For What It’s Worth

“I earn 10% of what my partner makes.”

By Anonymous contributor

Joined at the Chip

It can be pretty hard to talk about money – particularly when you don’t have time to talk about, well, anything. Take it from me: parenting a 2-year-old is a surefire way to make sure you’re always either too busy or too knackered to even hear about your partner’s day, let alone have that knotty – yet very important and long overdue – finance chat.

Sonya and I have generally been pretty good at communication since we started seeing each other seven-and-a-bit years ago. It probably helped that we’d been work friends for ages already, spending plenty of office hours (and gallons of coffee) helping each other work through our respective messy personal lives. After moving in together, adopting a cat and spending various lockdowns living on top of each other in a gardenless third-floor flat, I think we both thought we were pretty much able to read each other’s minds.

Then along came our daughter, a tiny bundle of chaos, and suddenly we just didn’t have the time or headspace to talk the way we used to. Parenting has many upsides. But it definitely doesn’t give you a lot of time to keep tabs on your own life and relationship – including the crucial side of how much we’re both earning and spending.

So, in the spirit of radical honesty and transparency that’s been crucial to our partnership thus far, we decided to open a joint account with Starling – and it only took a few minutes and a Bluetooth connection.

We kick things off by both transferring in £500 of our hard-earned cash. And agreeing that any spending on house stuff, kid stuff and cat stuff would go through the joint account.

‘House stuff’ is an immediate stumbling block. Sonya is very into making our flat a nice place by buying things like candles (£35), blankets (£40) and fancy soap (£20). I honestly like all those things too, but tend somewhat towards keeping using the same old stuff until it literally has to go in the bin, then waiting for Christmas to ask for replacements, rather than treating myself to new things.

On a similar note, Sonya has developed quite the Vinted habit, stuffing our daughter’s drawers with secondhand dresses (£7), leggings (£4) and jumpers (£5). I’m definitely supportive of buying pre-loved, and the looks are very cute indeed, but let’s just say the local Evri guy spends a lot of time at our house.

Basically, it turns out that Sonya buys a lot of the stuff that falls under the new remit of our joint account. So while I was previously sending her the occasional bank transfer to split the cost of new toddler outfits and pillowcases, it’s slightly alarming getting pinged every time another fiver evaporates.

But when I stop and think about it, I realise it’s actually me in the wrong. How come Sonya is buying stuff to make our house nice and our daughter happy? Especially when all I’m spending our joint money on is the boring stuff like food shopping and the occasional trip to B&Q? I decide I need to up my game.

Speaking of boring stuff: having the monthly bills come out of the joint account is a gamechanger. No longer do we have to play the ‘I owe you, you owe me’ game (essential equipment: biros, phone calculators and ibuprofen) that we’ve been doing monthly since moving in together.

On a rare evening where our daughter stops twitching and finally goes to sleep before 9pm, we manage to have a chat about day-to-day spending – something which probably wouldn’t have happened before we started using the joint account.

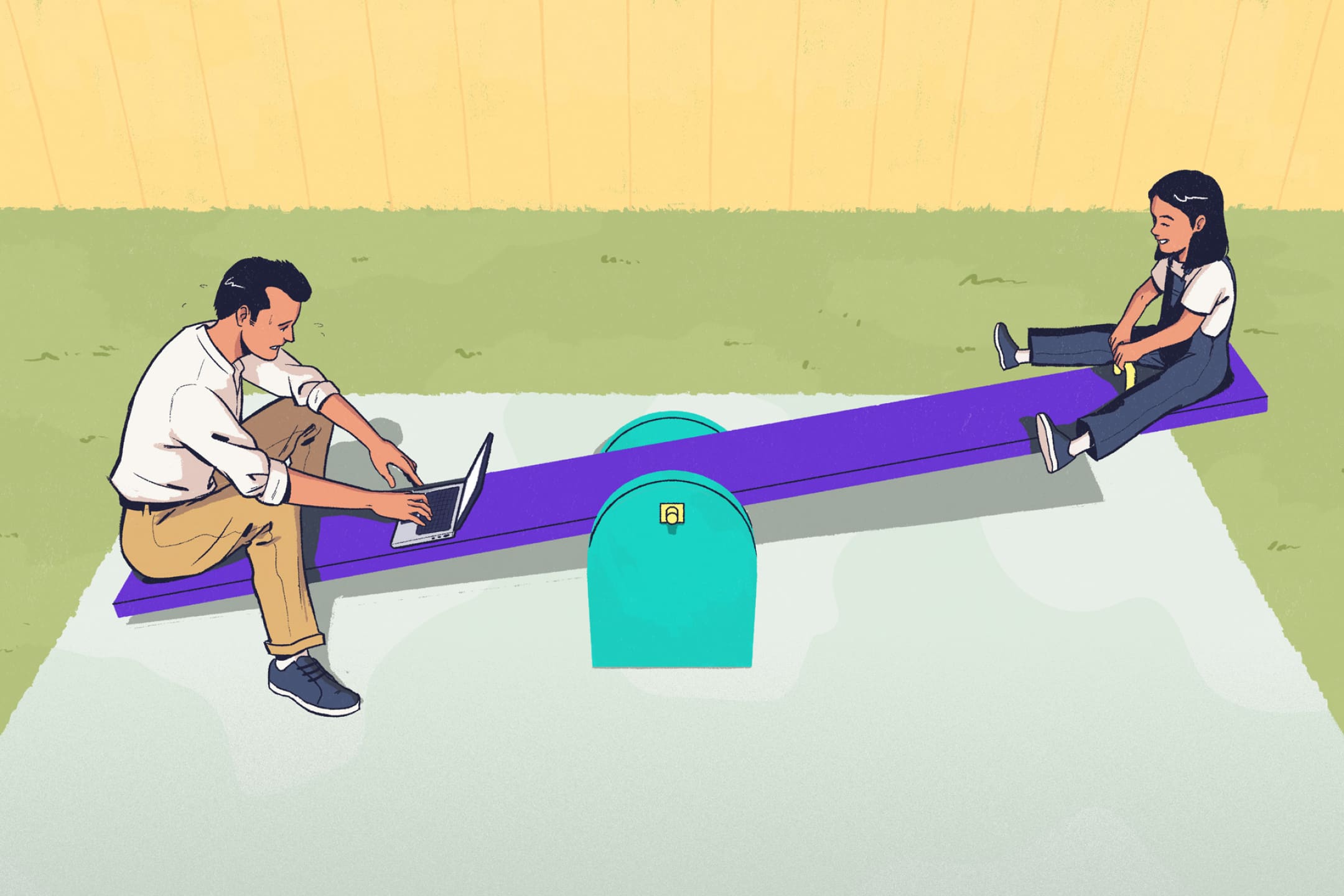

Before we became parents, Sonya was earning quite a bit more than me, but over the last couple of years she’s been on maternity leave and then freelancing while spending a lot of time on childcare. She’s now working four days a week and earning quite a bit less. I’ve also had a couple of pay rises, so suddenly the financial dynamic in our situation has changed – but we’re still splitting pretty much everything fifty-fifty.

We talk and agree that a) it’s rubbish that mums usually take the hit in situations like ours, and b) I should probably be paying a bit more towards bills and childcare. We get a takeaway (£43) delivered on the joint account to seal the deal.

At the start of this process, I honestly thought that Sonya spent more than me. I was convinced that I had a bit more of a puritan attitude: Mr ‘Is This Really Necessary?’ But now we’ve set up a ‘Treats’ Space on the Starling app, putting more of our personal spending through our joint account, and guess what? The parcels are starting to arrive from my, ahem, occasional splurges on Depop (new cords, £16) and Discogs (a Depeche Mode LP, £23).

It turns out I’m not averse to a little treat either, and it’s nice to be able to see that each of us is spending more or less the same amount every week on stuff that just makes us happy. Something that’s especially important while we’re contending with the latest nursery lurgy to sweep over our household.

We’re out of town for a few days, and our joint account is getting its first taste of sea air – plus a workout across the petrol stations, country pubs and National Trust cafés of East Anglia. Yes, we’re all having a lovely time – but having more visibility over our collective spending (fish and chips, £30) is reminding us that holidays are a pricey business.

We’re due to go away a bit more over the summer, and we agree to set up a ‘Tapas Fund Space’ and start saving now. That way, once summer hits, we can concentrate on having a lovely time on the beach rather than stressing about how much we’re spending on ice cream.

Before all this started, I was a bit dubious that all of Sonya’s ‘nice stuff for the house’ was necessary. But now it’s all coming out of our joint fund, I’m starting to realise how much I actually enjoy having such a cosy nest – and talking to her much more about the stuff we’re buying together. It definitely makes me feel closer to her for things to actually, officially be ‘ours’.

It’s also much quicker and easier to get our spending in check now we can see a breakdown of what’s going on groceries, eating out, shopping and bills. We’ll definitely be cancelling a few subscriptions – how much am I really using that Mubi account (£12 per month)? And we could probably look at turning down the thermostat too.

To mark a month of our new financial set-up, I pick up some flowers for the house (£9) as a surprise on the way home. I just manage to avoid buying them on the joint account. By this point, it’s become a bit of a habit.

Ready to be joined at the chip? We offer app-based joint accounts (terms and conditions apply) with 24/7 customer service.

Explore our joint account

For What It’s Worth

By Anonymous contributor

How Much Does It Cost?

By Anthony William

For What It’s Worth

By Anonymous contributor

Family

By Charlotte Lorimer