The current account

built for you

The current account

built for you

Organise your money, view spending insights and split payments all on one easy-to-use app.

You must be 18 or over, live in the UK, and have valid photo ID to apply for a personal current account. Terms and eligibility criteria apply.

Apply now

Why choose us?

Apply in the app

No more lengthy calls or standing in line to open an account.

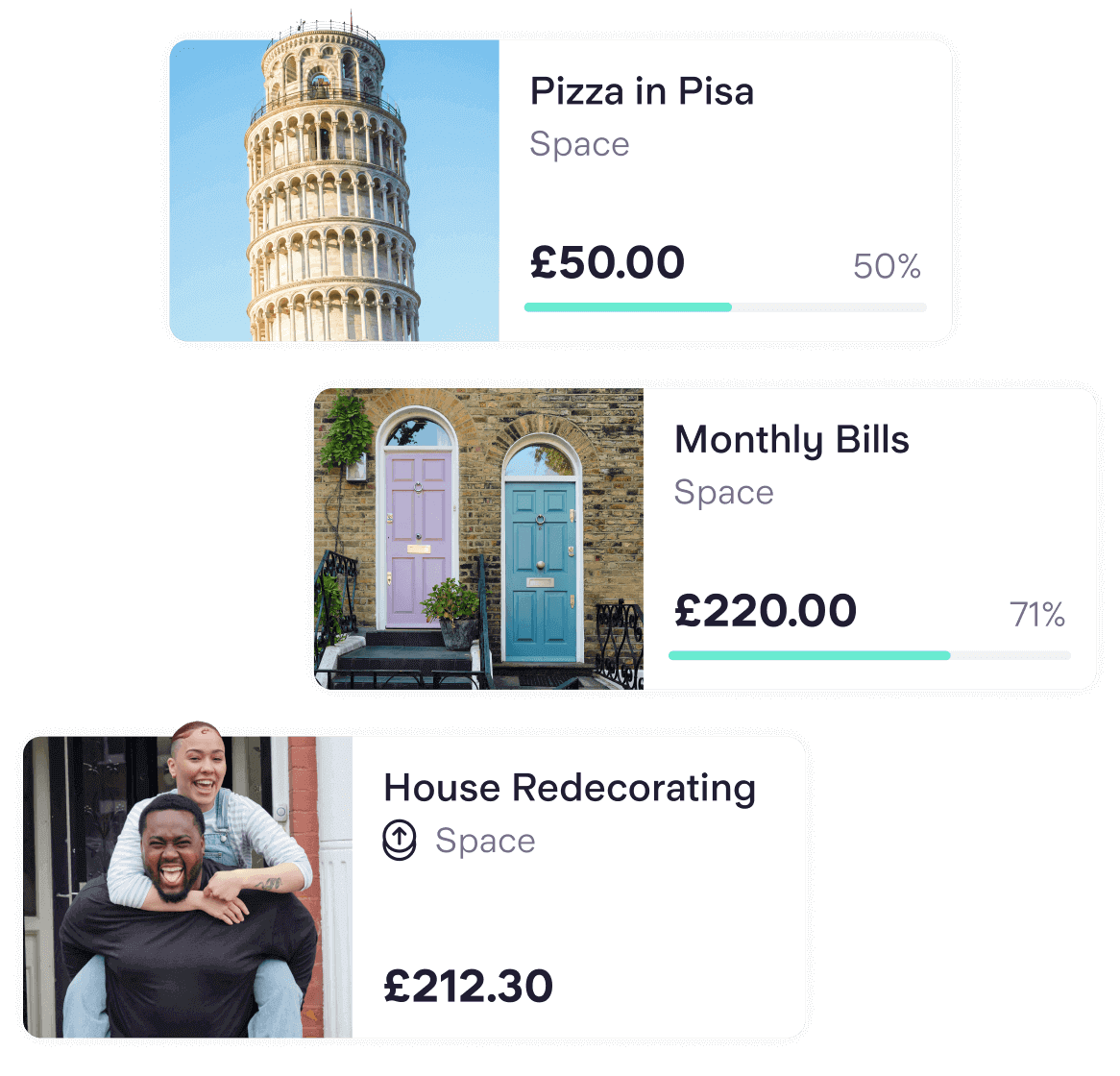

Smart money tools

A range of tools to help you manage your money.

If you’re awake, so are we

24/7 support from UK-based humans, no bots here.

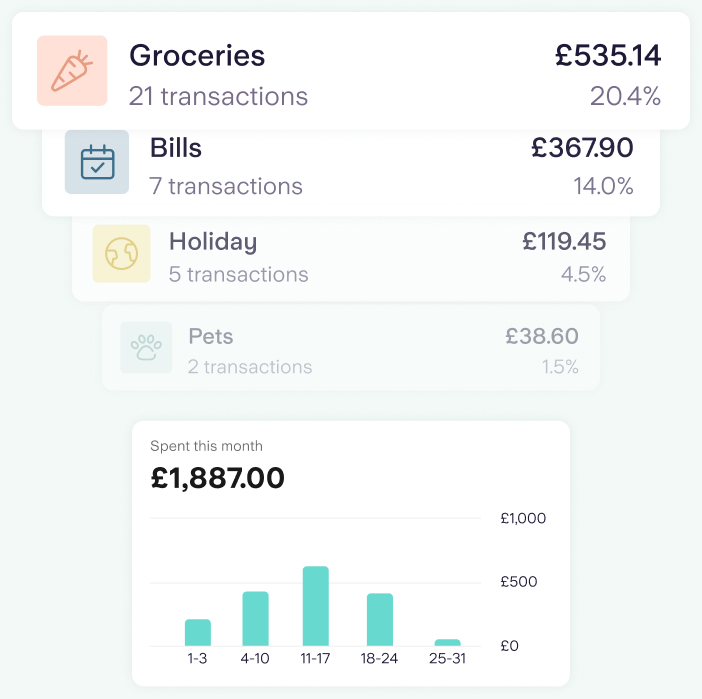

See where it all goes

Keep an eye on where your money’s going with Spending Insights. Spot trends across 50+ different categories and create customisable graphs to help you visualise your spending better.

Apply now

More features from your award-winning current account

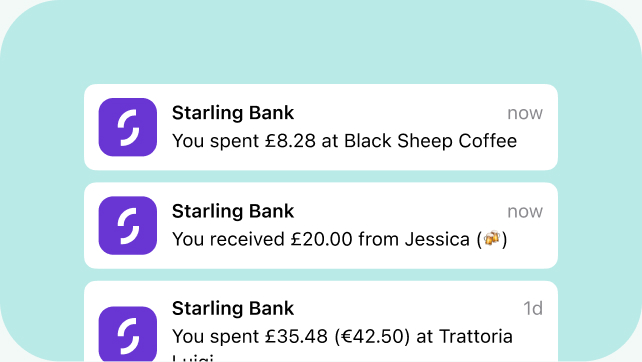

Instant alerts

We’ll let you know every time you spend, get paid or pay a bill. And if you want, we can also notify you whenever your account balance hits or dips below a certain amount.

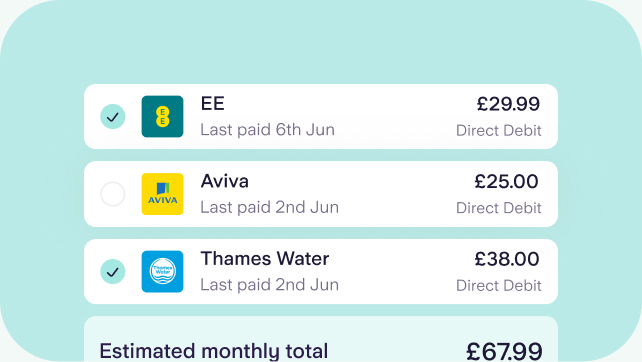

Bills manager

Put bills on autopilot, and pay them from a separate Space in your app. You’ll get a clear view of what’s left for daily spending.

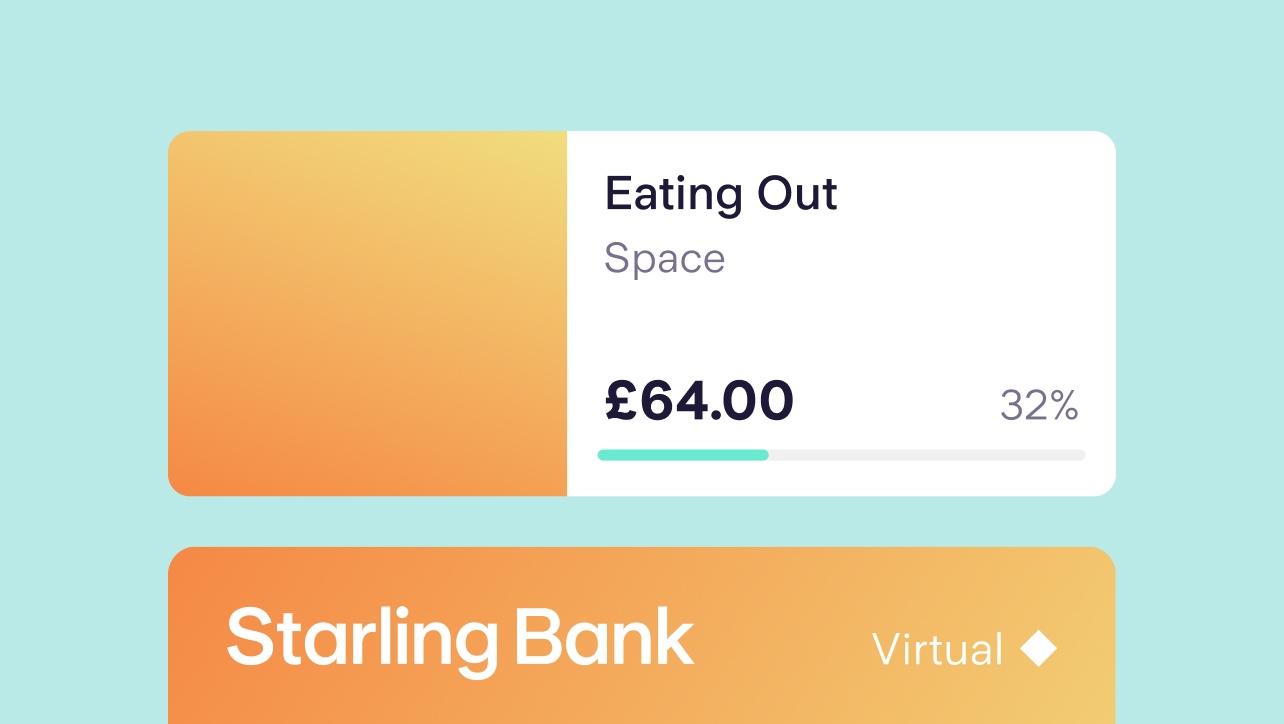

Virtual cards

Have a debit card for every budget. Each virtual card is linked to a Space, and can only spend the money in that Space.

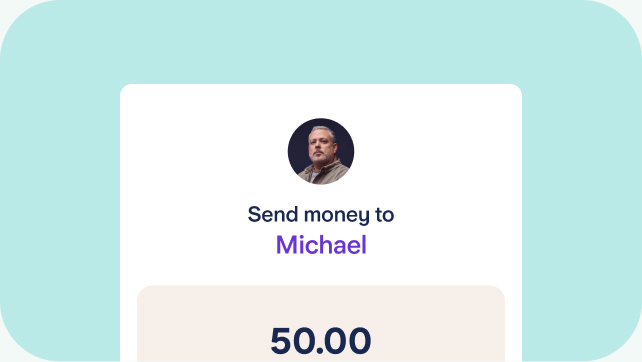

Settle up

Get paid quickly by sending payment links to friends with Settle Up, with no need to swap bank details – even if they don’t use Starling.

To open a Starling personal current account, you must be a UK resident aged 18 or over, with a valid photo ID and a UK mobile number. You’ll also need a smartphone to use our app. We’ll carry out a soft credit check as part of the application process – this won’t affect your credit score. Additional eligibility criteria may apply.

Everything you need

24/7 support, 365 days a year, from our UK-based teams. No ifs, no bots.

Deposit cheques of up to £1,000 by simply taking a photo of it in the app.

Withdraw £300 a day from ATMs. Deposit £1,000 each year for free, with a 0.7% fee thereafter.

No monthly fees and no surprise charges. Just a simple, straightforward current account.

No fees from us overseas. We won’t charge for using your card abroad.

Mobile wallet. Add your debit card to spend with your phone.

Lock your card with a tap if you misplace it, so it can’t be used.

Online banking if you prefer to manage your money on a computer.

Direct Debits can be paid from your main balance or a Space you choose, giving you control over where your money is sent from.

Contactless payments. Choose your own limit, up to £100.

Statements are downloadable in the app, with custom ranges.

Everything you want

Round Ups adds spare change from every transaction to a Space.

Low balance warning for when your balance hits or dips below a certain amount.

Arranged overdraft available up to £5,000. Check if you may be eligible with no impact to your credit score.

Recycled debit cards made from 95% recycled plastic.

Split incoming payments across your different accounts and Spaces.

Connected cards. Allow someone you trust to spend on your behalf.

Gambling block can be turned on, to prevent any betting transactions.

Nearby Payments allows you to pay other Starling users via Bluetooth.

International payments. Easily send money in the app to 35 countries.

A quick note on fees

There’s no monthly fee and no charges for day-to-day account use. We’ll always be upfront about any extras, like cash deposits over £1,000 a year or CHAPS payments, and we’ll show you any costs in the app before you go ahead.

See our full fees and charges for all the details.

It’s so easy to

switch your account to us

The Current Account Switch Service does it all for you. Money, payees and Direct Debits are moved in seven working days.

Plus, money sent to your old account is instantly forwarded to your new account.

Find out moreHow do we stack up

against other banks?

| Feature |  Starling Bank - Current Account Starling Bank - Current Account |  NatWest - Select Account NatWest - Select Account |  Lloyds Bank - Classic Account Lloyds Bank - Classic Account |  HSBC - Bank Account HSBC - Bank Account |  Santander - Everyday Current Account Santander - Everyday Current Account |  Monzo - Current Account Monzo - Current Account |

|---|---|---|---|---|---|---|

App Transaction History | real time | pending transactions | pending transactions | pending transactions | pending transactions | real time |

Mobile App Card Security | lock, unlock, cancel | lock, unlock, cancel | cancel | lock, unlock, cancel | lock, unlock | lock, unlock, cancel |

Arranged Overdraft Representative APR | 15.00% | 39.49% | 29.90% | 38.90% | 39.94% | 39.00% |

ATM World £100 Cost | £0 | £2.75 | £4.49 | £4.75 | £2.95 | £0 |

Faster Payments App Limit | £1,000,000 | £20,000 | £25,000 | £50,000 | £25,000 | £10,000 |

App Cheque Imaging |

Data supplied by Defaqto and correct as of 7 July 2025.

Apply for a Starling bank account today and enjoy app-based banking at its best.

Start your applicationFrequently asked questions

What is a current account?

It’s a bank account designed for holding and withdrawing money. Most people have their salaries paid into a current account, and they’re used for things like Direct Debits, paying bills, and your day-to-day shopping.

Is a debit card a current account?

When you open a personal current account, you’ll usually be sent a debit card, too – so you can make transactions from your account. Learn more about debit cards, account numbers and sort codes.

When you open a Starling personal current account, we’ll aim to have your debit card with you after 5-7 working days. You can add the digital version of your debit card to your mobile wallet as soon as your account is approved, and can use it to spend straight away – even before your physical card arrives!

Do I need any documents to apply?

To open an account, you’ll need to provide at least one of the following ID documents:

A valid passport

EU/EEA ID card

UK residence permit

UK photocard driving licence (full or provisional)

We may also ask you to provide a document that proves your address. We’ll perform a soft credit check, which won’t affect your credit score.

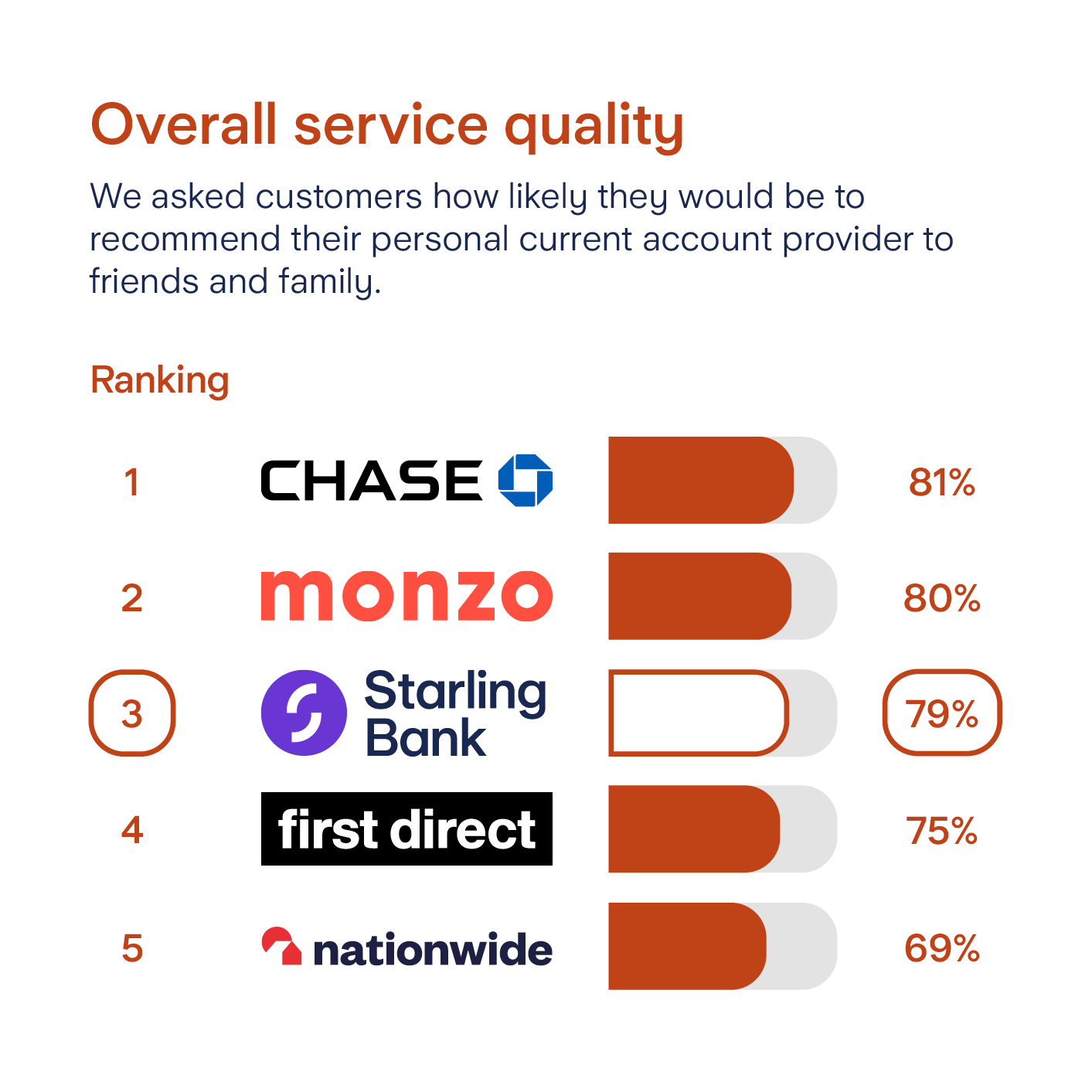

Independent service quality survey results

Personal current accounts, Great Britain

Published February 2025.

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1000 customers of each of the 17 largest personal current account providers if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

The requirement to publish the Financial Conduct Authority Service Quality Information for personal current accounts can be found here.