Business

“Becoming a mentor helped me see my own value.”

6th March 2025

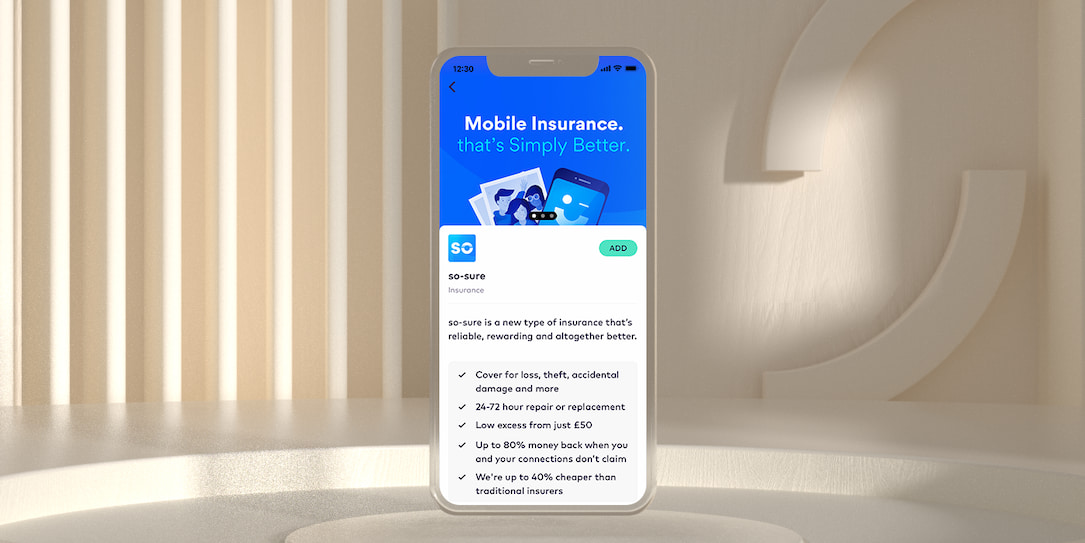

For business owners, freelancers and contractors, a mobile phone is often an essential tool for work. And that means phone insurance should be too. From today, Starling business customers can sign up for simple, reasonable and hassle-free insurance from so-sure.

Starling business customers - sole trader, limited company and multi-user accounts - can access so-sure phone insurance from the business Marketplace. In just a few clicks, you’ll be instantly covered for loss, theft, accidental damage, out-of-warranty breakdowns and international travel. Unlike other insurers, so-sure cover phones that are up to three years old. Plus if you don’t make a claim over the course of a year, you could earn up to 80% of your premium back.

To sign up, go to your Starling menu in the app, click Marketplace and tap Browse. Our partner so-sure can be found under the insurance category. Once you give your permission, we’ll take care of the faff of form-filling so that you can save time and energy for that freelance project or leafing through the CVs for a new employee. You’ll have enough business admin as it is, we don’t want to add to it.

Features of so-sure insurance include:

Replacement or repair within 72 hours

Low excess from just £50

Up to 80% of your money back if you don’t make a claim

Cover for phones up to 3 years old

Cover for second hand phones

We’ve all been there: you’re hastily washing up your cereal bowl and as you reach for a tea towel, you knock your phone over which tumbles into the soapy water. You frantically dunk the phone in a mug of rice. But it doesn’t work. Next step? Contact so-sure. Your policy will cover you for 24-72 hour replace or repair. There’s a low excess from £50 for accidental damage and from £70 for loss and theft when you validate your phone within the so-sure app. Of all claims made, so-sure declines fewer than 4%.

A key feature of so-sure is that it offers social insurance. That means you can link your policy to other business owners, freelancers or friends who also have so-sure, or if you’re offering employees insurance, connect these policies together. If by the end of the year, none of your group have made claims, you could receive up to 80% of your money back. Insurance with so-sure is also available to Starling personal customers.

Insurance providers giving money back to customers would previously be unheard of. But that’s what makes so-sure different - it’s about people, not profits. Find out more about the Starling business Marketplace.

Business

6th March 2025

Business

24th May 2024

Business

24th May 2024

Money Truths

8th July 2025

Money Truths

2nd July 2025

Money Truths

1st July 2025