Business

“Becoming a mentor helped me see my own value.”

6th March 2025

Unless you’re an accountant, the chances are that you didn’t start a business because you have an all-consuming passion for reporting VAT records. In fact, 42% of entrepreneurs feel that dealing with business finances is the most stressful part of running their company. Some 17% went on to add that the stress it caused was so great that it actually made them unwell.

And that was before the government’s new Making Tax Digital system was introduced. This initiative means that small to medium enterprises (SMEs) with a turnover of over £85,000 must now report their VAT records digitally. Although this will increase efficiency once people become familiar with it, right now it’s adding to the stress levels of many business owners. But Starling Bank can help you cope with all that paperwork pressure, leaving you with more time to concentrate on growing your business.

It’s our mission to make business banking simple and stress free. So, on top of providing the account for free to small businesses, we offer valuable features designed to alleviate the pressures of running a small business. Take a look at our expanding Starling Business Marketplace to see some of the ways our portfolio of partnerships can help you and your business.

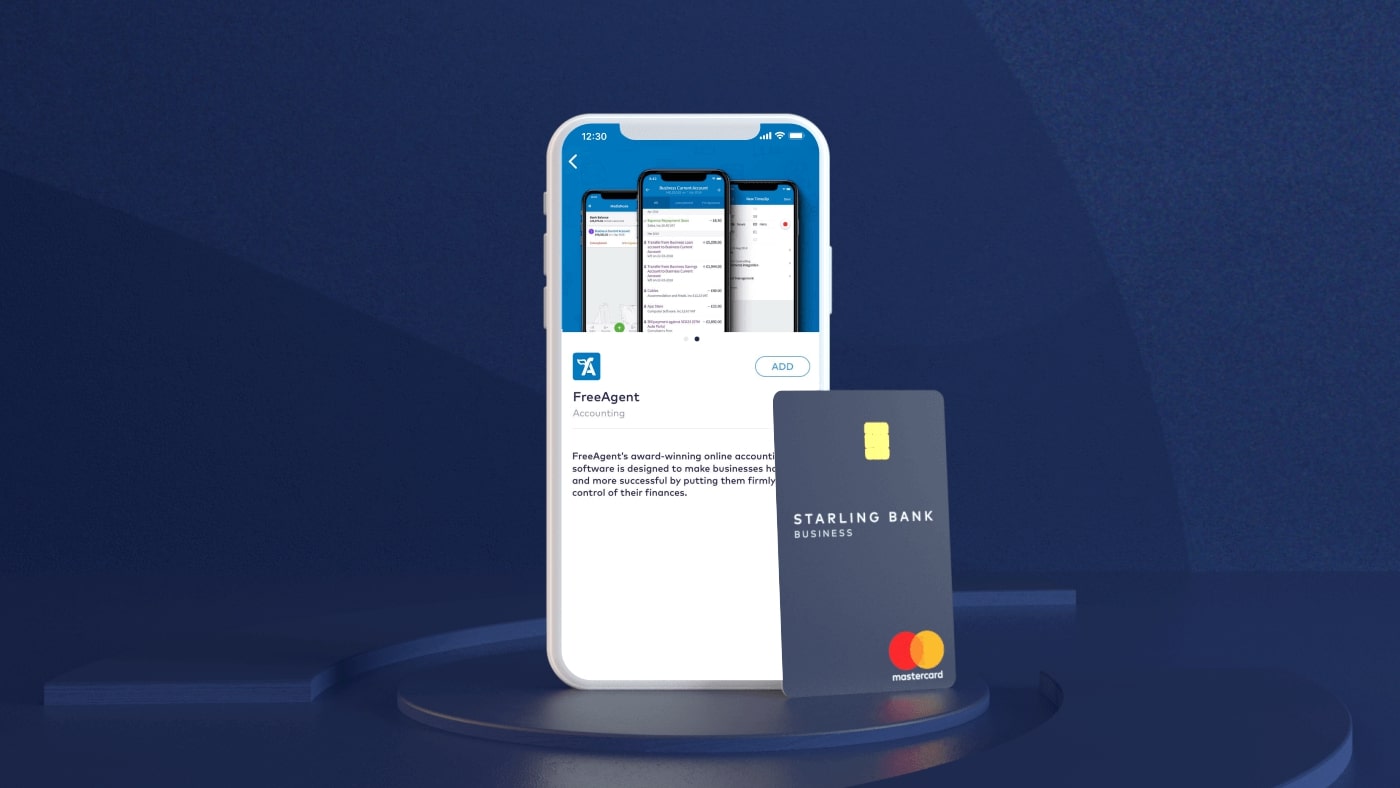

From today, you'll be able to sync your Starling business account with FreeAgent accounting software. We introduced this partnership in response to customer demand, following our integration with Xero last year.

Once you integrate your Starling business account with FreeAgent, you’ll be able to automatically share your transaction feeds in real-time with the software.

That means you can slash the time you spend on your daily admin, digitise your finances and relax about tax. In short, FreeAgent will enable you to spend your time more productively.

With your consent, FreeAgent accesses your Starling data. This includes data associated with your Starling transactions, including:

Spending category

Transaction time

Company name

What’s more, FreeAgent accounting software is ‘Making Tax Digital’ ready, so it can help you organise your numbers in a way that is accepted by the government’s new VAT reporting system.

FreeAgent can easily be accessed via their app, so you’ll be able to reconcile, view your reports and create or approve expense claims wherever business takes you.

And the best news? FreeAgent can help you reduce the time you spend on monotonous manual data entry needed to run your payroll and accounting. And you’ll cut the risk of inaccuracies creeping into your accounting because your transaction feed is sent securely and automatically to FreeAgent without you having to key them in.

As well as helping you to keep on top of your current Starling transactions, you can effortlessly upload up to a year of past transactions with us to FreeAgent.

FreeAgent is the second accounting software to integrate with our Marketplace, joining Xero which we launched in November last year.

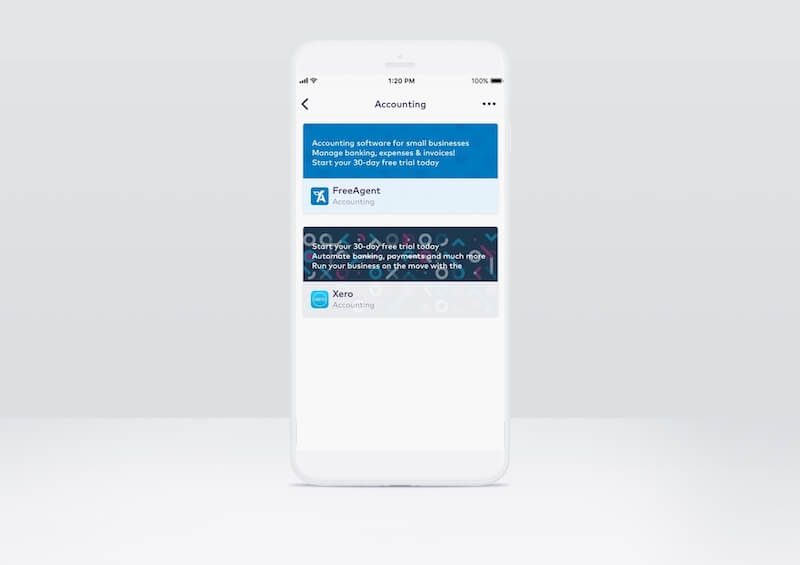

We’ve made linking your account to FreeAgent accounting software as easy as possible, so you can set up a bank feed in a matter of minutes. Just follow these simple steps:

Navigate to the Starling Business Marketplace from the ‘Account’ Menu

Click ‘Accounting’

Find FreeAgent and click the ‘Add’ button

Follow the instructions to authorise access and set up the account on FreeAgent

That’s it - you’re now ready to share across your FreeAgent data to Starling to view within the Marketplace.

Keeping your business successful isn’t easy, especially if your bank is heaping on the charges at every opportunity.

That’s why at Starling there are no monthly fees for SMEs. You’ll also be pleased to see that there are:

No fees on electronic payments

No fees on domestic transfers

No fees on withdrawals from cash machines.

Hate queueing? So do we. There's no time-consuming trip to a bank branch to apply for an account with us. We aim to have your Starling business account up and running in a snap - and you can apply for an account from anywhere.

Business

6th March 2025

Business

24th May 2024

Business

8th February 2024

Money Truths

8th July 2025

Money Truths

2nd July 2025

Money Truths

1st July 2025