Current account switch

Switch your bank account to Starling

Apply now

Switch your bank account to Starling

Apply now

Why switch your bank account to Starling?

It’s free and easy. Requesting to switch your current account only takes a few minutes and you won’t pay a penny. Find out how we stack up against other current accounts

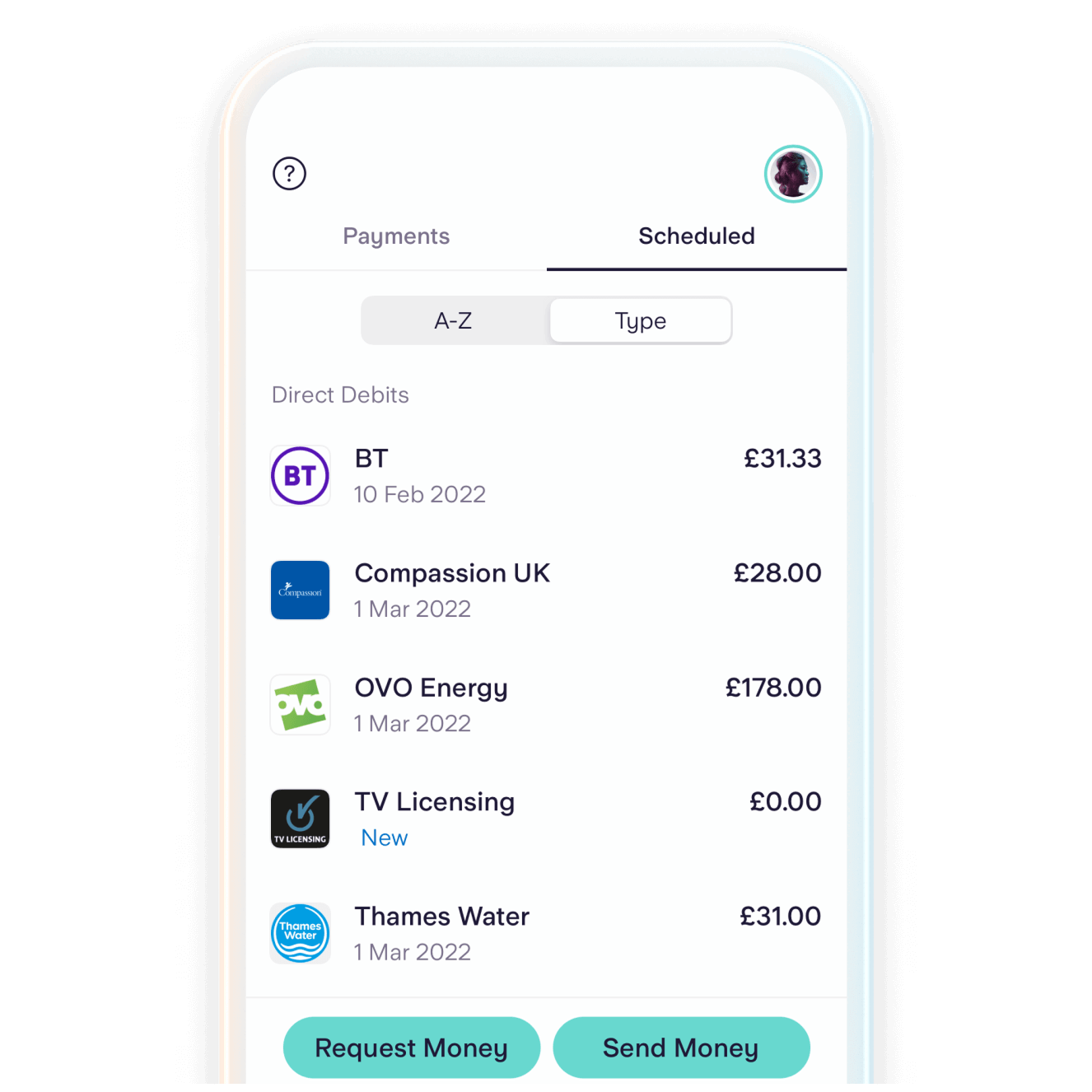

It’s seamless. We’ll do the legwork of moving outgoing payments, payees you’ve set up, Direct Debits and standing orders. Also, if anybody pays money into your old account it will automatically be redirected to your Starling account for three years.

Get the full picture. Managing your money when it’s all in different places can be difficult. By switching your bank account to Starling, you’ll be able to see everything in one place – and with our app features, you can get even more out of your money.

You’re protected. Over 99% of UK current accounts are covered by the Current Account Switch Guarantee and every bank and building society offering the service follows exactly the same switch process. In the unlikely event that something goes wrong with your switch, we will refund any interest (paid or lost) or charges incurred on your old or new account as well.

Here’s what happens when you switch bank accounts

The whole process is quick, safe and guaranteed. Switch your current account in a simple and stress free way.

Step 1

We’ll send a request to your old bank to confirm the switch.

Step 2

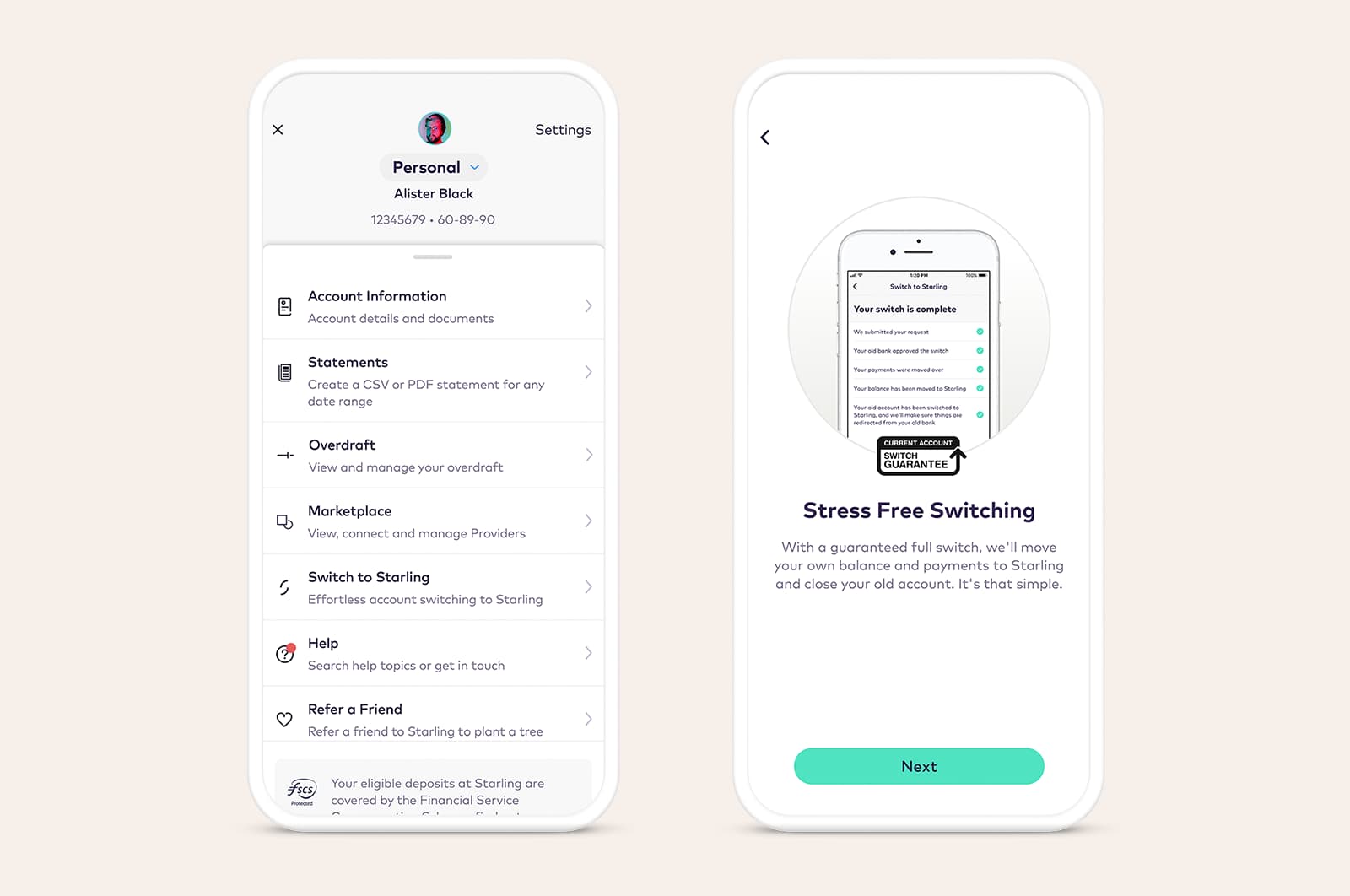

We’ll keep you updated every step of the way. You can also monitor the progress of your switch in the ‘Switch to Starling’ tab under the account menu.

Step 3

The account you’re switching from will be closed on your behalf and your balance, salary, payees, Direct Debits and standing orders will be moved to your Starling account.

Step 4

The switch is complete. Your old bank will make sure that any payments made to your old account are redirected to your Starling account.

Don’t have a personal or joint account with us yet?

Apply for an account in just a few minutes. If your application is approved and your account is verified, you can then follow the steps below to start your switch to Starling.

Apply nowPlease note: we do not support partial account switching.

Already have a current account with us? Here’s how to switch...

1. Tap the top right icon to bring up the account menu and select ‘Switch to Starling’.

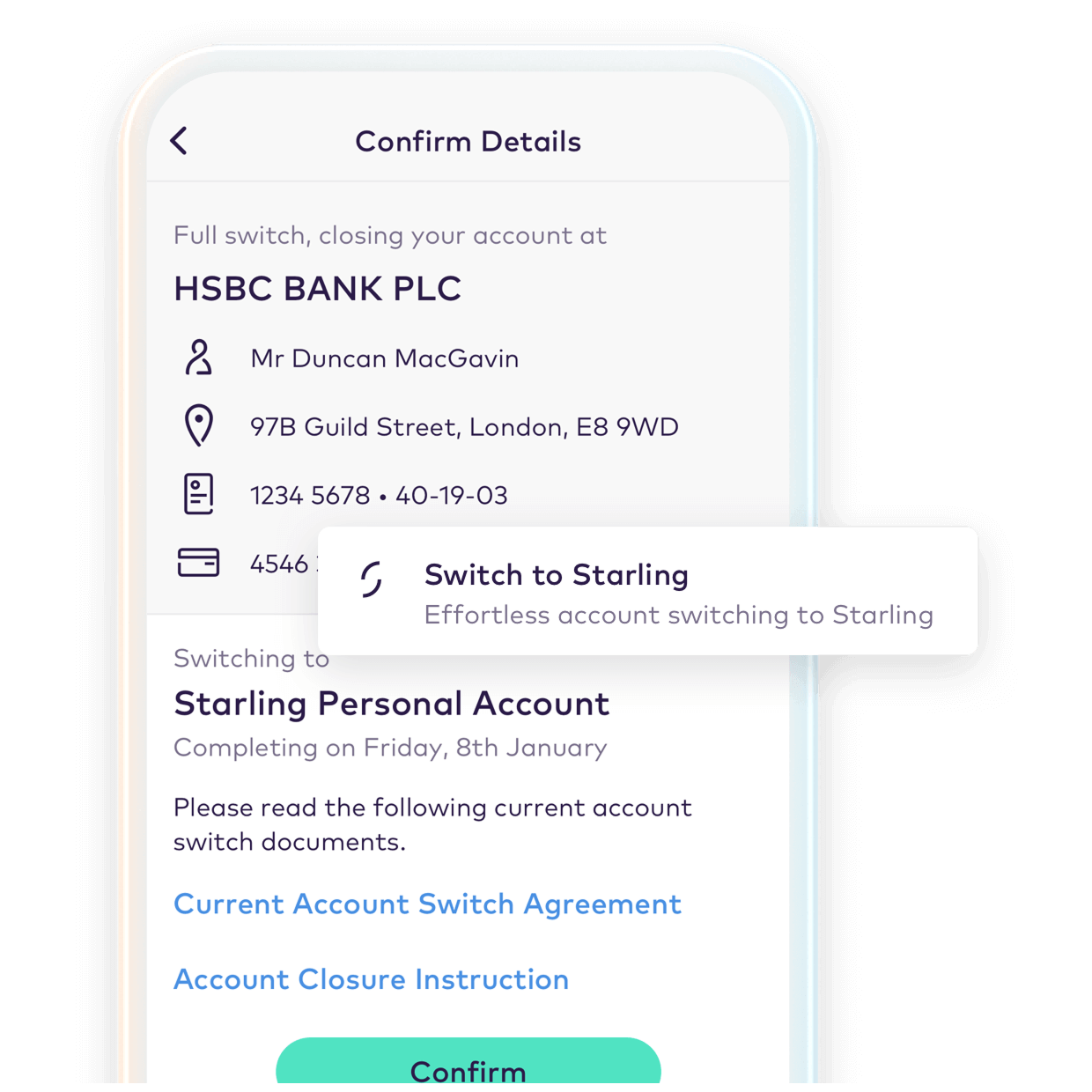

2. Select the account details you’re switching from.

3. Choose your switch date and agree to the terms and conditions.

4. We’ll take care of everything from here and complete it within seven working days. If any issues come up, we’ll fix them for you.

Switching a joint account?

If you’re switching a joint account, both of you will need to confirm the switch in the app. Join the thousands of customers who have already switched their current account to Starling.

Apply for a Starling current account and enjoy app-based banking at its best.

Step 1

Simply click on the button below to start your application and fill in a quick, fuss-free form.

Step 2

Download the app on your phone and we’ll ping over a verification code for you to enter.

Step 3

Create an account by telling us a bit about yourself: your name, date of birth, email address and home address.

Step 4

Finally, record a quick selfie video and take a photo of your ID so we can verify everything. And that’s it!.

Got an overdraft at your old bank?

Any overdraft balance on your old account will not be automatically transferred. You will need to agree to a new overdraft facility with Starling Bank. After you open an account with us, you can check if you’re eligible for an overdraft directly in-app before you initiate your switch. If you can’t get an overdraft with us, you’ll need to make separate arrangements to repay your existing overdraft with your old bank before you switch.

Frequently asked questions

What happens to my old bank account when I switch?

If anyone pays money into your old bank account, it will be automatically redirected to your Starling account. Your payee details, Direct Debits and standing orders will also be moved over and the old bank account will be closed.

Does switching banks affect my credit score?

Switching bank accounts shouldn’t negatively affect your credit score if you have paid off any outstanding overdraft from your old bank before switching.

How often can I switch bank accounts?

There’s no official limit for how often you can switch. However, you’ll have to wait for any switches in progress to complete before you can start a new one.

View all frequently asked questions on switching accounts.

Switch your current account quickly and securely. View the Current Account Switch Guarantee.

Don’t just take

our word for it

If you have given permissions to Third Party Providers to make payments on your behalf, or to access your financial data, access to these services won’t be transferred automatically to your new account as part of the Current Account Switch Service.

Please note, some Third Party Providers may not be supported by all banks and building societies. Check what Third Party providers we support.

1. Before you close your old account, check whether you have any Third Party Provider permissions set up and if so, who with.

2. Once your new account is open you can give your permission to the Third Party Provider to access your new account by providing them with your new account details. You will need to contact the Third Party Provider directly yourself to set this up.