Fraud

Anyone’s identity can be stolen these days

1st November 2024

30th August 2023

Age UK has reported that 940,000 older people fall prey to scams every year. Many people blame themselves for “falling for” a scam, when in fact, they’re victims who’ve been targeted and socially engineered by fraudsters.

In fact, anyone can become the victim of a scam, whatever their age. But it is the case that criminals do exploit a lack of knowledge around technology to target older people with certain scams.

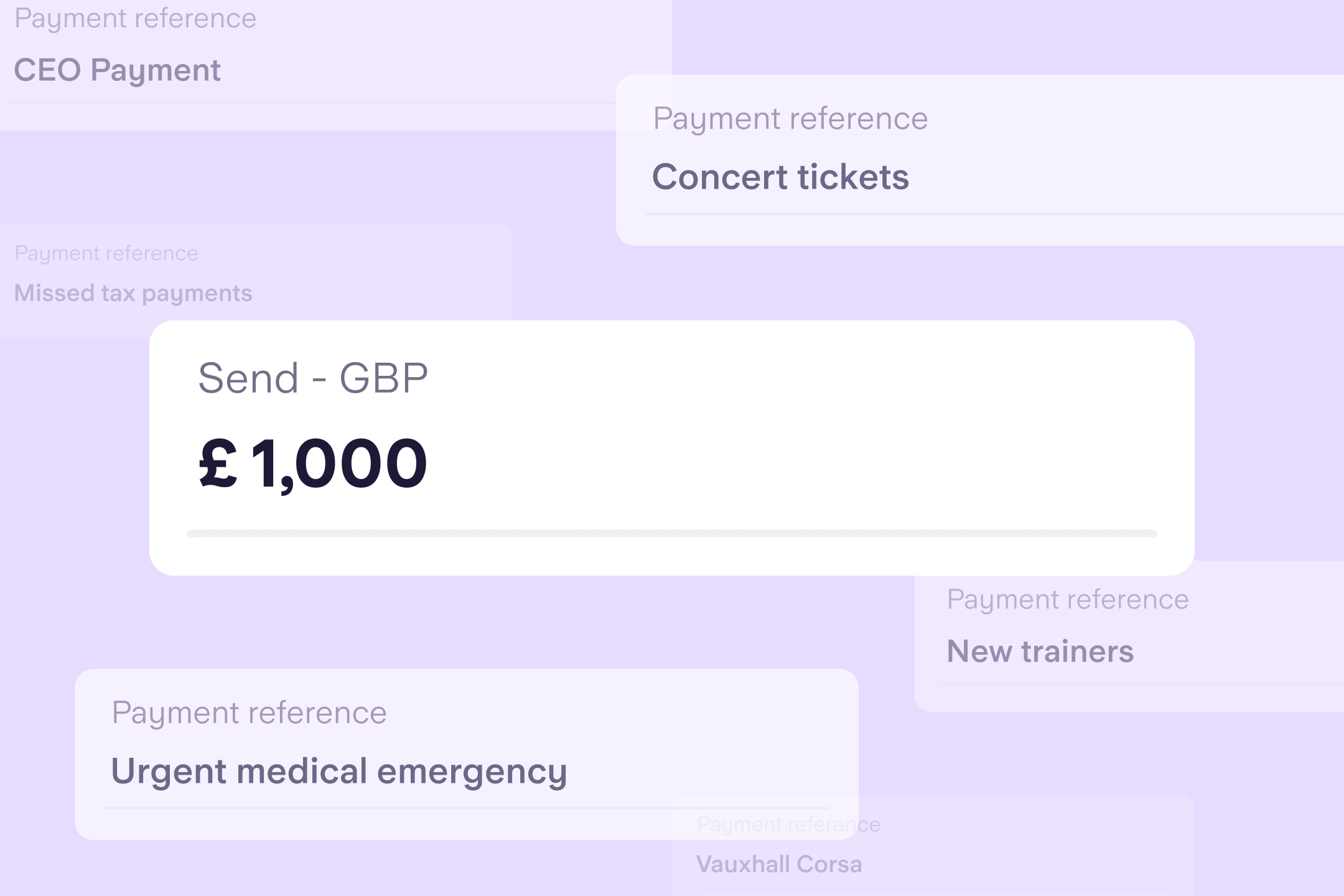

Someone calls pretending to be from the tax office, the bank or the police. They ask you to make payments to a new account. You should hang up.

You’re sent an email or text asking you to click a link because ‘your account is due to expire’ or ‘you need to pay £2.59 [or similar] for unpaid postage’ or even ‘you can win an iPhone 14 Pro’. Don’t click on the link.

You get an urgent request from the social media account of someone you know, asking for money. Call the person you know first to verify it’s legit. If the message is from someone you’ve never met: don’t send money. You get a friend request from someone you don’t know. Don’t accept.

Someone contacts you, saying they’re your bank, IT support, an internet provider or someone else ‘helpful’. They ask you to download applications on your computer or phone to share your screen, or to ‘help protect you’. Don’t download their application.

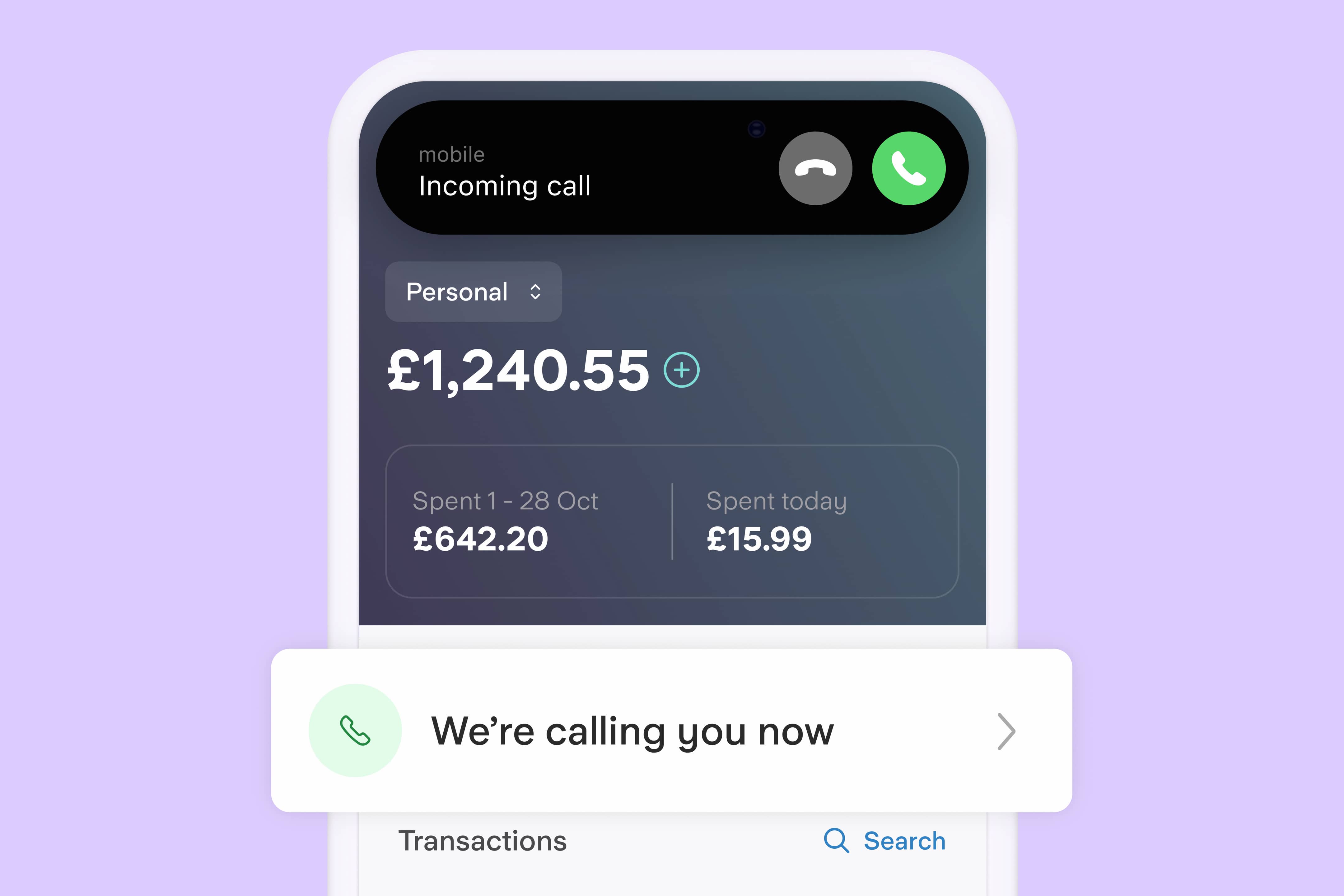

Criminals call, pretending to be from your bank, the police or even HMRC and demand an immediate payment, perhaps to protect your money from ‘hackers’ or because you’re ‘being fined for not paying tax correctly’. They may ask for security information.

Unfortunately, phone numbers can be ‘spoofed’. So the call appears to come from a real bank or company, but actually it’s fake. Criminals put pressure on people to act quickly, without giving them an opportunity to seek help from a family member or friend, putting them into a state of panic.

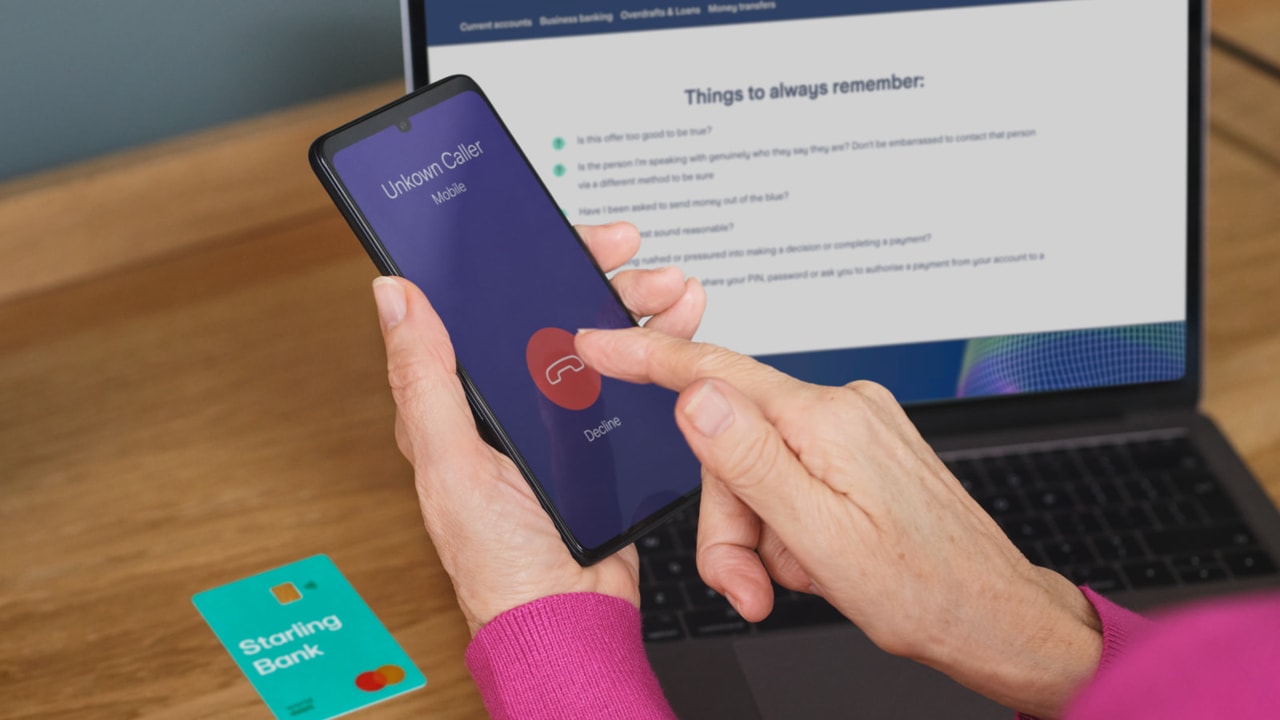

The best thing to do is to hang up and call back on a number you find independently, for example by searching on Google. Or you can dial 159 to speak to your bank or to check the call is genuine.

If you get the call on a landline, wait at least 15 minutes before calling (or better still, call back on another phone) to stop the scammer from staying on the line and pretending to be from the real organisation. Starling (or any other genuine company) would have no issue with you hanging up to check the contact was legit.

In order to commit fraud, a criminal first needs to gather information on their victim.

If you’re sent a message asking you to click a link, be very careful. Common scams ask you to click a link because ‘your account is due to expire’ or ‘you need to pay £2.59 [or similar] for unpaid postage’ or even ‘you can win an iPhone 14 Pro’. However the websites belong to the criminals.

Instead, go directly to the company’s website by typing the web address into the search bar on your browser and find the relevant pages from there. Unfortunately, most offers to win luxury items are fake, so it’s best to avoid responding to them.

Learn more on how to spot a suspicious email and fake texts from delivery companies.

It’s easy for a fraudster to create a fake identity on social media. That’s why many scams are initiated on sites such as Facebook, Instagram and dating sites. Here are some top tips for staying safe:

Don’t accept friend requests from people you don’t know in real life

Be careful with the personal information you share online. Before posting, ask yourself if you would give this information to a stranger you’d met on the street

If someone offers you an investment opportunity, don’t accept it. Genuine investment companies or financial advisors would never reach out to you on social media and there are lots of fake adverts around. Always use the FCA’s ScamSmart Investment Checker to ensure an investment is legitimate

If you start a relationship with someone you meet online, be very wary of requests for money. If you’ve not met them in person, don’t send any money

If you get an urgent request for money from the social profile of someone you do know on social media, call them on the phone to see if it’s genuine, it may very well not be

Explore more on how to stay safe with our articles on shopping scams and romance fraud.

Screen Sharing applications are software that can be downloaded onto a phone or computer to allow you to share your screen with another person. Scammers often use this technique to remotely control your device and steal your money and data.

The fraudster may impersonate a bank, investment company or an internet provider and ask you to download applications onto your device. They may say it’s to help fix a technical issue with your device, catch a “hacker” or to help you with an investment. But it’s all a trick. A genuine organisation would never call you unexpectedly and ask you to download a screen sharing app.

Hang up immediately if you get a call like this. If you think you’ve sent money that’s part of a scam, let us know as soon as possible by contacting us via the app or calling us.

Further information about scams can be found on Age UK’s site (Avoiding Scams) and at Take Five. The Metropolitan Police have also developed The Little Book of Big Scams and an audio version is available.

Support for victims of crime can be found at Victim Support.

Fraud

1st November 2024

Fraud

1st November 2024

Fraud

4th October 2024

Money Truths

2nd July 2025

Money Truths

1st July 2025

Money Truths

29th May 2025