Personal overdraft

Personal overdraft

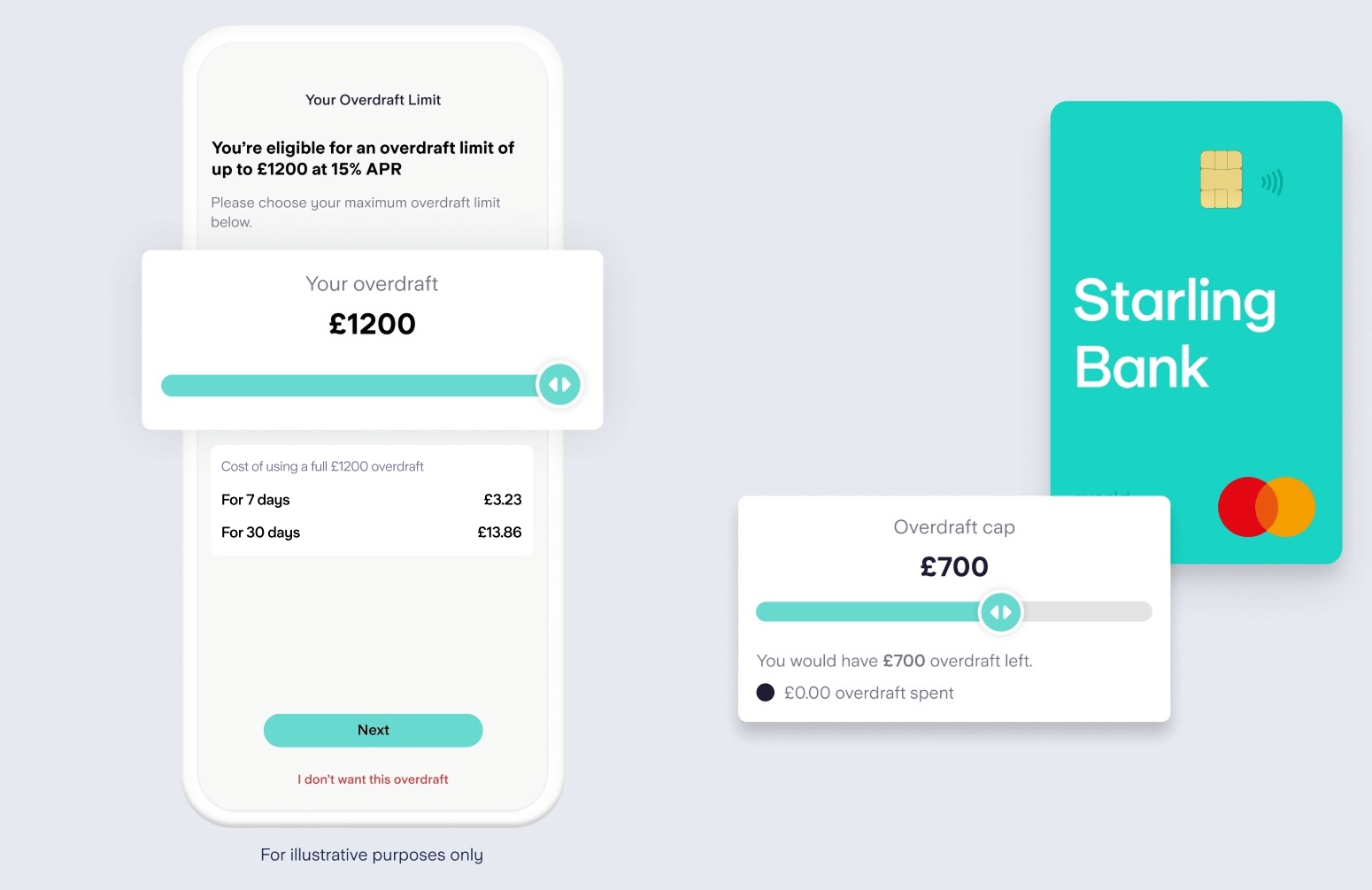

Designed for short-term borrowing, apply for an overdraft to help cover unexpected expenses. Easy to manage and no additional fees.

Understand your overdraft

We offer overdraft interest rates of 15%, 25% and 35% EAR (variable).

Representative example

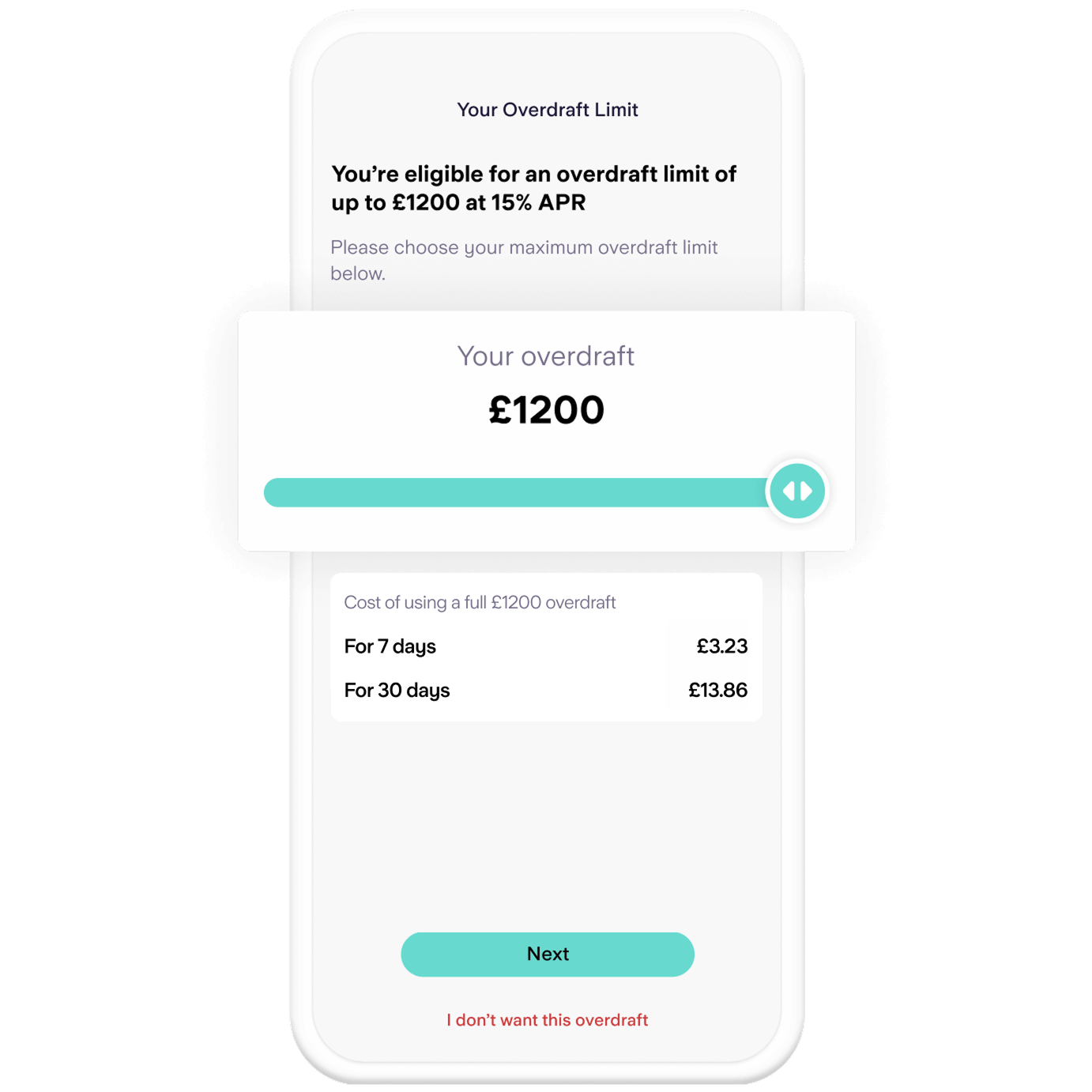

The representative APR (variable) is 15%. If you used an arranged overdraft of £1,200 for 30 days, at 15% EAR/APR (variable), it would cost you £13.86 in interest.

How does our overdraft compare?

The representative APR shows the cost of borrowing over a year, so you can use it to compare the cost of our overdraft against other overdrafts and ways of borrowing.

If you already have a personal account with us, you can check if you’re eligible for an overdraft in the app.

How does an overdraft work?

We all need a little extra support from time to time. At Starling, we know that an overdraft can act like a short-term safety net when you’re feeling the burn financially.

But we want to make banking better – which means offering a better kind of overdraft. One that’s easy to manage and fair on fees. Manage your money and keep tabs on your overdraft, all from our award-winning app.

How a Starling overdraft can help you

Your interest rate

Interest is accrued daily and charged on the 15th of the following month – and it’ll always be updated clearly in your app.

We offer interest rates of 15%, 25% and 35% EAR (variable) for arranged overdrafts based on a range of different factors, including information from a credit reference agency - and a representative rate of 15% APR* (variable), assumed credit limit £1,200. You can use our overdraft calculator to see how much an overdraft will cost you.

No fees

We won’t charge you an additional fee on top of the interest you pay.

Gone over the limit?

If you go over the overdraft limit you’ve agreed with us, we won’t charge you any interest or fees on the extra amount. But, be aware that your payments might be declined if there’s not enough in your account to cover them.

Complete control

Once your overdraft is approved, you’ll be able to manage the amount you want to spend with our in-app overdraft cap feature.

Credit score

They’re easy to set up and just as easy to manage – but don’t forget, a Starling overdraft is a credit facility. So, it could affect your credit score.

Financial support

A lot of people are facing financial challenges at the moment, and you may be finding that you need a little more support than usual.

If you’ve been impacted or expect to be impacted by the rising cost of living, please take a look at our support page and content on money worries for further information and guidance.

We’ve built these tools so that you can check your overdraft eligibility and what an overdraft could cost you.

Interest rates explained

Our representative APR is the advertised rate (or a lower rate) that we reasonably expect at least 51% of customers who are accepted for and enter into an overdraft agreement will get with us.

An EAR (Equivalent Annual Rate) is a common way of showing interest rates on overdrafts which you can use to compare different banks’ interest rates - this does not include fees that some banks may charge you in addition to interest.

An APR (Annual Percentage Rate) is a common way of showing interest rates on overdrafts which includes fees that banks may charge. Starling does not charge additional fees.

Helping you stay in control of your spending

There are times when you may need an overdraft, like if you have a scheduled payment and not quite enough money. That’s why we’ve designed an overdraft that’s flexible and easy to manage. An overdraft that puts you in control.

Need an overdraft, apply in seconds in the app.

Adjust how much of your overdraft you want to spend with our handy in-app overdraft cap feature.

Never miss a scheduled payment again – we’ll remind you when they’re due and let you know if you have insufficient funds. We’ll send you an alert when you’re using an overdraft, too.

See how much it will cost you before you apply.

You’ll also be able to use the app to see how much interest you’ve accrued.

Get instant notifications whenever you spend so you can keep on top of your finances.

With Spending Insights, you’ll be able to see an overview of your spending habits, so you can see where there might be room for improvement.

How to apply for an overdraft

When you open an account with Starling Bank, you can apply for an overdraft in the app. This will be subject to a credit check and assessment of your personal circumstances, this way we can help ensure that an overdraft is both affordable and manageable for your current situation. Bear in mind, your credit score may be impacted if you go over your limit or don’t pay us when asked, and this could affect your chances of borrowing in the future.

Apply for a current accountAbout interest charges

If you do have an overdraft with us, we charge interest at 15%, 25%, or 35% EAR* (variable) based on a range of factors including information from multiple credit reference agencies. This is the actual rate you’ll pay, although we may update rates from time to time (but we’ll always let you know beforehand, so you can decide whether to keep it or not). Interest is accrued daily, charged on the 15th of the following month and updated clearly in your app.

*An EAR (Equivalent Annual Rate) is a common way of showing interest rates on overdrafts which you can use to compare different banks’ interest rates. This does not include fees that some banks may charge you in addition to interest. Starling does not charge additional fees.

Overdraft calculator

It’s worth noting

These figures are to be used as a guide only. We will only charge you interest based on how (or if) you use your overdraft. The costs shown are for overdraft interest only and assume that the borrowing is repaid in the same charging period. If the borrowing is not repaid within the same charging period, the cost of your overdraft may increase over time. This is because we may charge interest on the arranged overdraft interest previously incurred on your account. An unarranged overdraft is when you go over your agreed overdraft limit, or when you go overdrawn without an overdraft in place. Applying for or using an overdraft can affect your credit score.

This calculator assumes that:

You remain overdrawn for the number of days and overdraft amount you have selected, without making any payments to your account to reduce your overdraft usage

You repay your overdraft at the end of the period you selected

How much could a Starling overdraft cost you?

Unarranged overdraft charges

We want our overdraft to feel like a source of reassurance and support in your everyday life, rather than something that further contributes to financial pressures – so we’ve taken steps to make sure that you’ll never spiral out of control.

Payments that would take you over your overdraft limit may be stopped before they can go through. However, in the rare instances where you do go into an unarranged overdraft by accident — and let’s face it, it happens — you won’t incur any charges or interest on the overdrawn amount.

Struggling to pay off your overdraft?

You’re not on your own. Starling’s budgeting tools are designed to make money management easier, but if you’re still struggling, we’re on hand 24/7. Contact customer support in-app via live chat. Free debt counselling, debt adjusting and providing of credit information services is also available from the Money Advice Service – find out more by visiting the Money Advice Service website.

Want to know more?

Find out about our other personal current account or read our terms and conditions.

Apply for a Starling current account today and enjoy app-based

banking at its best

Step 1

Simply click on the button below to start your application and fill in a quick, fuss-free form

Step 2

Download the app on your phone and we’ll ping over a verification code for you to enter

Step 3

Create an account by telling us a bit about yourself: your name, date of birth, email address and current home address

Step 4

Finally, record a quick selfie video and take a photo of your ID so we can verify everything. And that’s it!