Fraud

Anyone’s identity can be stolen these days

1st November 2024

Sarah Lenette, one of Starling’s financial crime specialists, offers advice on how to spot ‘HMRC scams’.

You receive a call, text or email from what looks like the tax authorities at HMRC and they want to talk about your taxes. It must be genuine, right? But wait: are you sure they really are HMRC and not criminals?

It’s a scam that’s been around for years and it’s still here. A criminal impersonates HMRC or law enforcement, contacting victims to demand an immediate payment for an outstanding tax payment or tax-related fines. They may even threaten their target with arrest or a visit from bailiffs, if a payment isn’t made during the call.

This type of call can feel very real and it’s easy to be sucked in by how professional the caller sounds. They may even know some of your personal information, possibly gained through phishing emails or texts.

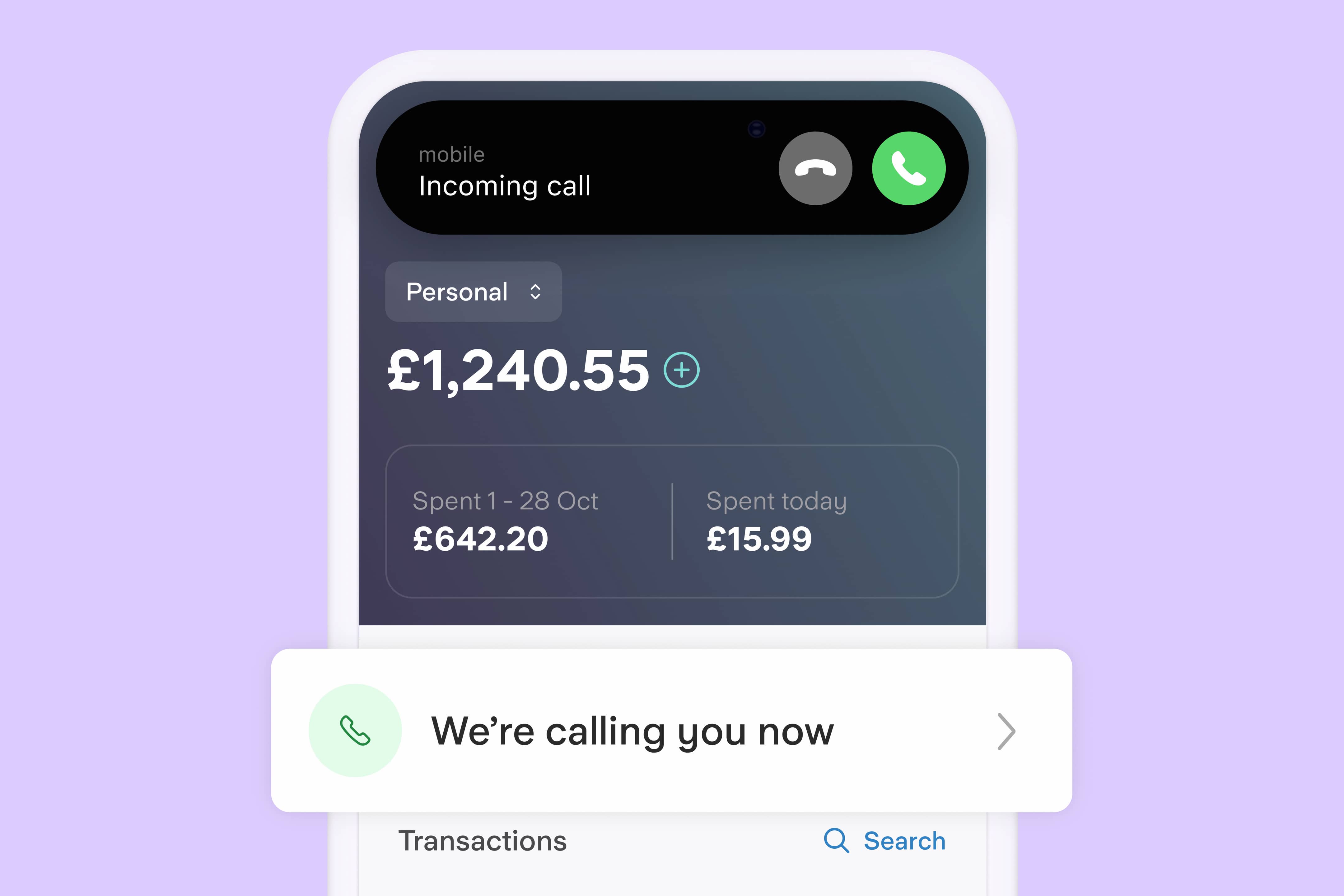

Contact may be initiated by a voicemail, telling you to expect a call from someone to discuss a case in your name, or even a call from an automated voice, telling you to press a number on your phone’s keypad, often ‘1’, to be connected to a ‘caseworker’. Any calls or texts can appear to come from a phone number linked to HMRC, law enforcement or the courts - this is known as phone number spoofing.

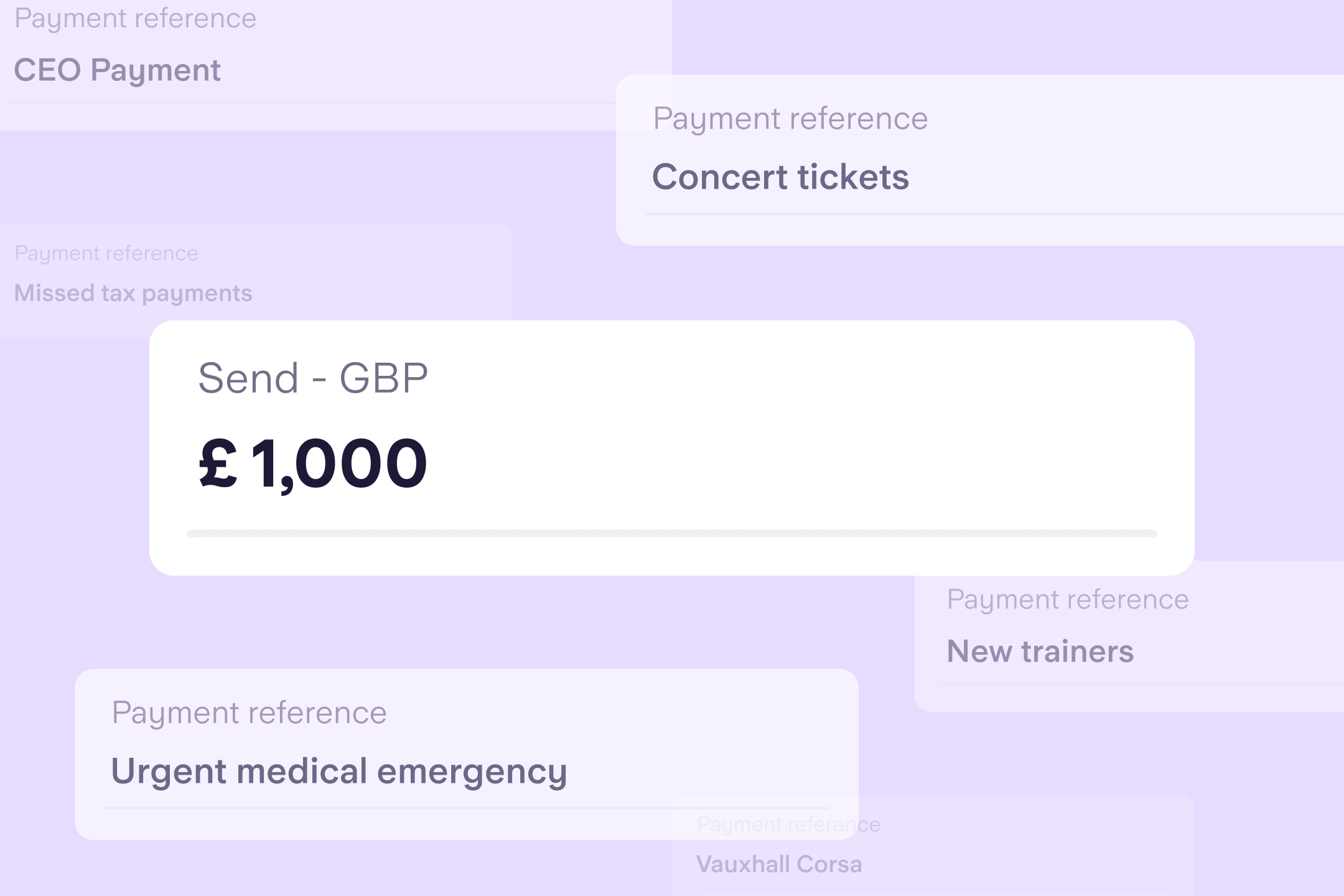

During the conversation, you will be given a story as to why you need to send funds immediately - maybe a former employer has messed up your tax code, or you’re told that you’ve been evading tax payments. It may even be as complex as being told that you’ve been impersonated by someone racking up debt and tax bills in your name and have to pay a fine whilst an investigation is taking place.

If you receive any calls from someone telling you that you haven’t paid the right taxes or are being fined, hang up the phone immediately and take a moment to think. Call HMRC (or the organisation you think you’ve been contacted by) back using a phone number found on their website, to confirm whether the call is genuine. Remember to Stop, Challenge and Protect.

HMRC or law enforcement will never:

Call out of the blue and demand an immediate payment

Threaten you with arrest if you don’t pay straight away during the call

Contact you via WhatsApp or other messaging platforms

Ask you for personal or financial information by email or text

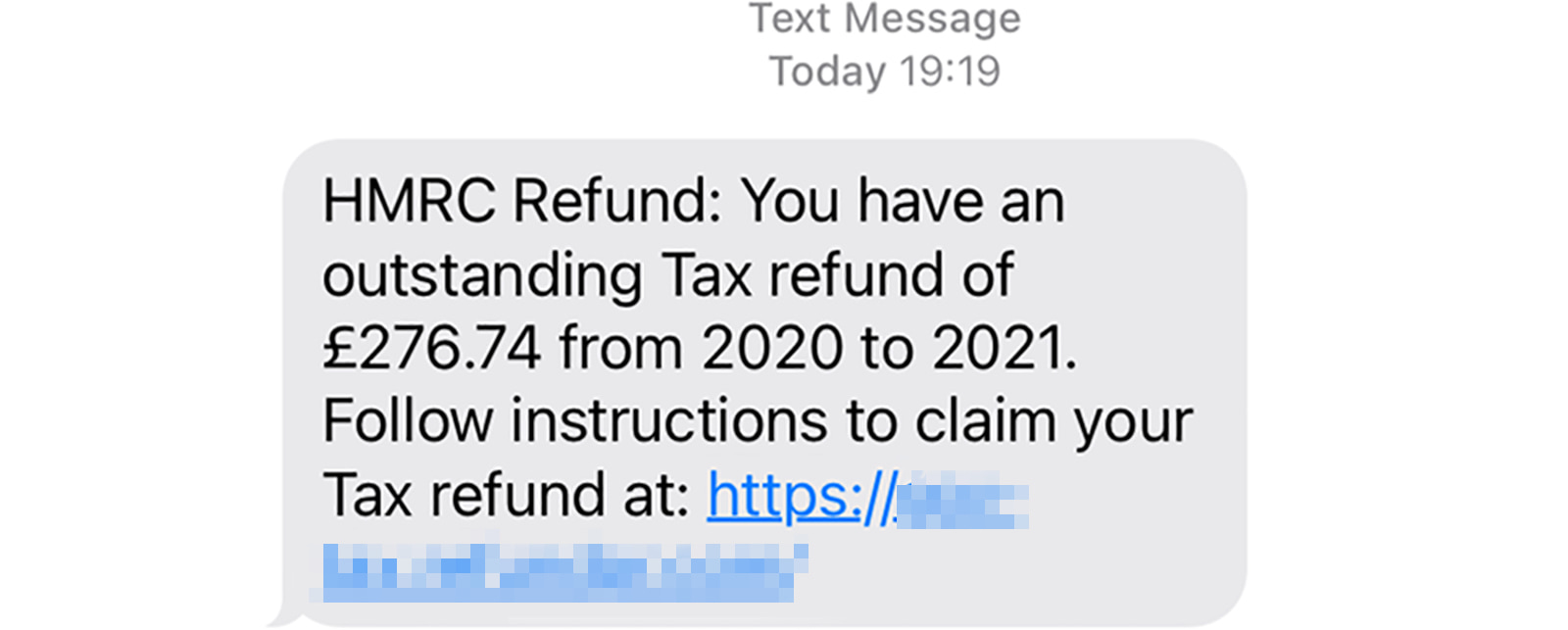

You should also be careful of any messages stating that you are due a tax rebate as this could be a criminal trying to obtain your personal information. HMRC does not send notifications of a rebate via email or text. If you receive a message like this, forward any emails to and texts to 7726 (a free SMS reporting service), then delete it and do not click on any associated links.

Visit our friends at Take Five for more straightforward scam advice or HMRC’s website to see examples of suspicious emails, calls and texts.

If you think you’ve been a victim of fraud, report it right away to your bank and also contact Action Fraud.

Remember, you can call 159 to get through directly to your bank if you think you are about to be scammed, or if you want to check whether a call from the bank is genuine.

Fraud

1st November 2024

Fraud

1st November 2024

Fraud

4th October 2024

Money Truths

29th May 2025

Money Truths

28th May 2025

Money Truths

20th May 2025