Business

“Becoming a mentor helped me see my own value.”

6th March 2025

By: Team Starling

25th July 2019

At Starling, our aim is to provide the best banking experience for individuals and businesses across the UK. Now, we’re extending our mobile business accounts to even more companies.

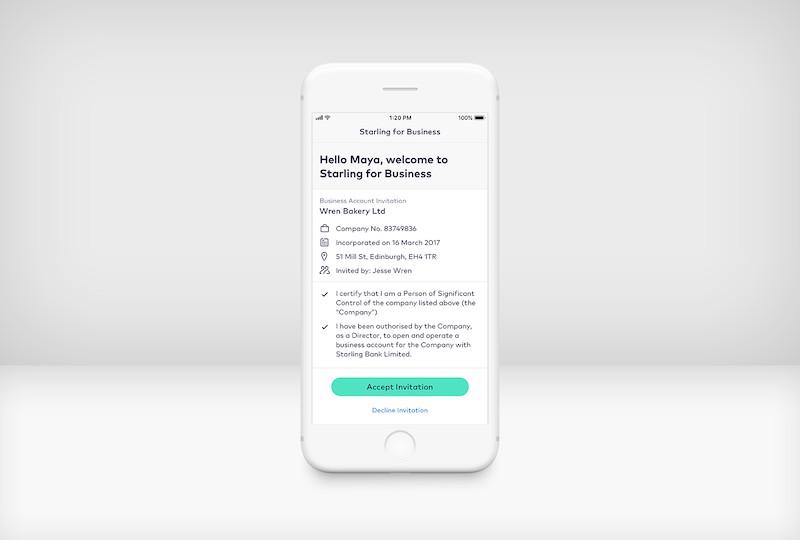

In March 2018, we launched the UK’s first mobile business bank accounts. For the first time, British limited companies with one person of significant control could apply for a business account in minutes, all from one app. A few months later, we launched business accounts for sole traders and now companies with multiple persons of significant control/directors will be able to apply for a Starling mobile business account.

At the moment, only people who are directors can have access to the account. However, we’ll need to know about anyone who is a person with significant control (a PSC, someone who typically owns 25% or more shares of a business and/or 25%+ of the voting rights).

With Starling business accounts, you’ll have everything you’d expect from a regulated bank account - instant payments from the app, protection of deposits up to £85,000 and cash deposits at the Post Office. You’ll also have what you want from a modern, digital bank - no monthly fees, easy, paperless application and features and integrations to help you manage your money.

Real-time notifications when money moves in or out of the app

Spending insights to breakdown outgoings into categories

Card control to turn off online payments, ATM withdrawals or the Mastercard debit card if lost or stolen

International money transfers

Marketplace integrations with partners such as online accounting software providers Xero and FreeAgent

Notes and photographs of receipts to help with tax returns

Separate space to set money aside for Tax or National Insurance from your main business balance

If you’re new to Starling, you’ll need to download the app and apply for an account. If you already have a Starling account, you can apply for your new business account through the app. To verify your limited company, it will need to be registered on Companies House.

If you have two directors who want to access the business account, you can both have the app and you’ll both receive navy business cards. If one of you spends money, both of you will receive a notification outlining the amount, merchant and who used the card. Similarly, when money comes into the account, you’ll both be kept in the loop.

Multi-owner accounts are one of our most requested account types. Over the last few months, we’ve been working hard to launch them for you. But, of course, the hard work doesn’t end now. We’ll be adding lots more new features and products for our business customers, including intelligent forecasting tools, and relationship management functions. We’ll also be adding the ability to let team members that aren’t PSCs have access to your multi-user Starling business account. Stay tuned.

Business

6th March 2025

Business

24th May 2024

Business

24th May 2024

Money Truths

29th May 2025

Money Truths

28th May 2025

Money Truths

20th May 2025