Personal finance

“We couldn’t get on the pitch – there were loads of men playing. The girls were so disappointed.”

15th May 2024

In the second of our series on finding lost money, Rosie Bannister, personal finance writer, investigates the areas of insurance, inheritance and more.

There are likely billions of pounds of long-forgotten money hanging around waiting to be found in many different places.

In my last article, I looked at how you might find lost money from current accounts, Premium Bonds, child trust funds and more. But there could be other assets out there that you’ve forgotten, or never even knew about.

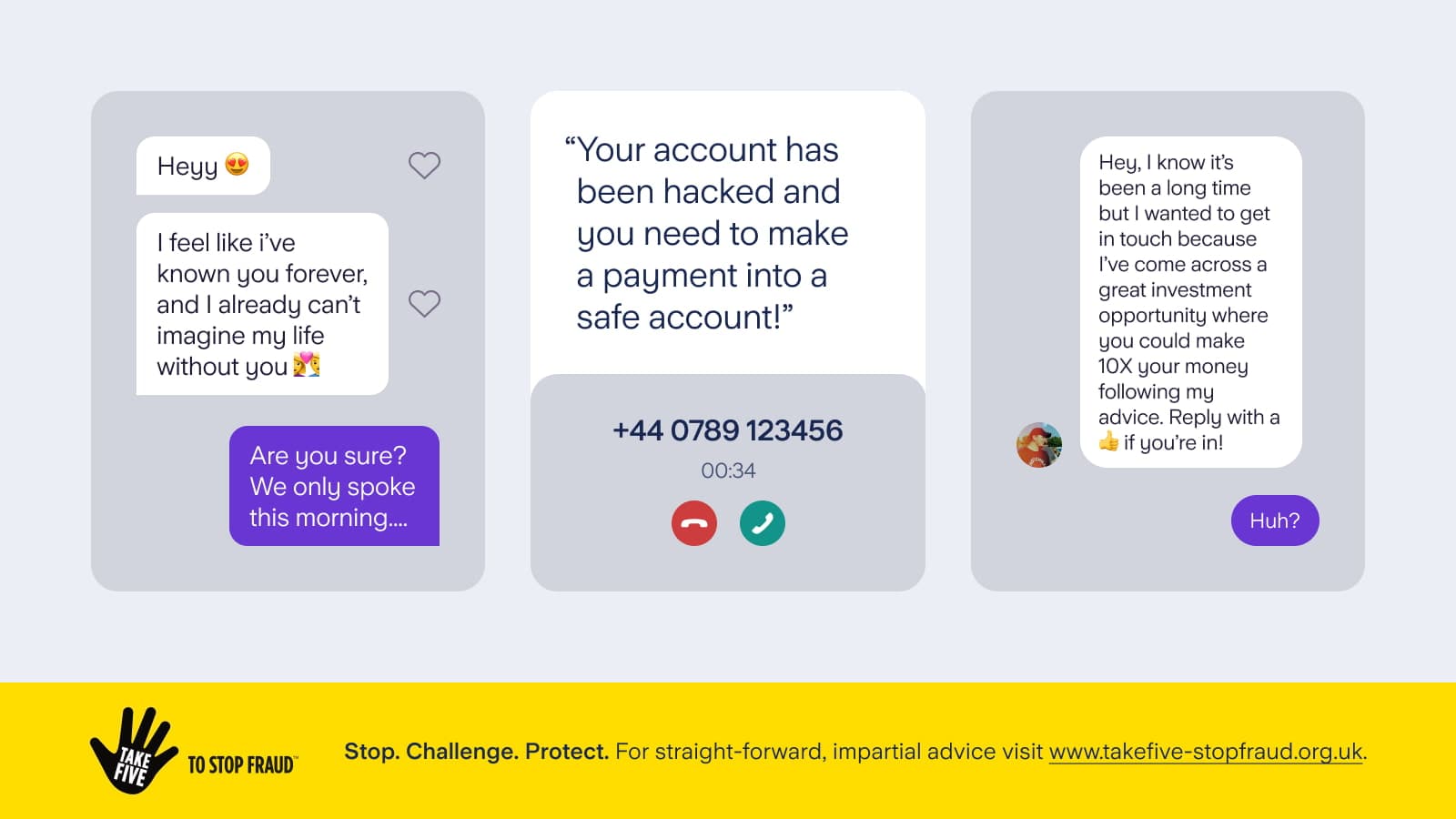

Be very wary of anyone you find that’s looking to charge you money to track down lost assets or investments, it may well be a scam. I do list a few exceptions to this general rule in the information below.

In this article, I’ll focus on some places to look for lost pensions, insurance policies, investments and inheritances.

The Association of British Insurers has estimated that there could be more than £19 billion in lost pensions across the UK. It can be easy to lose the details of your pension if you change jobs or move house, for example, but there are ways to track them down.

If you already know the contact information for your pension provider or former employer then it’s best to get in touch with them directly to see if they can help you find your pension.

If not, you can use the free Pension Tracing Service to find contact details for your own workplace or personal pension scheme(s).

To use the service, you’ll need to know the name of the employer or pension provider. You can use the service online or by phone.

Try to gather as much information as possible before you start, including the name of your previous employer or pension service and the dates you were part of the scheme.

The Pension Tracing Service will help find you the name of the pension administrator. Then, you can get in touch with the administrator and hopefully track your pension down. The Money Advice Service has template letters you can send to a former employer or a pension provider.

If you’ve lost an insurance policy, which may for example happen with a life insurance policy that covers many years, you could try the following steps to find it.

Know the insurance company you used? Get in touch with it directly and ask for details of your policy.

Don’t know the company? Try checking your bank or credit card statements for any regular payments to an insurer.

If you’ve ever had any investments that you’ve lost track of completely, you may well be able to find them. Losing investment details can happen fairly easily, especially if the company you hold your investments with has merged with another and changed name.

There are different things you can try depending on the type of investment you have. Here are some examples:

Shares - you can contact one of the main share registrars, Computershare, Equiniti and Link Group. They’ll search their records for free but will charge a fee if you want a replacement certificate issued.

Unit and investment trusts, and other investments – you can try contacting the Investment Association or The Association of Investment Companies. It’s also worth using the free My Lost Account service, which may be able to find some of your details.

No luck with the above routes? As mentioned earlier, you can try using the Unclaimed Assets Register.

It’s a sobering thought, but many people each year die without leaving a will. This can make it much harder for any inheritances to be passed on to their rightful heirs.

There is a list of unclaimed estates, updated daily, which you can check. You can then use the government’s intestacy tool to see who inherits someone’s estate based on the relatives they had.

A claim on an estate can be made to the Bona Vacantia division of the Government Legal Department (BVD). You would need to send BVD a family tree which shows how you’re related to the person who’s died, including the dates of birth, marriage and death of anyone on the tree.

You could then be asked to send more evidence, which may include:

Birth and marriage certificates of each person between you and the deceased.

ID showing your name and address.

An explanation of any discrepancies in the documents you’ve sent, or any missing documents.

More guidance is available on the government’s estates claim website.

The above article is intended as general information and does not constitute advice in any way. You should take independent legal advice if you have any questions about your specific circumstances.

Personal finance

15th May 2024

Personal finance

13th May 2024

Personal finance

14th March 2024

Money Truths

8th July 2025

Money Truths

2nd July 2025

Money Truths

1st July 2025