The Habit Lab

“Not all habits are made equal.”

By Justin Quirk

Group holidays

I can’t remember exactly how my university friends and I came up with the idea of saving £20 a month for a dream trip for our 40th birthdays – seven years ahead of time. But I do know that when it was suggested, it was a resounding yes from all nine of us.

At 33, our 40ths felt like a lifetime away. Our earnings varied hugely – within our group of nine we have a nurse, a solicitor, a journalist and a social worker. But all of us agreed that £20 was a figure none of us would miss if it left our bank account every month.

We all agreed there should be one trusted ‘banker’ for the group trip. As I had an extra bank account that wasn’t used for anything, everyone was happy for it to be me. Standing orders were created and promptly forgotten about.*

Life carried on. We got married, had babies, moved house and changed jobs – and all the while, the fund kept growing.

When we got together for a party or dinner, we’d talk about where we might go and what we might do. I don’t think many of us thought we’d be able to afford a week in Mexico. But we were wrong – proving how ‘little and often’ really works. The year before we planned to go, we knew we’d each have saved almost £2,000. So we decided to go big.

Once the flights and hotel were booked, the last piece of admin was transferring the remaining group funds from the account we used to collect the money to my Starling account.

Starling doesn’t charge extra fees for using your card abroad so we knew we wouldn’t pay more than we had to. The app also has a ‘Going abroad?’ section where you can check real-time Mastercard exchange rates for the currencies of 240 different countries, including Mexico.

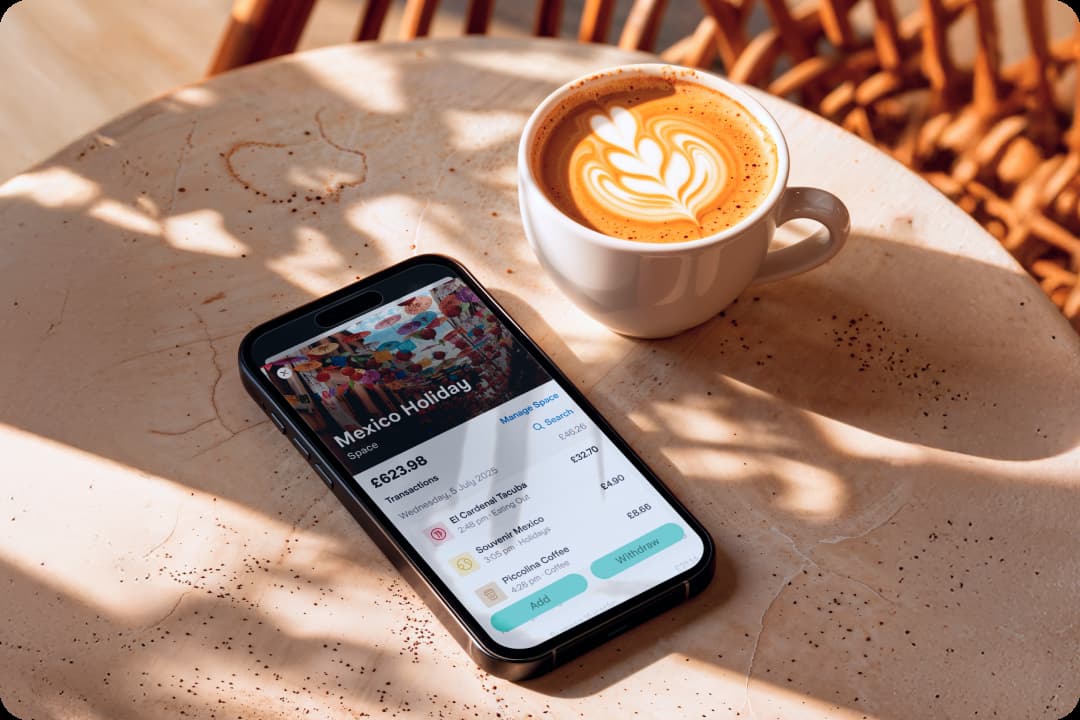

To keep our group holiday money separate from my own earnings, I set up a ‘Mexico’ Space in my Starling app. I then created a virtual card which allowed me to spend directly from that Space – no need to move money back and forth or keep tabs for our visit to Tulum’s ruins or when we went to a restaurant in town.

The fact that most of the trip had been paid for up front took away a lot of the stress you might associate with group travel. And because we’d become part of the surge of people choosing a ‘Trad Holiday’ in an all-inclusive hotel, there was very little splitting of bills or concern about some people eating or drinking more than others. If people wanted to spend extra on a massage or souvenir then that was up to them but there was no tension around who could afford what.

We’re already talking about saving up for our 50ths – £20 at a time – so we can do it all again.

Choose a timeframe and a realistic amount everyone can set aside each month. The most important thing is being together, not trying to aim for as much as possible or excluding anyone who can’t afford it.

Make sure the plan suits everyone. Take time to ensure each person is happy with the plan. It’s their money – they shouldn’t feel coerced into anything they’re uncomfortable doing.

Factor in a holiday budget buffer. If things get more expensive than expected, that can make people panic – and that’s the last thing you want. Consider rounding costs up when working out your group budget – anything that’s not spent can always go towards the last group meal.

Put the planners in charge – every friendship group has people who like organising and those who don’t. Just make sure they leave some space for spontaneity. The trip might have been planned for years, but that doesn’t mean everything else has to be set in stone.

When you get there, double check that you’re paying in local currency to avoid merchant fees and conversions. That way, if you bank with Starling, you’ll receive the exchange rate set by Mastercard, rather than the rate set by the merchant.

* Kat and her friends chose to transfer money into one bank account. An alternative option would be for everyone to set money aside in their own savings account.

The article above includes general information and should not be taken as financial advice. If you have questions about your specific circumstances, please speak to an independent financial advisor.

Don’t let money get in the way of a good holiday. Plan ahead with Spaces, then spend directly from your holiday pot with a virtual card.

Travel with Starling