Fraud

Anyone’s identity can be stolen these days

1st November 2024

Criminals are constantly adapting the way they use technology to try and steal money. In this blog, we’ll take a look at how remote access software is used in some of the latest scam trends.

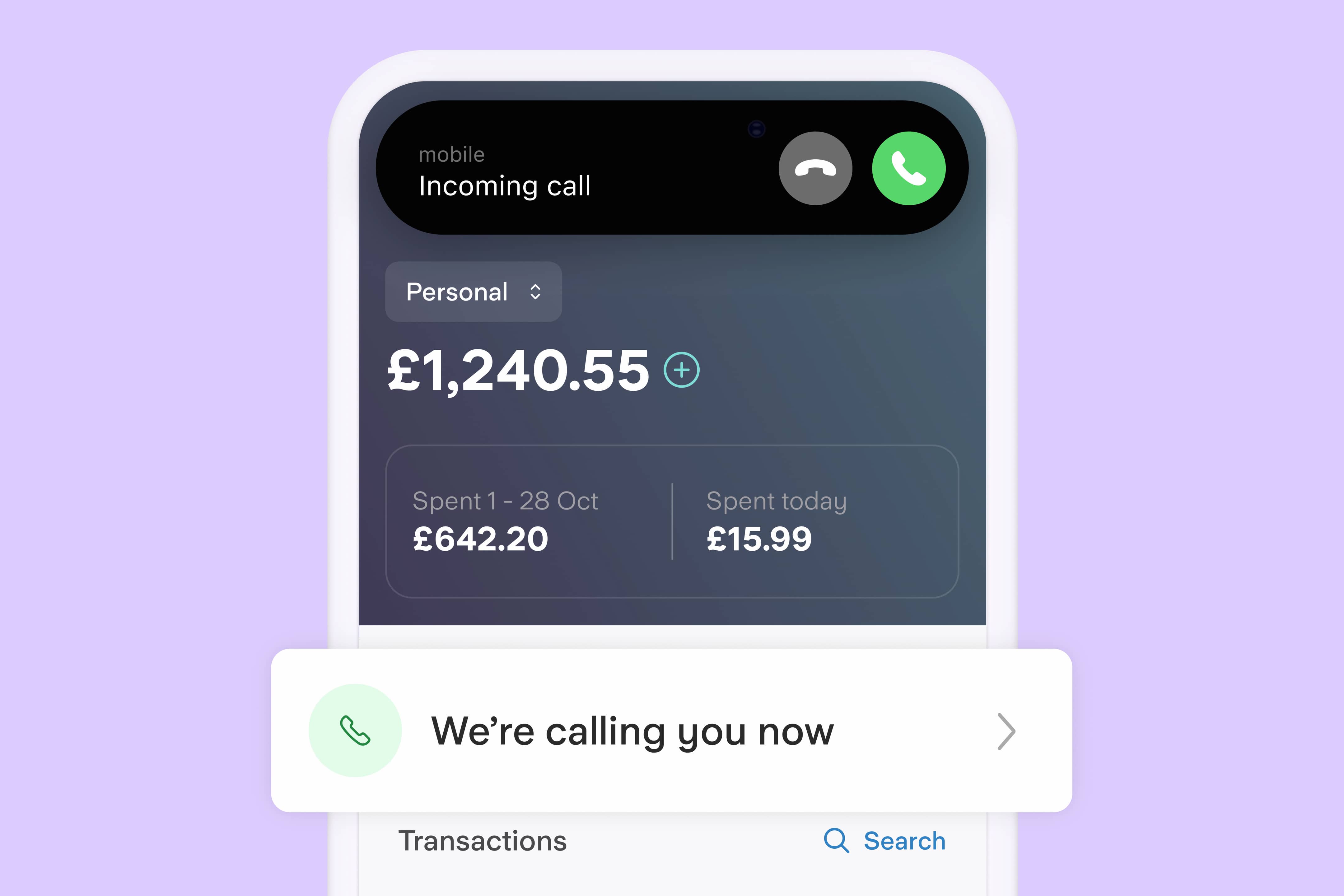

If you receive a call out of the blue, from someone claiming to be from your bank, law enforcement or an internet provider, and advising that you need to move your money out of your bank account because ‘it’s not safe’, hang up immediately! Fraudsters can use this tactic as a way to convince you to download remote access software in order to ‘help you move your money out safely’.

Once downloaded, they’ll be able to see any login details you enter and could remotely control your device to send funds out of your bank account. Be aware that if you have login information stored anywhere on your device (for example, saved as a note), this could be accessed by the scammer.

They can even present false screens onto your device, making it look like money is leaving your account. In reality, if your bank had concerns about the safety of your account, they would take the necessary steps to secure it for you.

So, what is remote access software?

Remote access applications or software can be downloaded onto your computer, or phone, to allow another person to control your device or view your screen. This type of software is often used legitimately, by individuals who wish to work from a location that’s different to where their main computer is, or by an office’s IT team helping a member of staff fix an issue with their device (when turning it off and then on again doesn’t work!).

Unfortunately, criminals have been seen to use this type of software when attempting to steal innocent victims’ money. Another scam trend is outlined below.

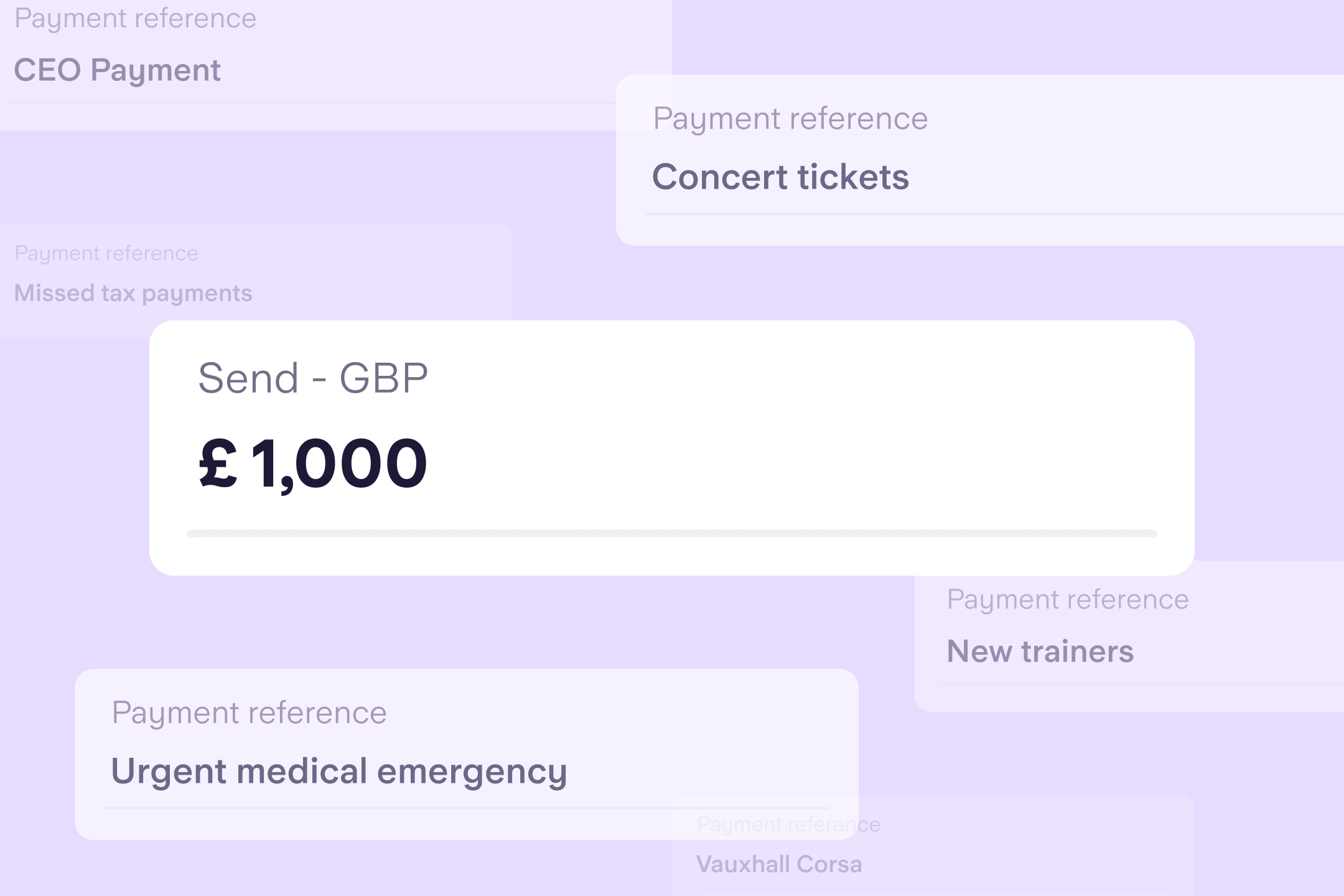

Scammers advertise themselves online as trading experts and offer to help you invest your money into a scheme with high returns. Part of their ‘service’ will include assisting you with setting up your trading account by using remote access software. In doing so, you’re opening a legitimate account at a trading platform, but the scammer can see all the information you use to open the account, including your login information.

Once you have deposited a significant amount of money into the trading platform, the scammer may access the account using your login details and move any funds into other accounts they control.

If someone calls you out of the blue, always verify who they are. Remember that phone numbers can be spoofed (made to look like they are coming from a genuine organisation), so call a company back on a trusted number you find yourself on their website. Or call 159 to contact your bank directly

Keep calm. Scammers will try to pressure you into making decisions quickly. Speak to a trusted family member or friend first, if someone you don’t know is asking you to move money or download software to your phone or computer

Never share your passwords or login information with other people

Anyone offering financial advice should be FCA regulated - check the FCA register

A genuine organisation will never ask you to download a remote access app or software to assist you with financial matters. In fact, it may go against the terms and conditions of your bank to allow a third party access to your account

Not only are these scams ways of stealing money, they’re also how criminals obtain personal information about an individual. See our blog on identity theft for information on what the scammers can do with your data.

If you think you might have given a criminal access to your device, we recommend the following:

Uninstall the software or app immediately

Change any passwords that may have been seen by the criminal

Contact your bank to advise them that it’s possible your banking information may be compromised

Keep an eye on your credit report to ensure your information isn’t being used to take out any credit in your name. You can also sign up to protective registration from CIFAS as an extra precaution

Report the incident to Action Fraud (or Police Scotland)

Fraud

1st November 2024

Fraud

1st November 2024

Fraud

4th October 2024

Money Truths

8th July 2025

Money Truths

2nd July 2025

Money Truths

1st July 2025