Budgeting

“Bills, Bills, Bills” – Sorted in three simple steps

By Esmeralda Dyer Bray

When you’ve saved up for a well-earned break or weekend away, the last thing you want is to be charged additional fees for using your debit card abroad. Especially when the fees are easy to avoid.

So if you’ve booked a weekend in Berlin or a trip around the Greek Islands, read on to find out how to spend money abroad without fees.

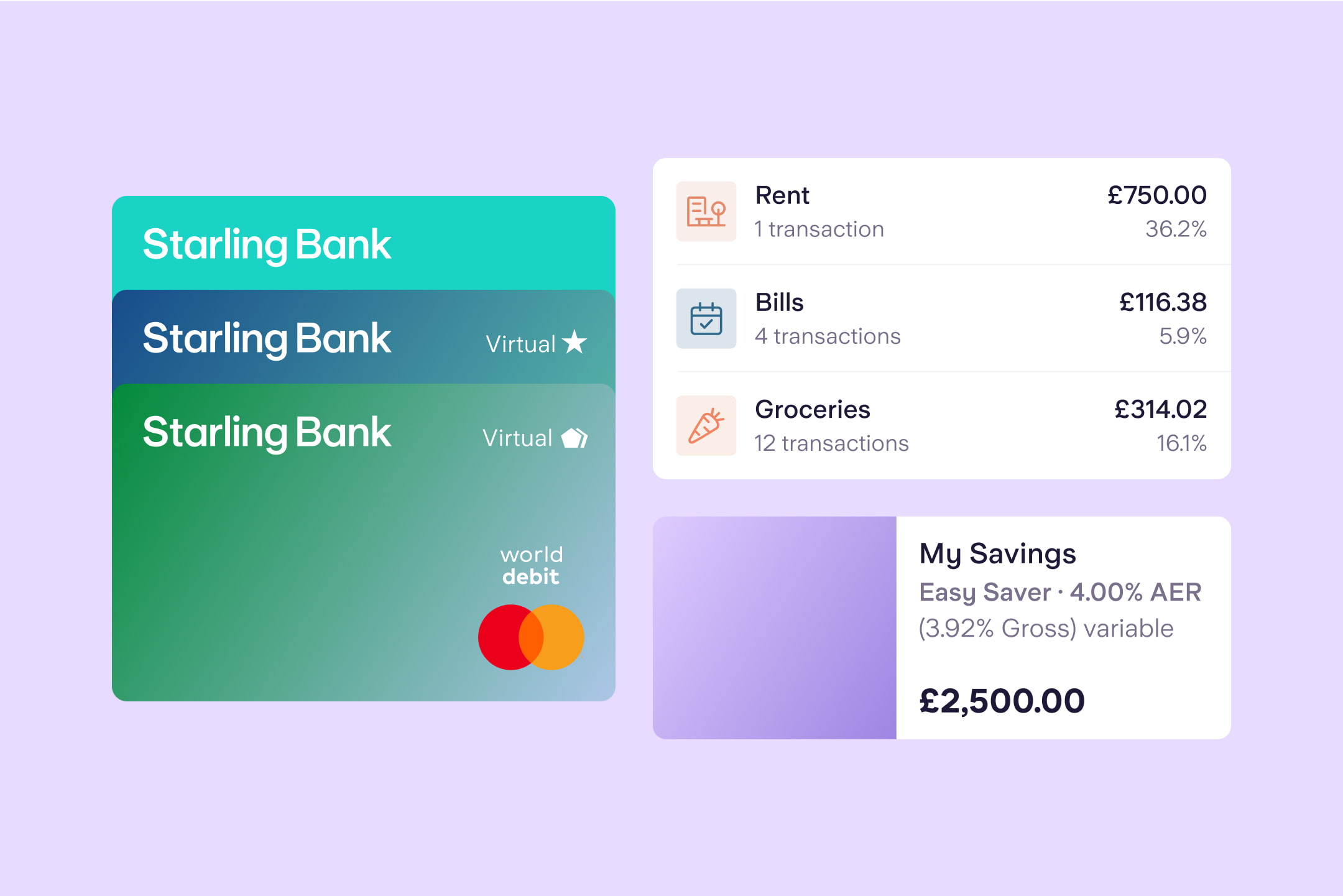

At Starling, we don’t charge our customers for using their debit card abroad. This means you can use your card to pay for your morning croissant in Provence or cocktail in Barcelona without being clobbered with additional fees from your bank.

You also don’t need to tell us that you’re going away. Your trip can be as spontaneous as you like (some banks may block debit cards if they’re used abroad and the customer hasn’t told them they’re travelling to that country).

Starling customers can also withdraw cash abroad from an ATM without being charged any additional fees by us. The ATM itself may charge for withdrawals but it will depend on the country you’re in and the bank or owner associated with the ATM.

For example, in New York pretty much every ATM will charge you regardless of the UK bank you use. While in many countries in Europe, you can often find ATMs that don’t charge you for withdrawing cash using a UK debit card.

Starling customers can withdraw up to £300 per day, whether they’re at home or away.

With Starling, when you pay the bill for your pizza in Naples or your tagine in Morocco, tap the option to pay in the local currency. That way, you’ll receive Mastercard’s real exchange rate, which we pass on to you without adding any fees on top.

The same goes for withdrawing money abroad from an ATM - don’t accept the optional conversion rate shown by the ATM. By rejecting it, you should receive Mastercard’s real exchange rate.

If you do choose GBP when you pay for that pizza, you’ll be given the exchange rate determined by the merchant (likely to be higher) and any additional fees the merchant has set.

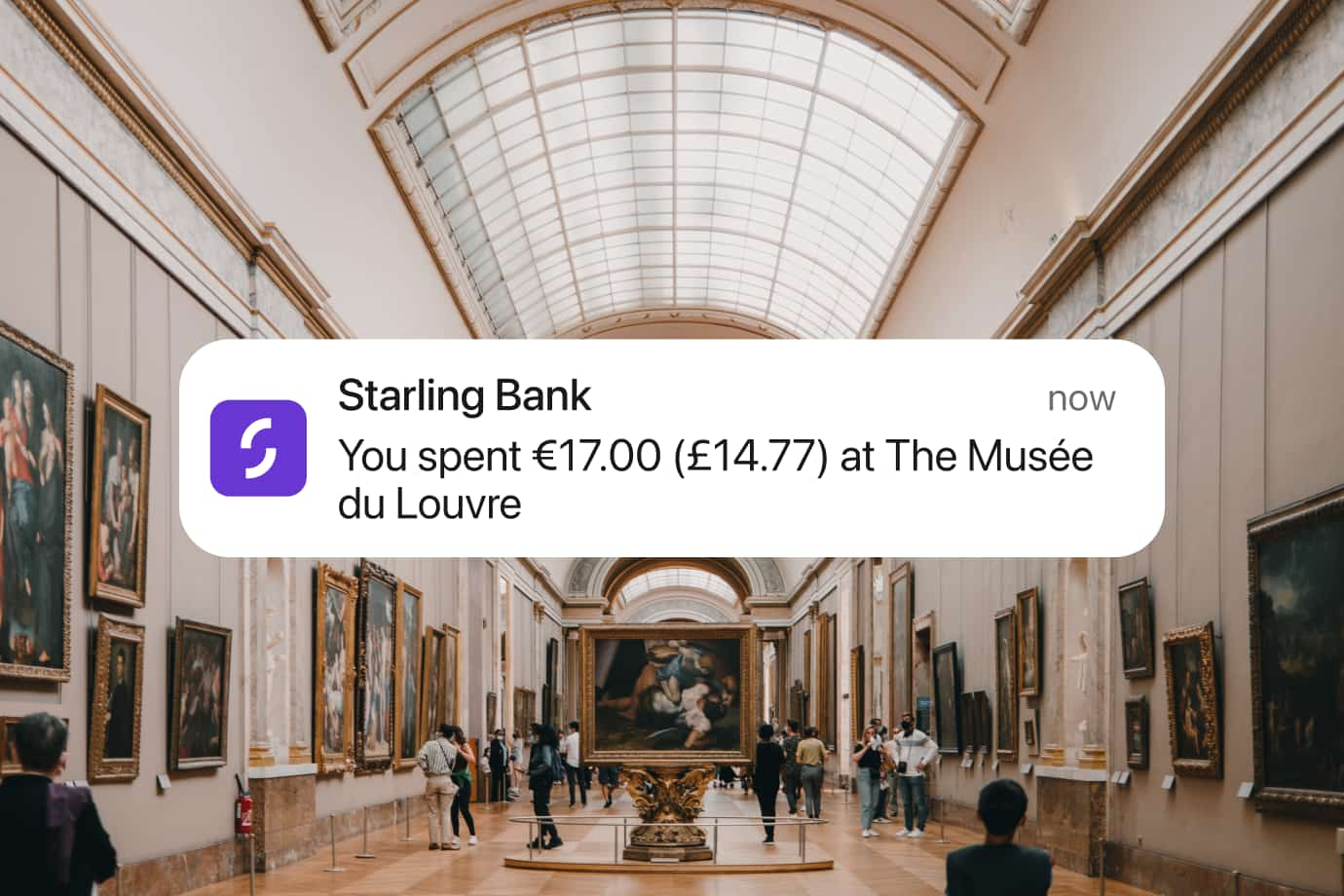

Once the transaction has been made, you’ll receive a notification from the Starling app outlining how much you’ve spent in the local currency and how much you’ve spent in GBP so you can see exactly what your boat trip or museum visit cost. It’s also a good idea to keep all your receipts and card machine receipts to check that you’ve been given the option you chose.

If you have a few coins and notes leftover at the end of your holiday, think about donating it or selling it on to a friend or family member you know will be visiting that country soon. Or hold on to it for your next trip to dodge additional foreign exchange fees.

Converting it back to GBP at the airport or at a foreign exchange on the high street will mean paying foreign exchange fees twice - once to go from the foreign currency to GBP and a second time to return it back to the foreign currency. If you have lots leftover and really need to convert it back to GBP, shop around for a good exchange rate (something that’s not usually found at the airport).

Wherever you’re going, a little research always goes a long way, especially if you’re planning a big trip to another continent. For example, if you’re set to travel around South America, you should be able to use a debit card or digital wallet in many places but you may well need some cash if you’re going to explore the Andes mountains or grab some food at a street café.

Even so, when you’re abroad, there’s a good alternative to those prepaid travel cards or getting lots of cash out in advance. Simply bring your Starling card and enjoy no fees from us when you travel overseas.

The article above includes general information and should not be taken as financial advice. If you have questions about your specific circumstances, please speak to an independent financial advisor.

Budgeting

By Esmeralda Dyer Bray

Expert interviews

By Vicky Reynal

Budgeting

By Charlotte Lorimer

Saving

By Matt Poskitt