Business

“Becoming a mentor helped me see my own value.”

6th March 2025

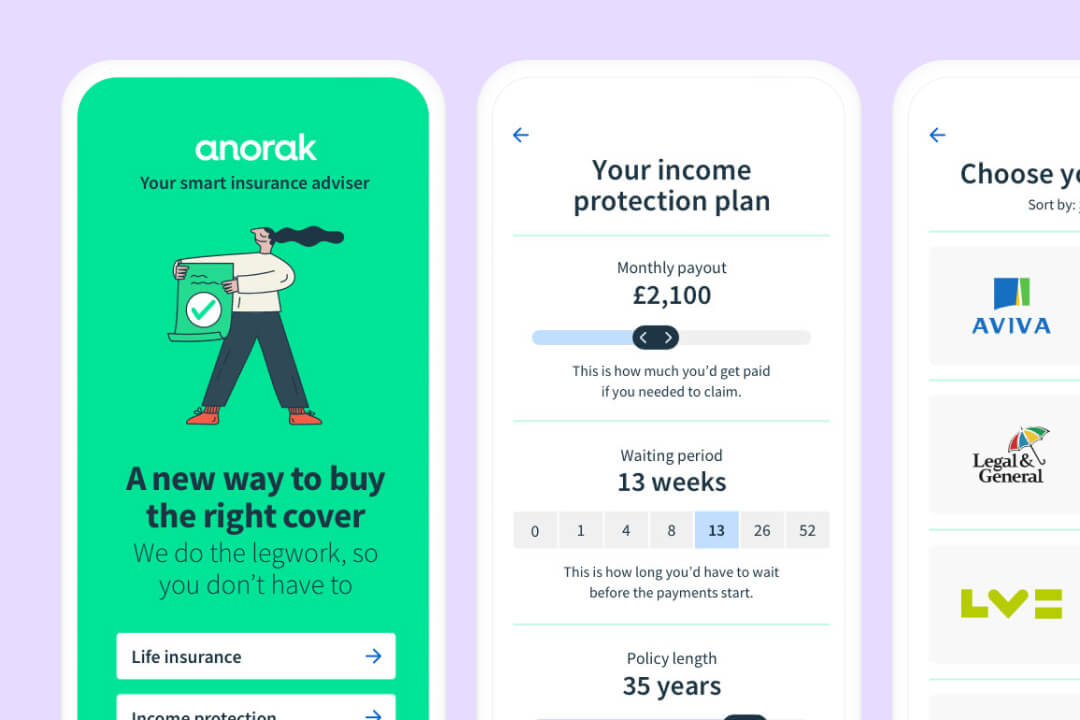

Anorak, one of our Marketplace partners and an independent online broker for life insurance, income protection and critical illness cover, talks about insurance cover for sole traders.

A life of self-employment has its pros and cons. It means you can be your own boss, set your own hours, and boost job satisfaction. Great! But it also means you may not have the safety net of sick pay or other employer protections, leaving you and any loved ones financially vulnerable if something happens to you. Not so great.

So to help our sole trader customers make sure they’ve got the right financial protection in place, we’ve partnered with Anorak: the online adviser for life insurance and income protection. Anorak’s online service is a simple way to get expert, unbiased advice on your financial liabilities and help choosing the right insurance for your circumstances.

Anorak exists to make it easy for sole traders like you to help financially protect yourself and your family by providing the safety net of sick pay and life insurance. It’s independent and FCA-regulated.

If you’re a freelancer, contractor or sole trader, you don’t automatically have the safety net of PAYE employees, with sick pay and other employee benefits. Without such protection, if something happens that means you can’t work, you and loved ones could face financial struggles. Taking out life insurance and income protection can help protect you if things go wrong.

Got it. Where do I start?

Head to the Business Marketplace in your Starling app and look for Anorak in the ‘insurance’ category. From there, you can take Anorak’s quick online assessment to find out exactly what insurance you need (if any) and how much it’ll cost. Anorak will shortlist the policies most suitable for your needs and profile, fetching you best-priced quotes from the whole market of insurers. It goes like this:

Take an online assessment (it shouldn’t take longer than five minutes)

Get instant, online advice about what insurance you need

See your best-matched policies from the whole market

Get expert help choosing what to go with

And if I want to take out cover?

If you decide to go ahead and get covered, Anorak will guide you through the process and help you make a properly informed decision. If you decide to go ahead with their recommendation, they also handle the admin for you.

This is intended as general information and doesn’t constitute advice. Make sure you take independent advice if you’ve got any questions about your specific circumstances.

Article updated 8th July 2022

Business

6th March 2025

Business

24th May 2024

Business

24th May 2024

Money Truths

8th July 2025

Money Truths

2nd July 2025

Money Truths

1st July 2025