What’s your money language?

Money languages - Acts of Finance

By Ellie Austin Williams & Hayley Quinn

Money languages

“When I was diving, if I ever went to a competition and did really well, I’d reward myself.” How does a gold medalist approach money habits in a relationship? Synchronicity, timing, knowing each other’s strengths – there are clear parallels with the pool.

We speak to Tom Daley and his husband, screenwriter, director and producer, Dustin Lance Black, about their money languages. Despite living together in LA, their approach to money is worlds apart. But they make it work – through shared values on what’s worth it.

One’s a spender, one’s a saver; Scarcity Mindset meets Lifestyle Enrichment. So, for this transatlantic couple with two kids, how do they navigate these financial differences? Especially when, as Lance puts it: “Tom gets a little British about certain things…”

Well, let’s talk money:

What’s your partner’s core money language?

Lance: I think Tom is fluent in many money languages, as long as it has to do with spending.

Tom: Ha! I’d say Dustin’s is a ‘Scarcity Mindset’. He doesn’t like to spend money on anything. If he’s going to buy something, he spends about six months researching, making sure it’s right, and deciding whether he definitely still wants it.

Whose money language causes the most confusion at home?

Tom: Me. I get targeted by a lot of ads. They know their market!

Lance: Actually I’d say me. Even though I never stop working and I make money, I don’t know what to do with it. He’ll say, ‘Why don’t we go on holiday?’ and I’ll reply, ‘No, we can’t afford it!’ But my logic doesn’t make sense.

Do you ever argue about money?

Tom: Yes, most recently around Christmas decorations, like a massive animatronic Santa. My argument is that our kids are only young for a short period of time, and we have to make it magical…

Lance: Right, to be clear, Tom has recently bought an acoustic drum kit, a singing Santa and reindeer, and an electric guitar for our 2-year-old. And it’s not about the spending. It’s about the noise. If he just had a little better sense of rhythm, it wouldn’t be so rough…

Do you think your money languages are financially compatible?

Tom: We’re basically the opposite. He likes to save, I like to spend. Although it’s usually on other people and experiences. When Lance tries to rein it in, I remind him: if it helps you work better or makes the kids happier, it’s worth it.

Lance: Yeah. If there were two of me, it wouldn’t be as fun. But if there were two of Tom, we would never get any work done. We’d just be on the road all the time – and we’d be buried in delivery packaging.

How do you approach your financial relationship?

Lance: We each have our own accounts with one joint account that we share and fund equally each month. I think it’s vital that we’re open about how we spend – and see – money. I think communication is what makes it work. Though sometimes, Tom does get a little British…

Tom: I just don’t ask as many questions! We’re both very different with the way that we handle our money. For example, I don’t barter, I would rather not spend my time trying to wrangle.

Do you think one of you is better with money?

Tom: Well that depends how you define being ‘good with money,’ right?! I’m much more impulsive…

Lance: Me. I’m the guardrail. I’m the safety net.

Who could survive the longest on £20?

Tom: Me. I would happily just live off beans. I wouldn’t even need a microwave to warm them up.

Lance: Really?!

What single purchase brought you the most joy?

Lance: When we moved to Los Angeles, of course we needed a car. And we just let our son, Robbie, run through the car sales lot and pick a colour, which was a bright banana yellow that looked like a toy. The kids just love it.

What’s your money mantra?

Tom: Always remember to reward yourself for the hard work you’ve done. When I was diving, if I ever went to a competition and did really well, I’d reward myself. Otherwise you get caught in the trap of just working, working and working – and for what?

Make money work as a couple:

Identify your money language – acknowledge and embrace it. If you’re opposites, remember you can learn from each other

Try to find something that works for you when it comes to shared finances; a mix of autonomy and partnership

Prioritise open communication. Commit to regular, non-judgmental money talk

Align spending with shared values – define what’s ‘worth it’ to you as a couple. And what isn’t.

(*The article above includes general information and should not be taken as financial advice. If you have questions about your specific circumstances, please speak to an independent financial advisor.)

What’s your money language?

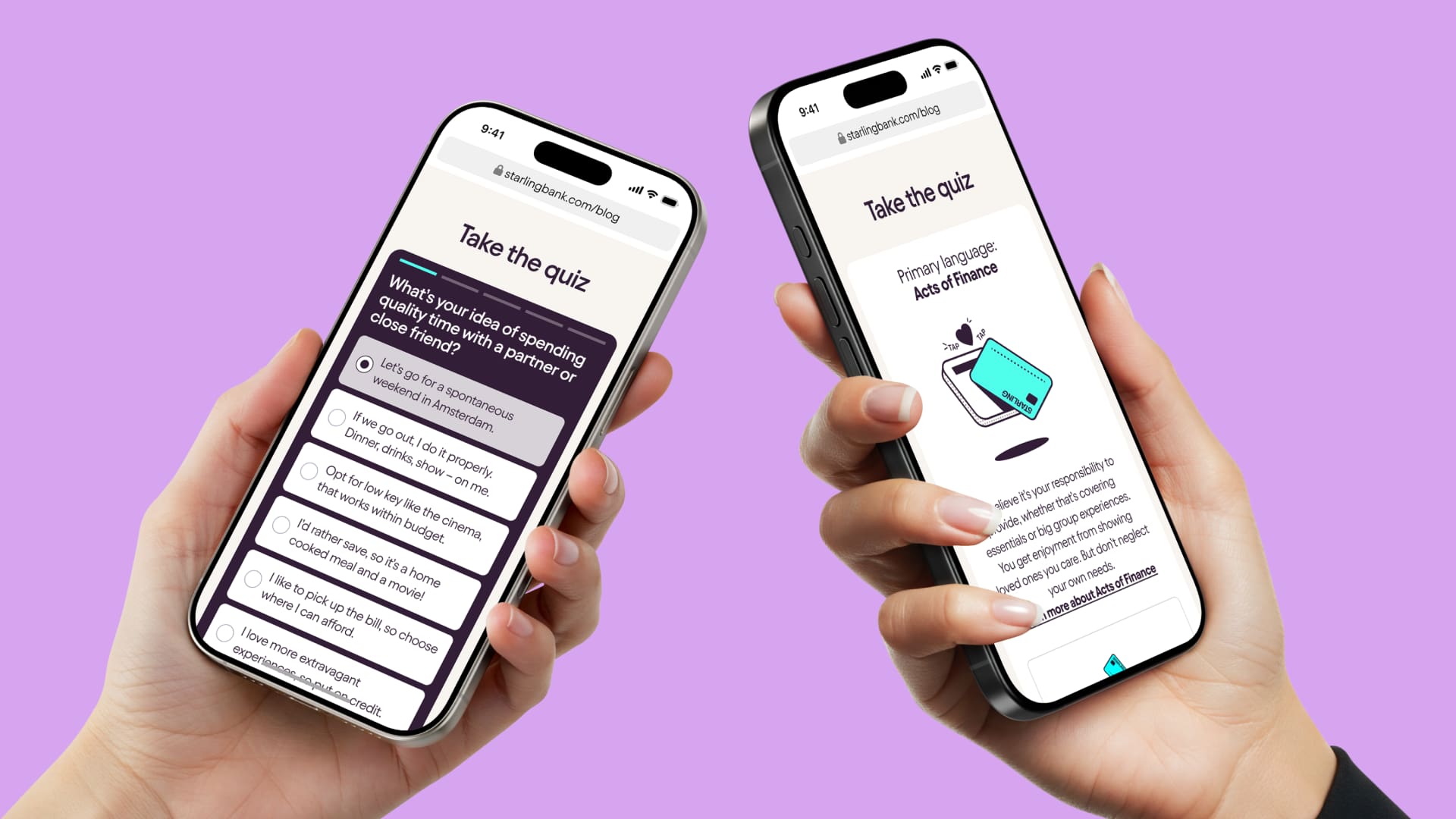

Take the quiz

What’s your money language?

By Ellie Austin Williams & Hayley Quinn

What’s your money language?

By Ellie Austin Williams & Hayley Quinn

What’s your money language?

By Ellie Austin Williams & Hayley Quinn

What’s your money language?

By Ellie Austin Williams & Hayley Quinn