Personal finance

“We couldn’t get on the pitch – there were loads of men playing. The girls were so disappointed.”

15th May 2024

13th May 2024

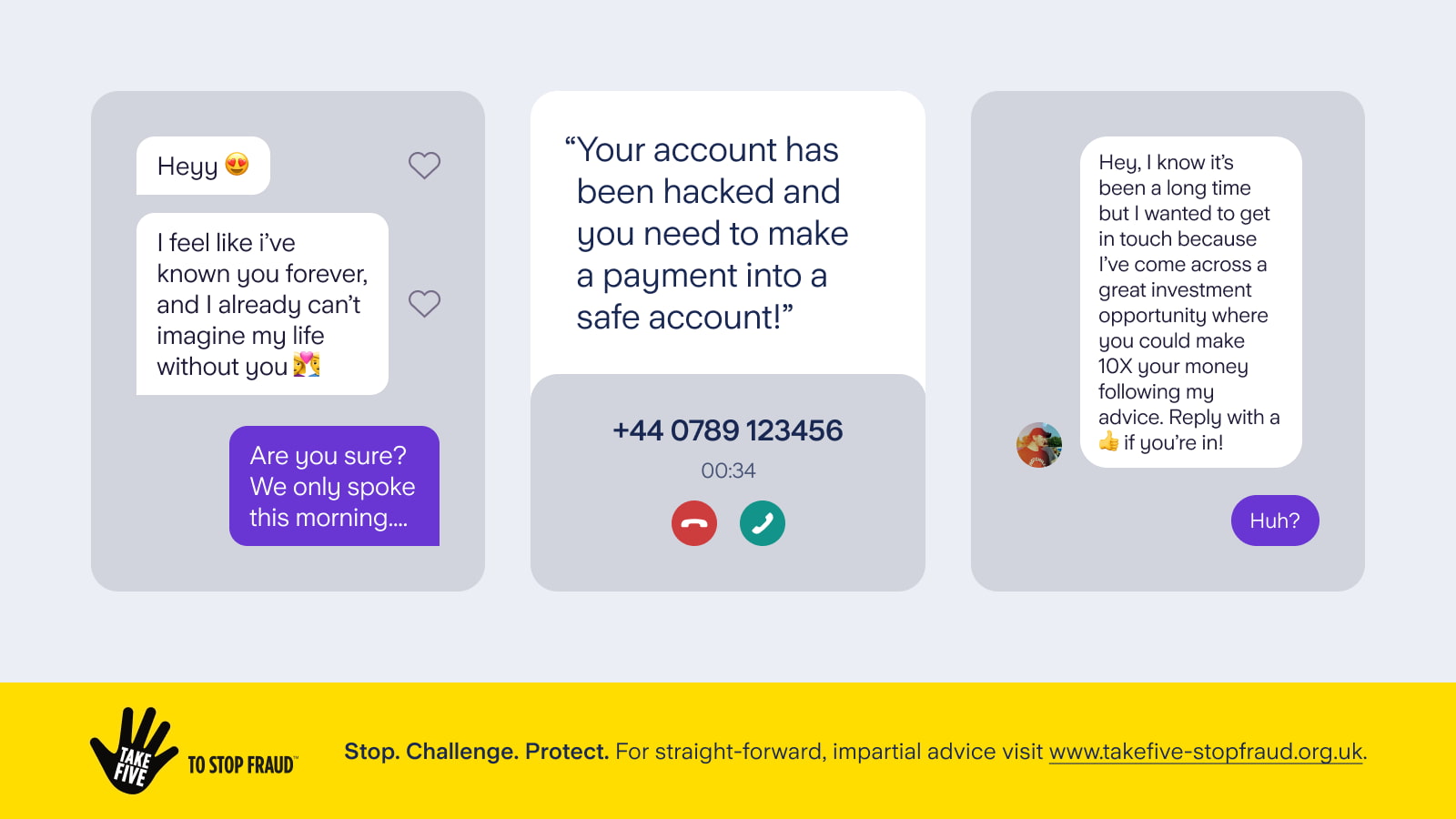

‘ScamSceptible’ is the theme of Take Five Week 2024 (13 - 19 May) and we’re proud to take part. The campaign focuses on those moments in our lives when we may be more susceptible to scams and how criminals can take advantage.

Take Five is a national campaign led by UK Finance, offering practical advice on fraud prevention. Starling is a member. Here are some scams to watch out for:

Imagine this scenario: The phone rings. It’s someone who claims to be from your bank, telling you that hackers are trying to access your account and if you don’t act immediately, you’re going to lose everything. To protect your money, you’re told to move funds to a new account that’s been set up for you, or to approve payments in your app.

Perhaps normally this would set alarm bells ringing, because it sounds like a scam. But how you’re feeling at the time of the call may well impact what your next actions will be. There are life events such as illness, stress or job loss that might influence your behaviour and could perhaps mean you’re less clear headed.

It’s important to stop whenever you’re asked for money, and take time to assess the situation. The scenario where someone claiming to be from your bank calls and asks you to move money is always going to be scam.

In fact, a bank would never ask you to move money or approve a card payment to keep your money safe. If you receive a call like this, hang up and call 159 - this will put you through to your bank, who’ll verify any contact received. At Starling, we would contact you via the app beforehand, so you know it’s us.

To trick you, the fraudster may spoof the bank’s phone number, making a call/text look like it’s coming from a legitimate organisation - the call/text ID may even show as the name of the ‘bank’. The fraudster may also volunteer information about your own account to convince you of who they are, such as your date of birth and address - using your stolen details.

Scammers can impersonate other organisations, such as internet providers, the police or HMRC using similar techniques. They could try and pressure you into making payments quickly to supposedly ‘avoid losing money or getting into legal trouble’. They may even impersonate family members, sending you a text from a new number - pretending to have lost or damaged their old phone and asking for money to help buy a new one or pay important bills. Always stop and verify any requests for payment before acting.

Read our blog post on impersonation scams to find out more.

You think you’ve just met your ideal partner on a dating app, and you’ve been speaking every day since. You really feel like this is ‘the one’ - you have everything in common, they’re kind, funny and you can’t wait to meet in person.

Then, you get some bad news. They’re having some issues with their bank account, and can’t buy the flights needed to come and meet you. You’re willing to do anything you can to make sure they get on that flight and are about to send the money… but then you stop, and consider if this could be a scam.

Perhaps you’re at a moment in your life when you’re more susceptible to being scammed, particularly by someone claiming to offer emotional support - maybe you’ve been recently bereaved or gone through a stressful breakup. Perhaps you’re currently living on your own and are lonely. These are all life events that can impact your feelings and how you react to a request for money.

If you’ve been asked to send money to a partner or friend you’ve not met in person, don’t do it. Scammers will pretend to be someone they’re not in order to steal from you, using stolen images and scripts to make you think they’re perfect for you. Always speak to a friend or family member if you get a request like this. They may be able to help you identify a scam.

Our romance fraud blog has more information and advice on what to look out for.

You’re looking into how you can make your money go a bit further and search around online for suitable investments. You stumble across a company with a professional looking website, offering a great return with no risk. After entering your contact details, a friendly sounding representative calls you, explaining how the investment works and when you’ll start seeing your returns. They even send you all the paperwork by email. It sounds fantastic, but you’ll need to act fast as this offer isn’t available for long.

You may have already guessed by now that this is a scam.

Maybe you’re about to retire, have lost your job or are struggling with the cost of living crisis. All are factors that might affect your emotions when it comes to wanting to make some extra money.

If you’re looking to invest, there are several things you can do to avoid scams. Firstly, make sure you do your research.

Check if a company is on the FCA register. This will tell you if the firm is authorised to carry out investment related activities and give you their genuine contact details (in case the company is being impersonated). You should also visit the FCA warning list to check if the company is known to be operating without authorisation. The FCA’s ScamSmart Investment Checker is an excellent tool, which can provide guidance on different types of investment.

Consider how you identified the investment. If you were approached out of the blue (especially on social media), it’s almost certainly a scam. This is also true if you’re being pressured to act quickly. You can use the contact details on the FCA register to verify if the approach was genuine.

No investment is ever without risk, and you should never invest more than you’re prepared to lose, no matter what the potential returns appear to be.

You can find more information on our investment scam blog.

It’s important to remember that anyone can be a victim of a scam - you could be more susceptible than you realise.

Personal finance

15th May 2024

Personal finance

14th March 2024

Personal finance

7th March 2024

Money Truths

8th July 2025

Money Truths

2nd July 2025

Money Truths

1st July 2025