Last Digit Widget

Stimulus. Routine. Reward.

By Vicky Reynal

Trend Vetter

I am the millennial you’ve been warned about. I have drunk enough novelty drinks to, if not buy, at least fill a house. But something had to change, I decided over my pumpkin spice latte. It was time for a “Great Lock-In.”

I had previously tried to curb my impulsive habits with good old-fashioned willpower (if that’s what you can call deleting coffee shop apps), but I knew I needed some more desperate measures.

According to TikTok, The Great Lock-In works like this. You figure out your self-improvement goals – be it more sleep or more steps, less junk food or a lot less scrolling – and you execute them day after day after day.

The trend is not about literally being locked inside the house – it’s about “locking in” to your ambitions. But as I found out over the course of my experiment, the latter did often lead to the former. And while my bank balance and blood sugar thanked me, my friends certainly didn’t.

“I did notice you clawing back,” says my friend Elle, “Typically you’re very generous and profligate, and eager to spend more than I would typically.” While Elle says she didn’t mind the shift in my personality, she confesses that she felt obliged to treat me to a takeaway lunch when I suggested staying in rather than going out. She’s too kind to say she begrudged me the meal, but it was interesting to see how the experiment affected my relationship dynamics.

But let’s rewind. The first day of your new life is always the easiest – and the most smug. With alarming ease, I worked out, ate my greens, read, and cooked at home – I even squeezed five lemons to make an elaborate drink all by myself. I ended the day spending £0, which was an absolute thrill, even if a voice in the back of my head told me I probably should’ve left the house.

And yet when day two dawned, I had to decline an offer to leave the house – turning down a friend’s suggestion that we grab cocktails that night. I love a silly little cocktail even more than I love some silly little milk, but it was money I’d promised myself I wouldn’t spend – and I knew I’d never cook at home if I had a drink out and about first. Though I was sad to miss out on socialising, I flicked on some fairy lights and snuggled on the sofa, enjoying the rare but deeply satisfying sensation of my bank balance having stayed exactly how I left it. Dreamy.

Two days of willpower is about all I have in me, so when some novelty peppermint cookies called my name while I was running errands on day three, they naturally made their way into my basket (and mouth). I had plans I’d already paid for that evening – a trip to the cinema – so I managed to get my social fix, but it did hurt to watch a film without splashing on dinner and drinks afterwards.

By the end of the week, it felt fantastic to have finished reading a book and eaten a cabbage. But I was worried my friends disliked the new me. No matter what Elle says, wouldn’t she sooner have gone out with a more spontaneous, footloose friend, rather than buy me a Mexican takeaway and sit on the sofa listening to music from The Sims?

Despite the ups and downs, I did notice a definite shift in my attitude to spending. I realised just how much I was splurging mindlessly – I must’ve saved at least £30 on silly little drinks . I’d saved even more on food (sorry Elle). I have a terrible habit of grabbing things on the go or ordering a takeaway after a difficult day – and my bank balance remained remarkably sturdy. It was eye-opening to realise I’d easily saved at least £100 over a week.

Still, what was the first thing I did when my experiment ended? Hand over six of my hard earned pounds for a white chocolate milkshake. But even this felt a lot more intentional than my spending had done previously, so I hope I can carry it forward with me (the mindset, not the milkshake). My Great Lock-In taught me that it’s nice to wait for a treat, rather than splashing on it spontaneously, and that no-spend days can be weirdly thrilling. Pumpkin spice is nice, but a healthy bank balance can be nicer. Anyone for a Little Lock-In instead?

My Great Lock-In top tips

Remember Starling’s real-time notifications can help you keep track of what you’ve spent. Your bank balance will never be a surprise again

Try leaving a temptation to splurge for a few hours (ideally a whole day). Waiting for a treat can make it more enjoyable, and sometimes you realise you didn’t even need it after all

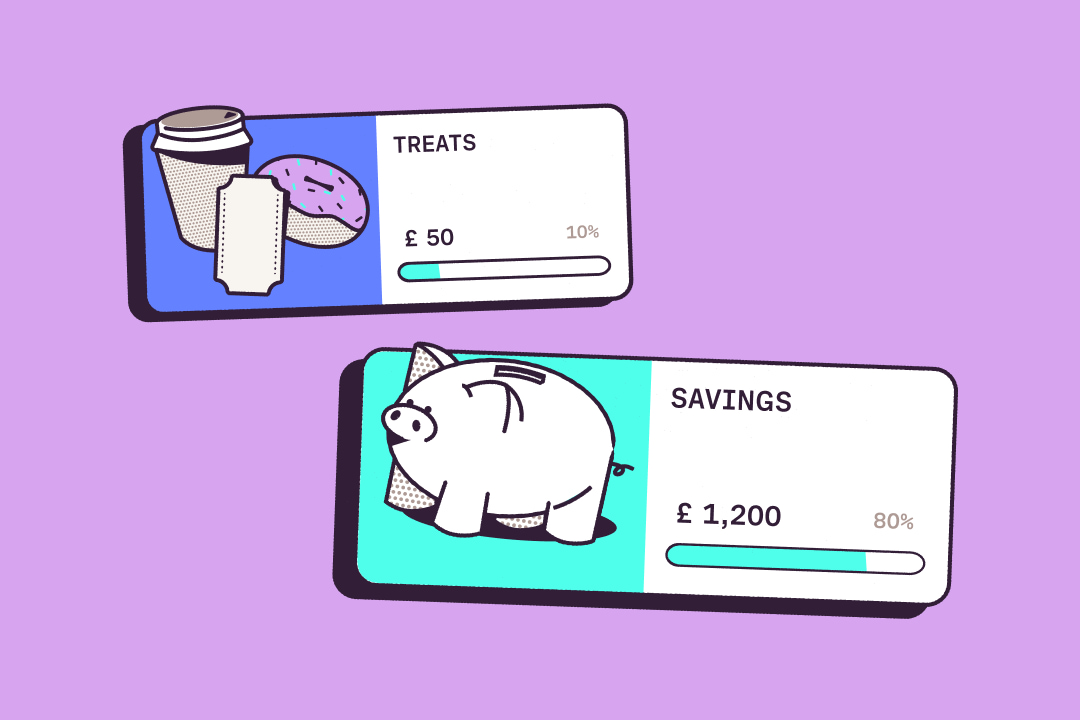

Just because you haven’t spent the money doesn’t mean you’ve saved it. Setting up small, automatic transfers to a Starling Space means you won’t splash the money

Lock-ins don’t need to be “great” to be productive – setting yourself little spending and saving challenges, rather than overwhelming ones, can be a path to more intentional spending.

Separate your serious money and your fun money.

Learn more about Spaces