Award-winning business banking with Starling

Apply for a digital business account with zero monthly fees and join a growing community of UK businesses who have changed the way they bank.

Award-winning business banking with Starling

Apply for a digital business account with zero monthly fees and join a growing community of UK businesses who have changed the way they bank.

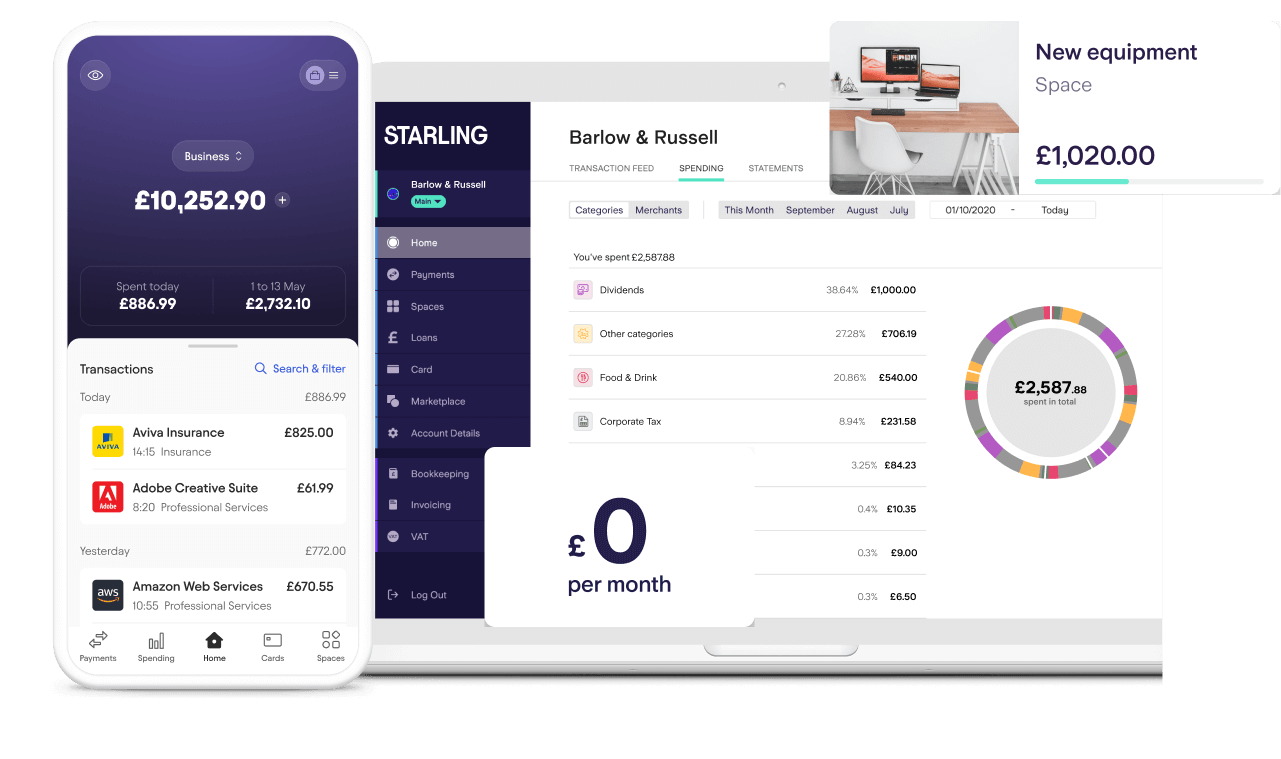

Less admin. More control.

There’s a faster, easier way to stay on top of your business’s finances. Apply for a digital business account easily within the app to get your Mastercard debit card, plus:

£0 a month

No monthly fees or UK payment charges. Other banks charge fees for what limited companies get for free with Starling business. Give our comparison table a quick scan to see for yourself.Free 24/7 UK support

Fast response times and help from real humans via app, phone or email.A fully regulated UK bank account

Your money’s covered up to £120,000 by the Financial Services Compensation Scheme.Switch with ease

If you want us to, we’ll move all your banking over for you through the Current Account Switch Service (all it takes is a few taps in-app).

Spending, simplified

Instant payment notifications. Get notified the second you pay or get paid, and get a reminder the day before payments are due.

Spending analytics. Break down your monthly spending and automatically sort it by category.

Digital receipts. Keep your files in order by adding digital receipts to payments.

Separate Spaces for separate costs. Set things like tax and overheads to one side.

Bills Manager. Get a clearer view of your money by paying Direct Debits and standing orders from a separate Space.

Good for business

Designed for sole traders, limited companies and limited liability partnerships (LLPs), including startups.

Free access for multiple directors/PSCs. Easily add directors to your account. We can’t provide access for third parties (like accountants) or other team members (e.g. finance teams or assistants).

Deposit cash at the Post Office for a 0.7% fee (£3 minimum fee), and cheques digitally in-app, for free.

Integrate accounting software like Xero, QuickBooks, and FreeAgent from the Starling Marketplace.

Integrate other business services like Zettle and SumUp.

Connect other business accounts you hold with other banks.

Mobile and online banking.

We have new accounting and tax tools launching soon – stay tuned! In the meantime, learn how we can help with Making Tax Digital.

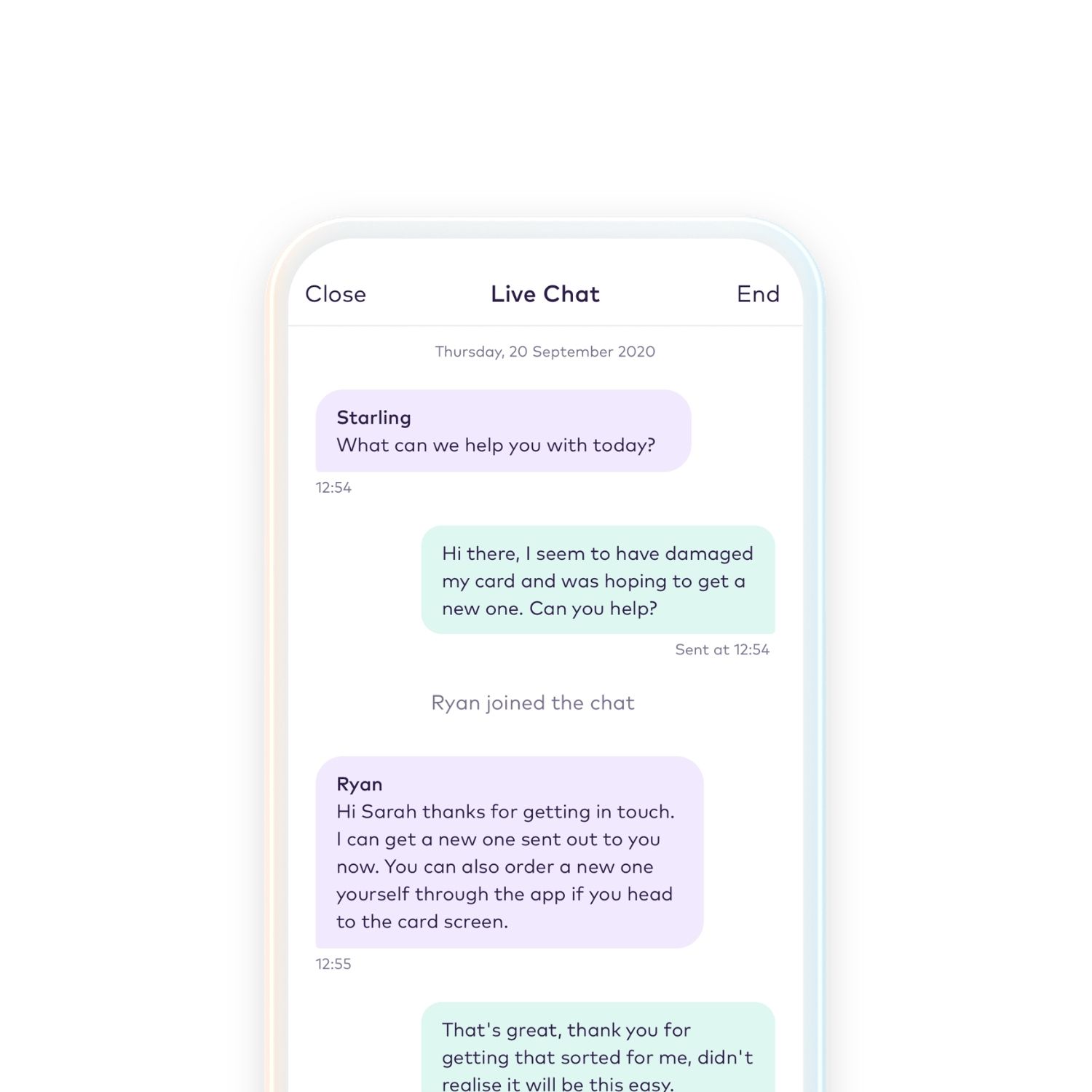

Fast, friendly help.

Whenever you need it.

Always open.

Day or night; we’re open 24/7 to lend a hand.

Always human.

Speak to real UK-based humans.

Always fast.

Save time with quick response times via app, phone or email.

Always free.

All service is priority service at Starling.

Many a happy customer

Don’t just take our word for it. We’ve been reviewed thousands of times on Trustpilot, and our customers think we’re “easily the best business bank account they’ve had”, “a refreshing experience”, and that we “make business banking easy”.