Making Tax Digital. It’s on us.

Making Tax Digital. It’s on us.

Our free, HMRC-recognised software is coming soon to our sole trader account. Why pay when you don’t need to?

What is Making Tax Digital for Income Tax?

From April 2026, sole traders and landlords in the UK with an income over £50,000 in the last tax year, must digitally report their income tax and expenses to HMRC.

Our HMRC-recognised tool does it all.

We’ve got you covered. Our Making Tax Digital tool is designed to keep up with HMRC changes, and best of all, it’s included for free with your Starling sole trader account.

| What HMRC need you to do from April 2026 | Our tool |

|---|---|

| Create, store and correct digital records of your self-employment, property income and expenses. | ✓ |

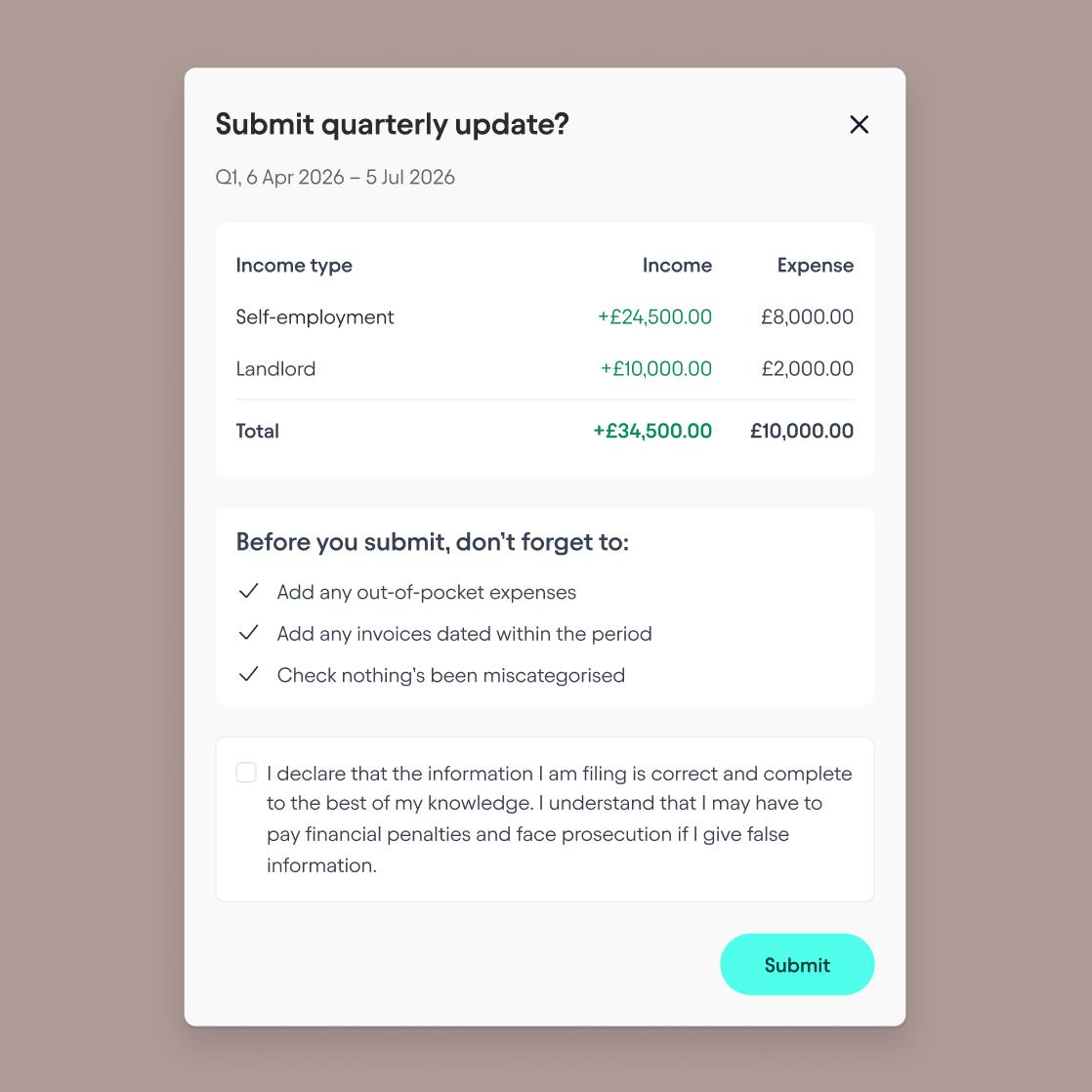

| Send quarterly updates. | ✓ |

| Submit your tax return by 31 January the following year. | ✓ |

Read our article to see how MTD changes will work with our tool.

Sorted, seamlessly.

It’s all in our account. Our tool is built into your sole trader account – at no extra cost and with no third-party software required.

Faster filing. Submit your updates to HMRC directly from your account.

Find all your expenses. Automatically categorise your transactions so they’re easier to sort ahead of your end of year updates.

Get started with our sole trader account.

You’ll need to open a sole trader account with us to use our Making Tax Digital tool – here’s what you need to know:

24/7 UK support. Fast response times and help from real humans via app, phone or email.

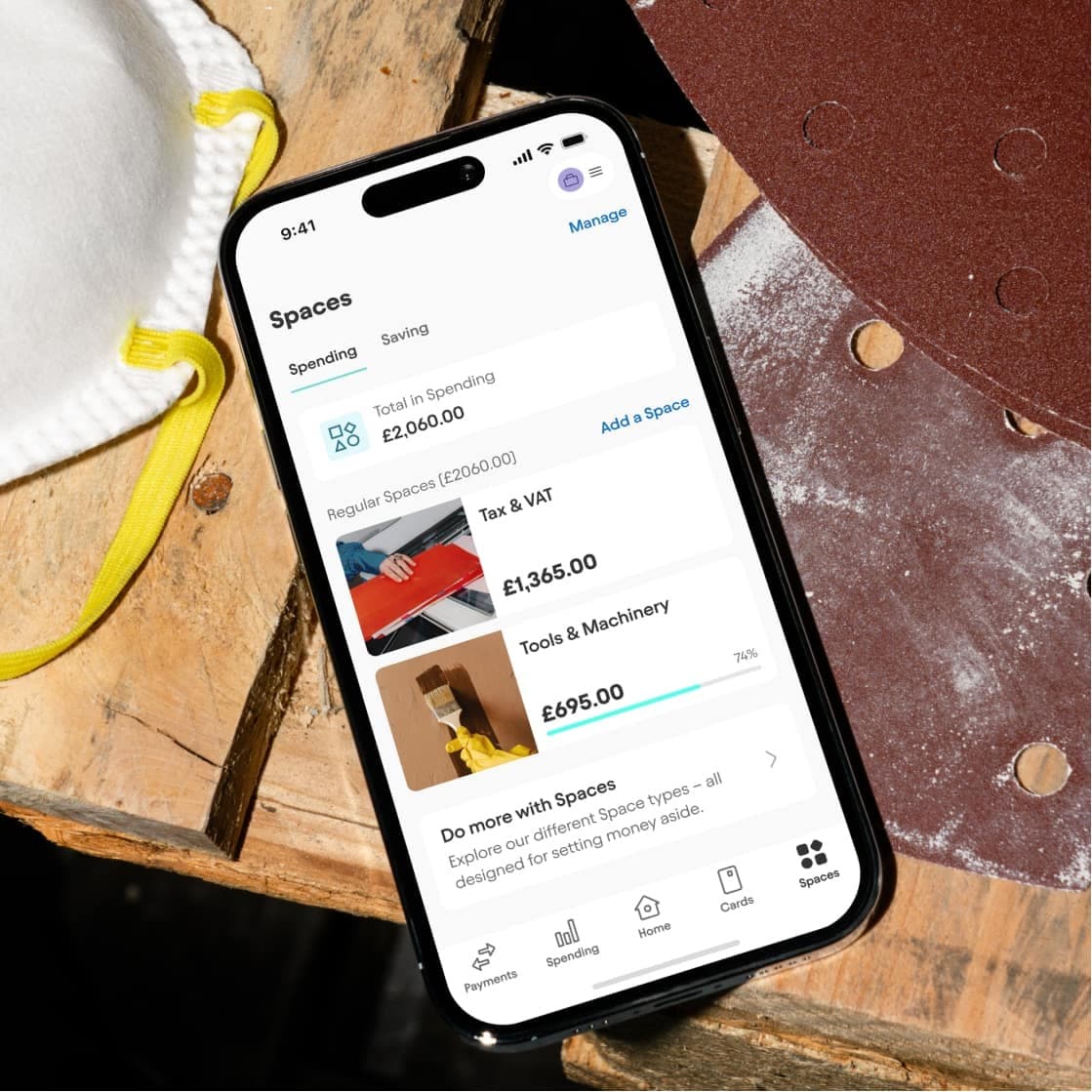

Put money aside for taxes. Keep it to one side in Spaces.

Capture receipts. Buried in receipts? There’s an easier way. Stay organised by capturing them in-app as you go.

Automate your expenses. Categorise your business expenses to simplify your Self Assessment tax return.

Sole trader accounts are subject to eligibility checks, which include looking at credit data and understanding the nature of your business. Fees, charges, and terms and conditions apply.

Be the first to know.

Our Making Tax Digital tool is coming soon, register for our latest updates.

Don’t have an account yet? You can still sign up to hear the latest about our tool, but you’ll need our sole trader account to start using it before April 2026.