.

Visit our help centreApply for a Starling current account and enjoy app-based banking at its best.

Step 1

Simply click on the button below to start your application and fill in a quick, fuss-free form.

Step 2

Download the app on your phone and we’ll ping over a verification code for you to enter.

Step 3

Create an account by telling us a bit about yourself: your name, date of birth, email and current home address.

Step 4

Finally, record a quick selfie video and take a photo of your ID so we can verify everything. And that’s it!