Budgeting

“Bills, Bills, Bills” – Sorted in three simple steps

By Esmeralda Dyer Bray

Money masters

Nobody has ever woken up in the middle of the night and, having been struck by a bolt of near divine inspiration, decided to change their bank account.

You need a reason to change. Much of our routine is inertia. I’ll get a cheese and tomato sandwich for lunch because I always get a cheese and tomato sandwich for lunch.

Why do we wait for a push before we make a change? There’s something better out there – all it takes is the time to look up and think for a second.

And you don’t deserve being bounced around robotic call centres. You don’t deserve a bank that goes against your values. You don’t deserve standing in a bank queue moving slower than ‘90s internet.

It’s a lot simpler than you first thought.

The Current Account Switch Service (let’s call it CASS) is a UK-wide scheme that guarantees a complete, hassle-free switch from one bank to another.

If you choose to switch, CASS will move all your payees, direct debits, standing orders and your balance to your new account after closing your old one. All for free.

You can read more about CASS here, but let’s get into why we’re actually worth switching to.

Yes, we’ve won lots of awards – and been chosen as a Which? Recommended Current Account Provider six times in a row (but who’s counting?).

But we’re just as thrilled that more than three quarters of our reviews on Trustpilot are five stars. Thanks!

We don’t charge any monthly fees for our personal, business or joint accounts. Or for withdrawing cash abroad. Or for using your card overseas.

We’ve teamed up with the National Trust to give primary and secondary school children better access to nature. So far, over 8,000 kids have taken part in nature workshops at National Trust places.

We’re also supporting sustainability projects to help protect and restore peatland. By April 2025, together with match funders, we’ll have supported the restoration of 400 hectares of peatland.

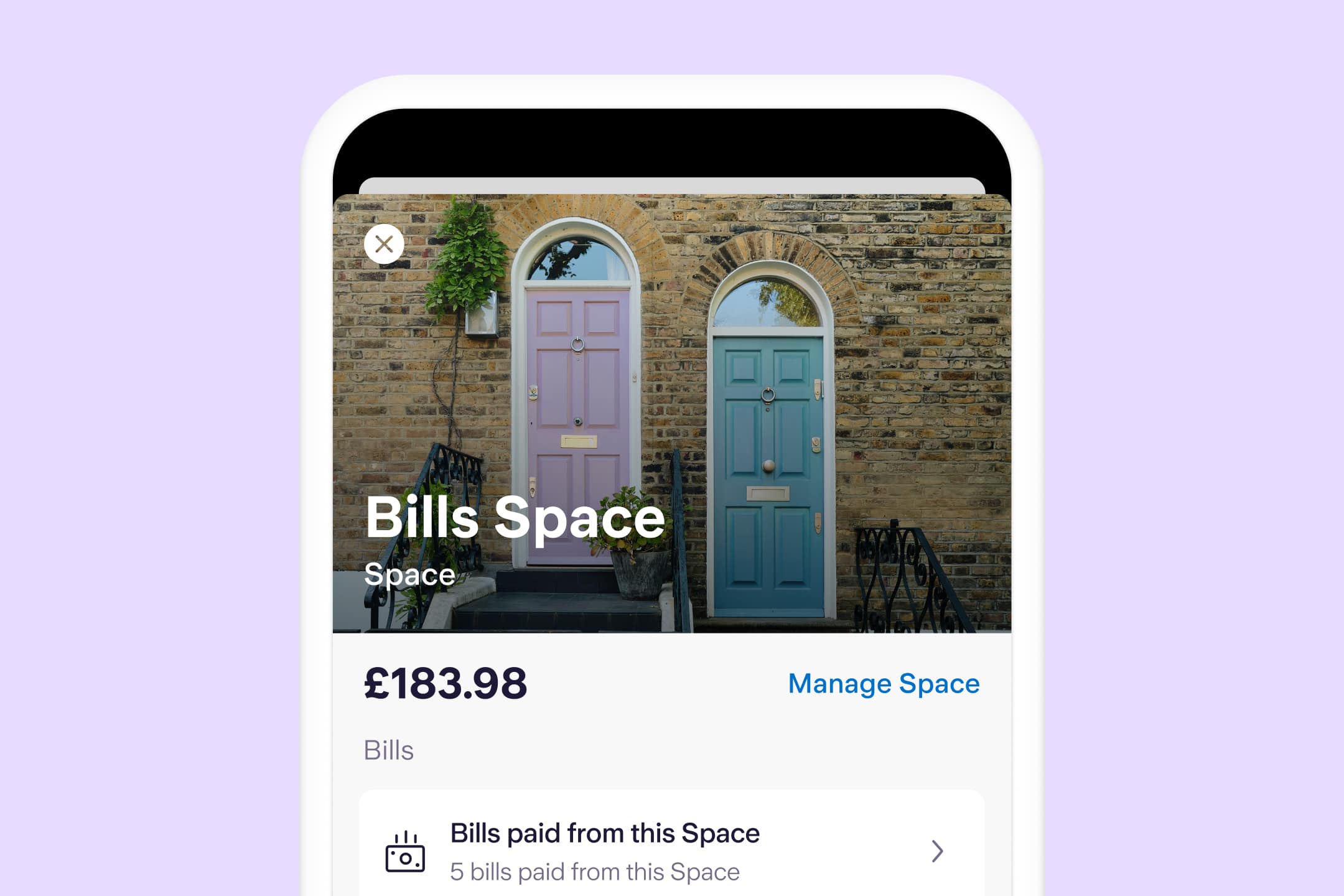

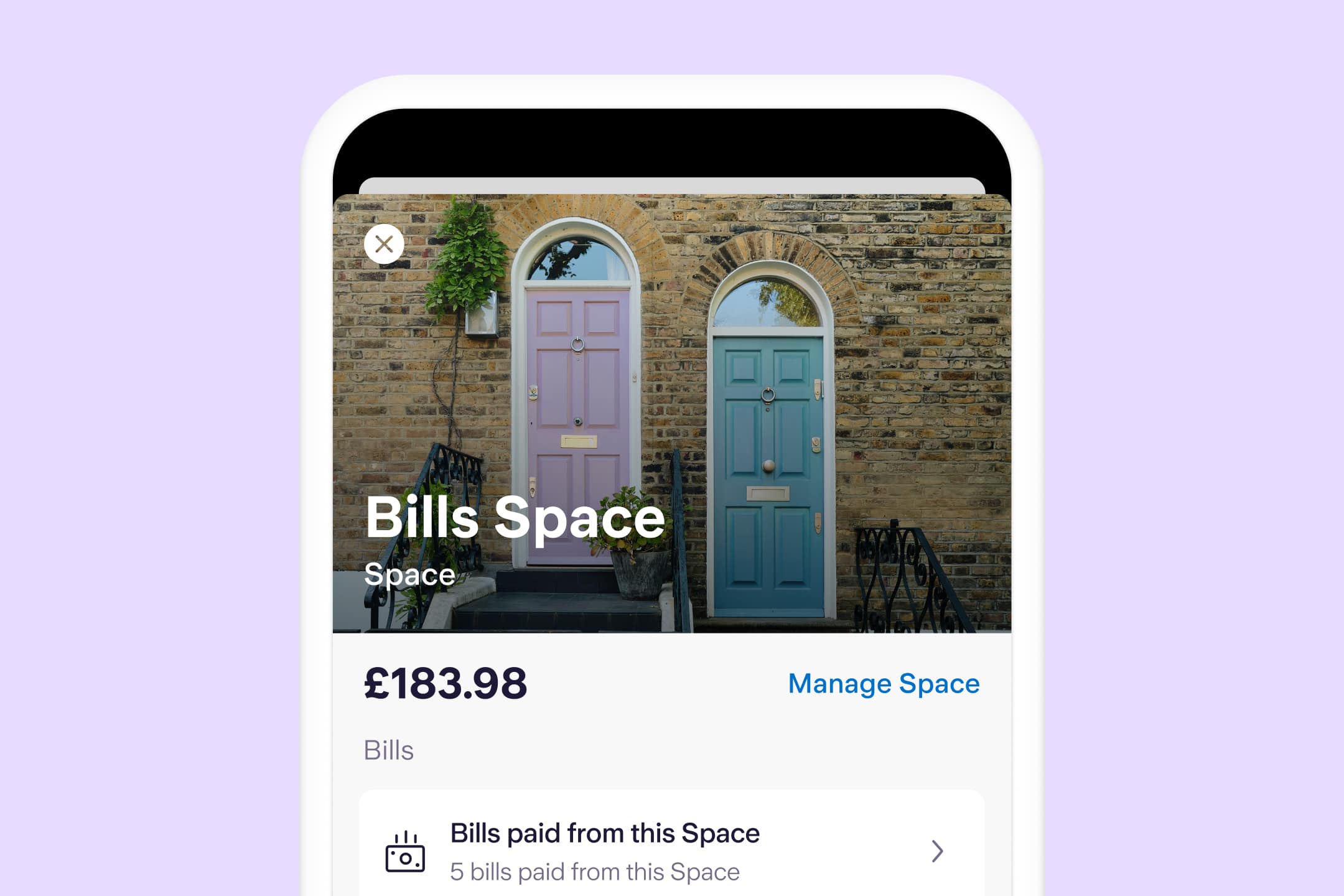

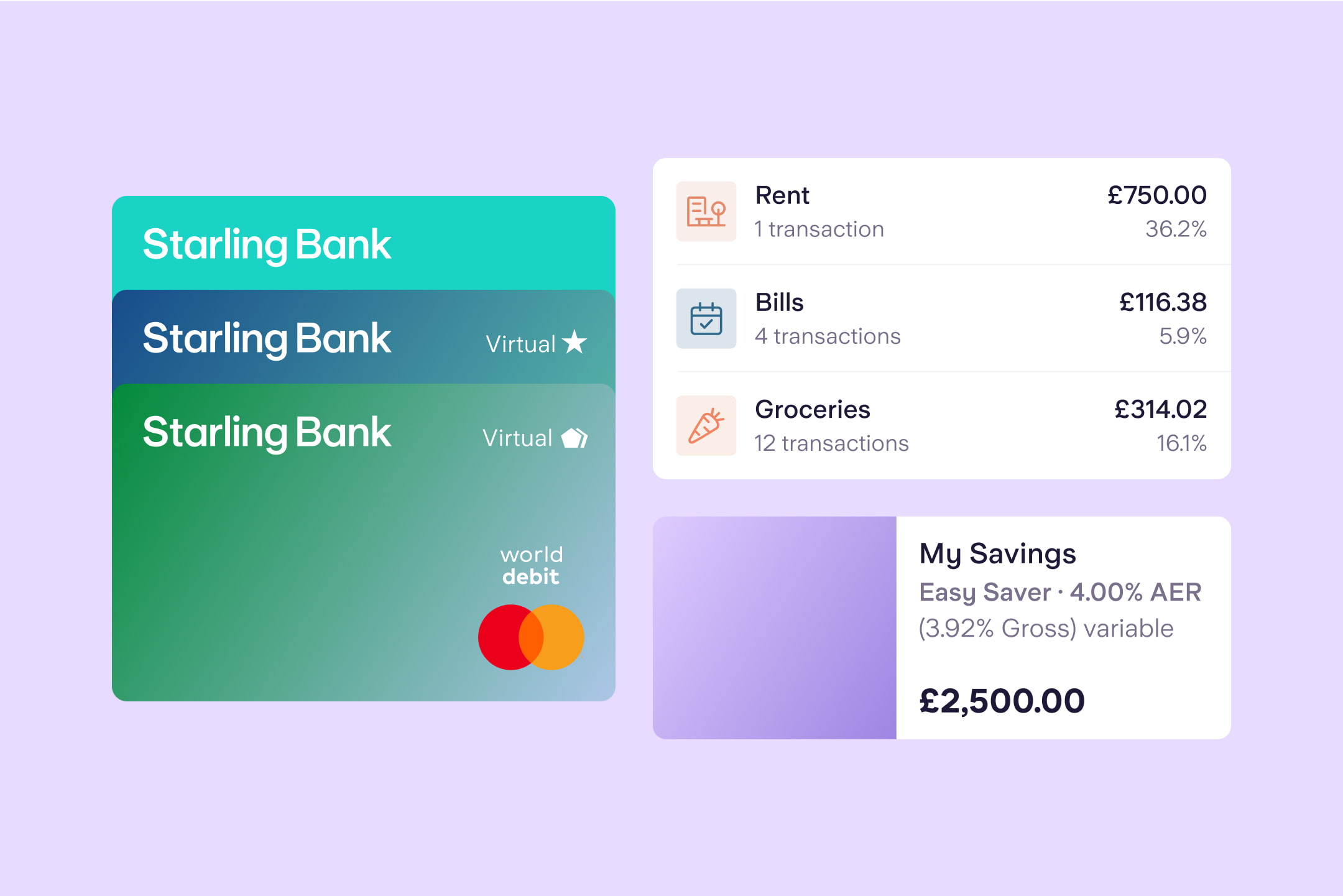

There’s no need for multiple bank accounts any more – Spaces are the way forward. It’s the easy way to split one bank account for bills, rent, or anything else you fancy.

So, no more realising your monthly gig budget’s been eaten by that overindulgence in the cheese aisle.

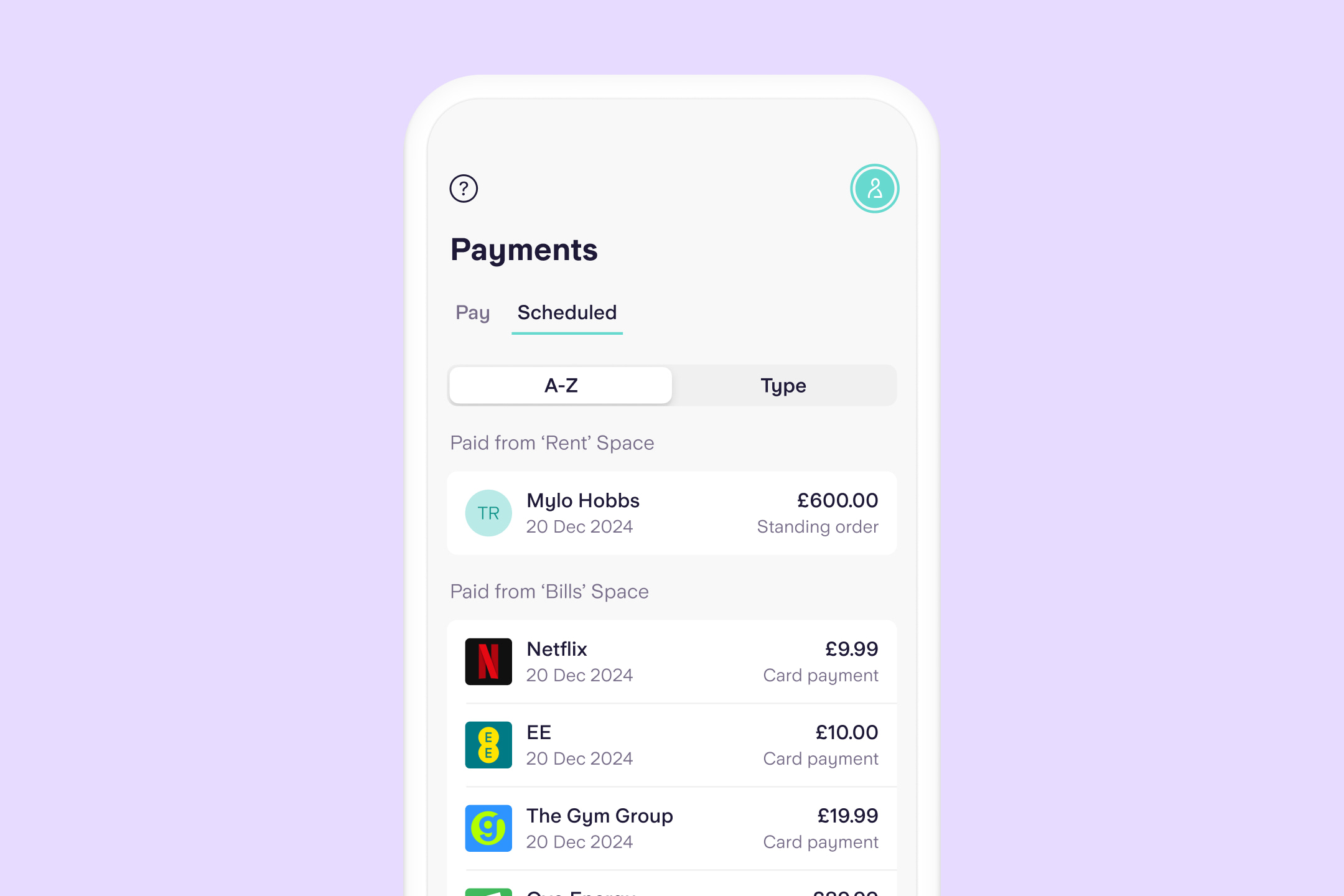

Seeing all of your scheduled payments (like subscriptions) gives you a better picture of your money and the chance to have a think about cancelling services you don’t use.

Sayonara, online hot yoga membership you used once.

It’s our savings account you can transfer money in and out of instantly. No penalties or notice periods. And all whilst earning 3.75% AER (3.68% gross) variable interest.

Think of it like a bank branch in your pocket. But with more award-winning customer service and fewer chained-up pens.

You can download a proof of address in the app too. And, if you need to change the name on your account, you can speak to Customer Service in your app.

Go to your Starling personal, joint or business account, press the + button next to your balance and select ‘Switch to Starling’. Follow the steps on-screen.

Then, choose a switch date. Seven days before that date, we’ll get in touch with your old bank and start moving everything like your Direct Debits and standing orders over. Don’t set up any new payments in your old account within this seven day period, as they won’t be moved over.

On the day your switch has completed, your balance will move over and your old bank account should close, unless you’re overdrawn.

Oh, and any payments sent to your old account will be redirected to your new account for three years.

We told you it was simple. See you there!

* Rate accurate as of 16th May 2025. Terms and conditions apply. Personal current account required. Interest paid monthly. Gross is the contractual rate of interest payable before the deduction of income tax; AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year.

The article above includes general information and should not be taken as financial advice. If you have questions about your specific circumstances, please speak to an independent financial advisor.

See how easy it is to switch current account (and what makes Starling a great choice)

Learn more about switching

Budgeting

By Esmeralda Dyer Bray

Expert interviews

By Vicky Reynal

Budgeting

By Charlotte Lorimer

Saving

By Matt Poskitt