Personal finance

“We couldn’t get on the pitch – there were loads of men playing. The girls were so disappointed.”

15th May 2024

24th May 2022

The simplicity of travelling with Starling is one of the many reasons I became a customer five years ago. For me, it’s far and away the best bank card for travel: there are no extra fees for withdrawing cash or using your card abroad, you’re given the Mastercard exchange rate for each foreign transaction and within seconds, you’re told exactly how much you’ve spent, both in the local currency and in sterling.

No matter where you are in the world, Starling makes life easier.

Ahead of my recent trip to Florence, there were lots of things to plan, from gallery reservations to dog sitters. Banking with Starling meant that organising travel money was one less bullet point on my to-do list. All I had to remember was my Starling debit card and my phone.

When I arrived at Bologna Airport last weekend, I simply used my debit card to buy my train ticket to Florence. There were no fees for using my Starling card and I didn’t have to warn Customer Service that I was going abroad to keep my card unblocked.

On our first night, my friend Sarah and I went to Osteria del Cinghiale Bianco, a restaurant that featured in the series Stanley Tucci: Searching for Italy. When our friendly waiter brought over the card machine, I made sure that the payment would be in euros, not sterling, tapped my card and immediately received a notification from Starling outlining the exchange rate used.

It’s always best to pay in the local currency so that you receive the exchange rate through Starling (Mastercard’s exchange rate), not the individual merchant. That way, you should avoid additional fees or poor exchange rates.

Throughout the weekend, we paid for almost everything by card. The one exception was the little sandwich shop near the Ospedele degli Innocenti. There were zero fees from Starling for withdrawing cash and I remembered to collect my card and cash before dashing off for a pecorino cheese and tomato focaccia.

When I was in Bali in 2018, I made the mistake of forgetting to collect my Starling card from the ATM after taking my cash. Luckily, I was able to lock my card straight away from the Starling app and then unlock it when I got my card back from the bank the following morning.

There was no need to contact Starling during my time in Florence but knowing that the 24/7 Customer Service team was on hand to help gave me such peace of mind.

It’s very rare that I ever need to speak to Customer Service as I can do most things myself using the Starling app. But whenever I have checked something or asked a question, the person writing back to me on the Live Chat has always been friendly and eager to help.

At the end of the weekend, Sarah and I were able to settle up quickly and easily. She’s also a Starling customer.

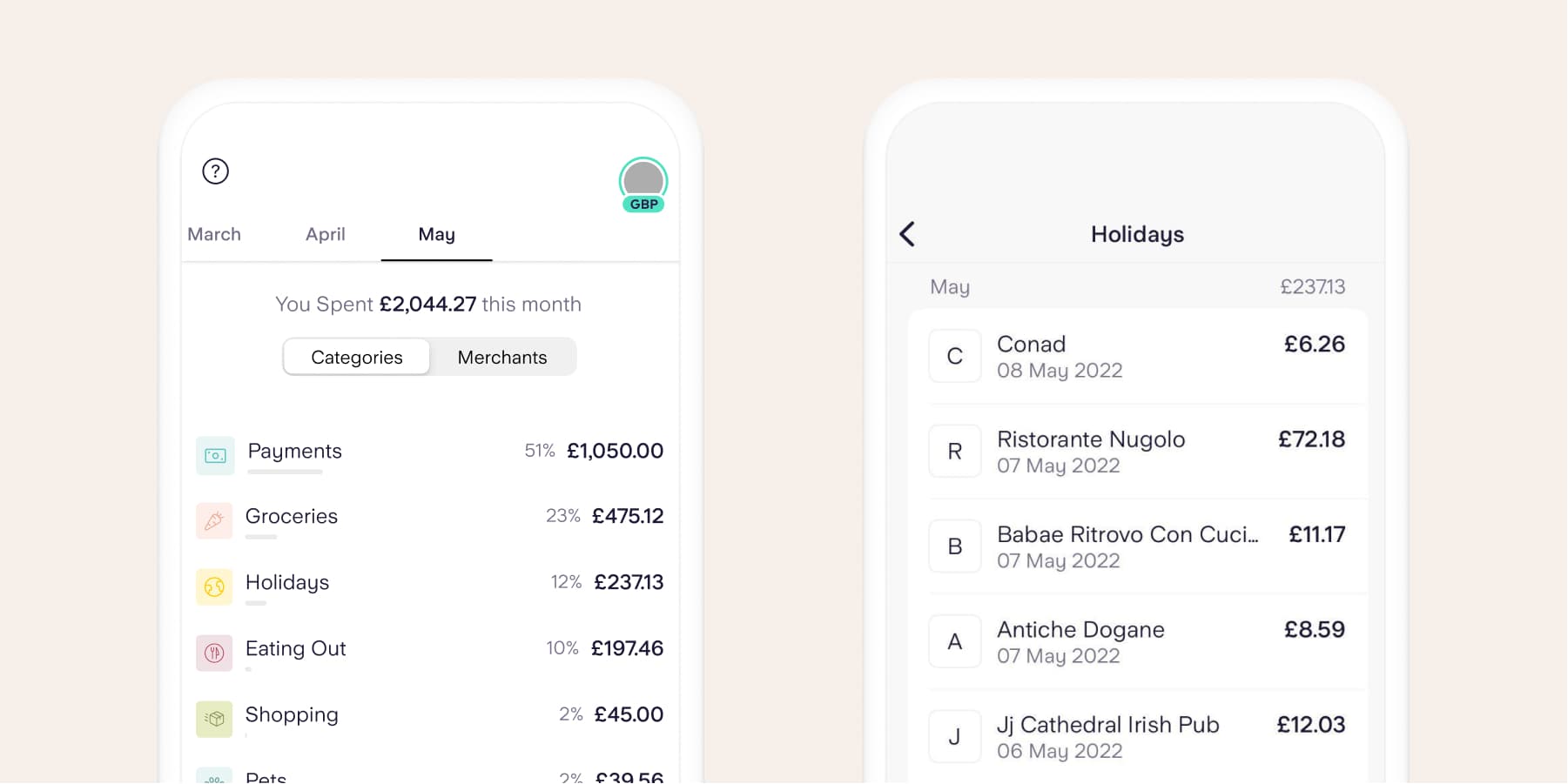

We both used the Spending Insights feature to change the category of all our Florence transactions from ‘Eating Out’ or ‘Entertainment’ to ‘Holidays’. To amend a category, swipe up in the app to see a list of all transactions and click on an outgoing payment. Tap on the category label to show a list of all categories, where you can change labels, for example, ‘Shopping’ to ‘Holidays’.

We then tapped the ‘Holidays’ category under the Spending screen to see an automatic calculation of what we had each spent and worked out who owed what. No spreadsheets, no faff.

As I had spent more, I used the Settle Up feature to request money from Sarah, who paid me back through her Starling app. Settle Up links enable Starling customers to send money to each other without setting up new payees or entering account details.

With Starling, our weekend in Florence was fee-less and fabulous, just as it should be.

Personal finance

15th May 2024

Personal finance

13th May 2024

Personal finance

14th March 2024

Money Truths

29th May 2025

Money Truths

28th May 2025

Money Truths

20th May 2025