Personal finance

“We couldn’t get on the pitch – there were loads of men playing. The girls were so disappointed.”

15th May 2024

Many of us have old accounts we haven’t looked at in years, or maybe that are forgotten about completely. It’s likely that there are millions or even billions of pounds in these ‘lost’ accounts. We asked Rosie Bannister, personal finance writer, to look at ways you could hunt these accounts down and get your money back. This is the first of two articles on the topic.

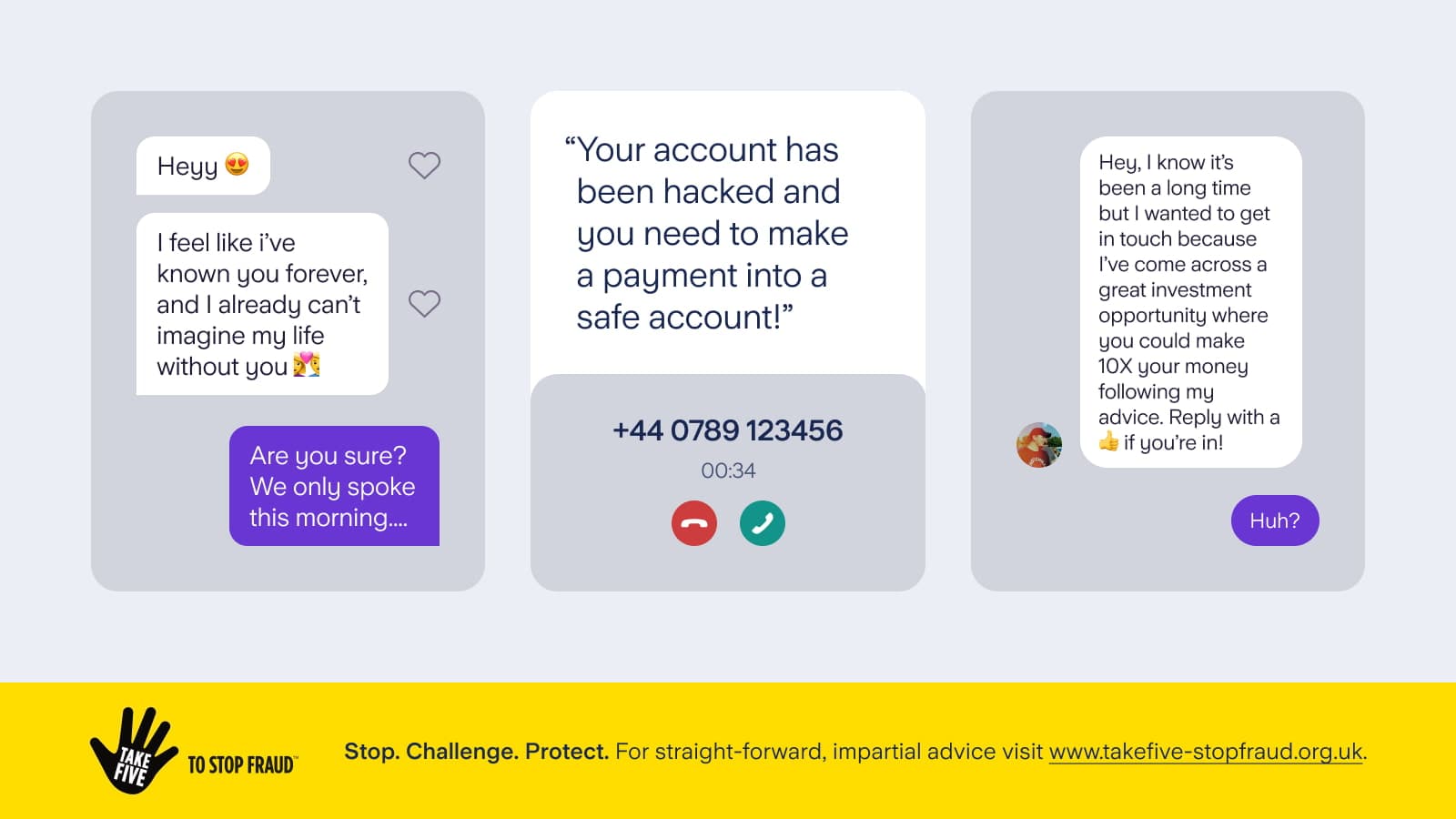

Before you begin, it’s important to know you don’t need to pay anyone to help you track down old accounts, so don’t be lured in by anyone asking for money.

It’s easy to lose track of old accounts – you might have had one opened for you as a child, or moved home and forgotten to update your address.

If you haven’t used the account for a long time and your bank is unable to get in touch with you, they become dormant. To show the potential scale of forgotten cash out there, the government founded Reclaim Fund, which financially supports social and community projects with money from dormant accounts not used for 15 years, had received a massive £1.35 billion as of the end of 2020.

If you think you’ve got money in an old account, you’ve a right to reclaim it. You can write to your bank or building society with any details you have and ask them to track it down, or use the free My Lost Account service.

Premium Bonds are one of the UK’s most popular ways to save, with around 21 million people holding £99 billion in them. Instead of interest, you’ve a chance of winning cash prizes each month, worth £25 to a cool £1 million.

Many of these prizes are paid automatically, if you’ve an online account with National Savings & Investments (NS&I) and have selected that option. But some have to be claimed.

There are currently more than 1.8 million unclaimed Premium Bond prizes worth over £68.9 million – an unclaimed prize is one that hasn’t been claimed within 18 months of being won. These could be unclaimed because the prize letter got lost in the post, or because NS&I doesn’t hold updated address info for you.

There’s no time limit to claim Premium Bond prizes, so you may have won a long time ago and still have a prize waiting. NS&I has full info on how to check for prizes. If you know your NS&I number or Premium Bond holder’s number you can check online or write to NS&I asking for your prize history.

Unsure of your Premium Bond details? You can use NS&I’s tracing service or My Lost Account to hunt them down. Alternatively you can phone NS&I or write to it to ask for a replacement bond record. Just include as much info as you can so that NS&I can find you in its records.

These are tax-free savings accounts for children that were opened for kids born between September 2002 and January 2011 (when the Funds were replaced by Junior ISAs).

The money in a Child Trust Fund is locked away until your child turns 18, when it becomes their cash. It’s estimated that between 700,000 and 1 million of these accounts are lost. If you think your child might have one, HMRC has a free tool you can use to find out which provider the Child Trust Fund is with. The tool can be used by you, if you’re the parent or guardian, or your child if they’ve turned 16. You’ll need the following info:

A Government Gateway ID – you can create a new one when you use the tool if you don’t have one already

Your child’s Unique Reference Number or National Insurance number

Your child’s full name, address and date of birth You should hear back within three weeks, and can then contact the correct Child Trust Fund provider.

Lucky for some – but only if you claim your prizes on time. There are millions of pounds in unclaimed National Lottery prizes out there. If you win, you’ve generally got 180 days from the draw date to claim your prize. After that, the money is donated to National Lottery projects across the UK and you forfeit your winnings.

If you bought your ticket in a store, you need to claim in person for a prize of any value. You also need to claim in person for prizes over £500 if you bought it online (over £50,000 if you paid by direct debit).

The National Lottery website has a list of unclaimed prizes. The site tells you the date of the draw and draw number, the game it was for (Lotto, Thunderball, Euromillions), the prize value, where the ticket was bought, the winning numbers and your last date to claim.

As of January 2021, there were several unclaimed prizes worth £1 million. So if you think you could be a winner, why not double check those old tickets?

It’s worth doing an audit of any old accounts you no longer use that may have account balances in them. For example, I just checked my TopCashback account, having not used it in a while, to find a small £2.31 balance which is now in my bank account.

While you’re unlikely to find a fortune in these, it could still add a few quid you’d forgotten about to your bank balance.

Places you could try looking include:

Cashback sites, such as TopCashback and Quidco

Amazon, for old gift card balances

Survey websites, such as i-Say and Swagbucks

Read the second article in our series on finding lost cash: Finding lost pensions and investments.

The above article is intended as general information and does not constitute advice in any way. You should take independent advice if you have any questions about your specific circumstances.

Personal finance

15th May 2024

Personal finance

13th May 2024

Personal finance

14th March 2024

Money Truths

29th May 2025

Money Truths

28th May 2025

Money Truths

20th May 2025