Personal finance

“We couldn’t get on the pitch – there were loads of men playing. The girls were so disappointed.”

15th May 2024

To help you better understand pensions, we’ve teamed up with our partners in the Starling Marketplace, PensionBee and Penfold. Here, we run through what you need to know.

State Pension - This is a regular payment from the government to you, which you can claim when you reach State Pension age.

To receive the minimum State Pension, you must have paid National Insurance contributions for at least 10 years by the time you reach State Pension age (currently 66). To receive the maximum amount (at time of publication worth £179.60 per week, set to rise to £185.15 in April 2022), you must have contributed for at least 35 years.

Workplace pension - This is usually arranged by your employer. A percentage of your pay is put into the pension scheme automatically every payday. In addition, you’ll usually receive contributions from both your employer (a minimum of 3%) and the government (in the form of tax relief).

Private/Personal Pension - Both Penfold and PensionBee offer private pensions. It’s an alternative or additional pension to a workplace pension. You are able to pick a fund that best suits you and a fund manager will manage your investments for you.

Self Invested Personal Pension (SIPP) - This type of private pension gives people more freedom over how they invest their pension. For example, with most private pensions you pick a fund and then the fund manager manages the investments for you, whereas with a SIPP you can pick and manage your own investments.

When investing in shares your capital is at risk and you could get back less than has been paid in.

See more information on the types of pensions.

The earlier you can start paying into your pension, the better.

But why?

Not only does starting earlier give you a longer time period to save but also the longer you leave your money to grow, the more chance it has to build over time.

Your pension is a long-term investment and like most investments, the value can go down as well as up and you could end up getting back less than what you originally invested.

If your pension does make a return and grows, that growth can cause even more growth because your returns will be reinvested and could compound over time. The longer time period your pension has to do this, the bigger your pension pot could become.

Both PensionBee and Penfold have handy calculators that can help give you an idea of how your contributions over time might impact your pension.

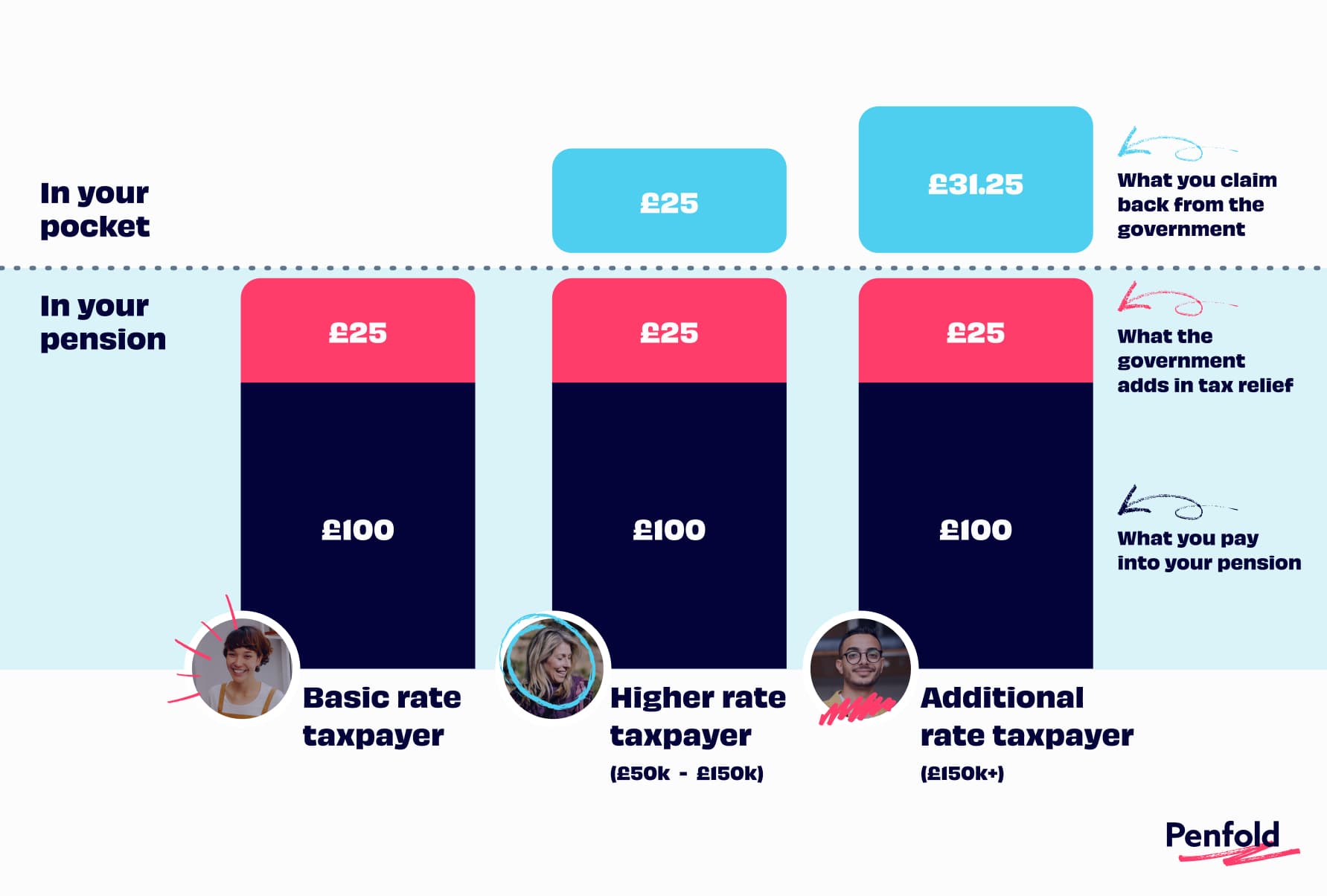

When you contribute to a personal pension, you will usually benefit from tax relief. Basic rate taxpayers (£12,571 to £50,270) usually get a 25% tax top up, which means that for every £100 you pay into your pensions, HMRC will add an extra £25. Most pension providers automatically claim the basic rate tax relief on your behalf and add it to your pension pot.

Higher and additional rate taxpayers can claim a further 25% and 31% respectively through their Self-Assessment tax returns.

For 2021/22, you can get tax relief on pension contributions up to £40,000 or 100% of your salary (whichever is lower) if you earn less than £240,000. Any contributions that you make over this limit are taxed at the highest rate of tax you pay. These figures may change with the March 2022 government budget, but don’t worry, we’ll keep you updated.

Below you can see how much tax relief you’ll receive in your pension and back in your pocket after making a £100 pension contribution, depending on what tax band you’re in.

If you run your own limited company and have a personal pension, you can either make contributions from your personal bank account or through your company. Both options can benefit from tax relief, and what’s right for you will depend on your individual circumstances.

The Association of British Insurers have said that 19.4bn pension savings are waiting to be claimed in the UK. The Department for Work and Pensions found that a large reason for this is that on average people will work for 11 different employers over their careers.

Here are a few tips to keeping track of your pension:

Keep a note of all your pension details and keep this safe over time

Make sure your pension provider always has your current address

Consider opening a private pension and transferring any previous pensions into one pot for easy management. This could also be suitable when you want to take your pension with you when you change jobs.

If you think you have lost a pension, here are some tips on locating it.

It is important to compare providers’ fees & any guaranteed benefits when deciding on whether to transfer, and be sure that the investments available are suitable for you. If you are unsure, please seek

The financial platform, Unbiased, found that only 49% of self-employed people have any pension savings at all and the average contribution was 4.1%. This compares with those on an auto-enrolled workplace pension who contribute the minimum of 8%.

Having no pension savings, or too little, means that you may have to work for longer or may not have as comfortable a retirement.

When your income varies from month to month it can be hard to predict how much to contribute and how regularly. Therefore it might be helpful to look for flexible pension solutions that fit your needs. Flexible pension providers, such as Penfold and PensionBee, allow you to change your contributions at any time, so whether you decide to contribute monthly, quarterly or via a one-off lump sum at tax year end or around Christmas, you’ll be able to tailor it to you.

If you decide that contributing one lump sum works best for you, putting money aside over the year will be really important. Starling’s Spaces feature, which allows you to ring-fence money from your main account, is one way to do this.

PensionBee has found that a gender pension gap exists in all UK regions and widens with age, meaning the size of women’s pension pots at retirement can be up to 57% less than men’s. Penfold also found that last year women on average contributed 28% less to their pension.

Planning to go on maternity leave, reduce your hours or take a complete career break?

Time is key to building up your pension pot, so if you stop paying into your pension during these breaks it can significantly impact the size of your pension at retirement.

If you’re able to continue paying into your pension during these periods, even if it’s not that much, it will make a real difference. Alternatively, if you have a partner who is working, you could ask them to contribute to your pension.

You can find our partners Penfold and PensionBee over at the Starling Marketplace.

Both PensionBee and Penfold are available to customers who hold a Starling personal or business account, including sole traders and owners of a limited company. You can set up an integration with either PensionBee or Penfold through the Starling Marketplace.

Once connected, you’ll be able to check your pension balance straight from the Starling app. Both PensionBee and Penfold have options to combine old pensions into one new plan or start a brand new plan from scratch. You can then choose a plan to suit your needs, for example a Fossil Fuel Free plan from PensionBee or a Lifetime plan from Penfold, which automatically adjusts your investments as you near retirement to minimise risk.

Article updated: 17 January 2022

The above is intended as general information and does not constitute advice in any way. You should take independent advice if you have any questions about your specific circumstances. Remember that with investments, your capital is at risk. Investments and pensions can go down in value as well as up, so you could get back less than you invest.

Personal finance

15th May 2024

Personal finance

13th May 2024

Personal finance

14th March 2024

Money Truths

8th July 2025

Money Truths

2nd July 2025

Money Truths

1st July 2025