Save tax free with a Cash ISA.

Save tax free with a Cash ISA.

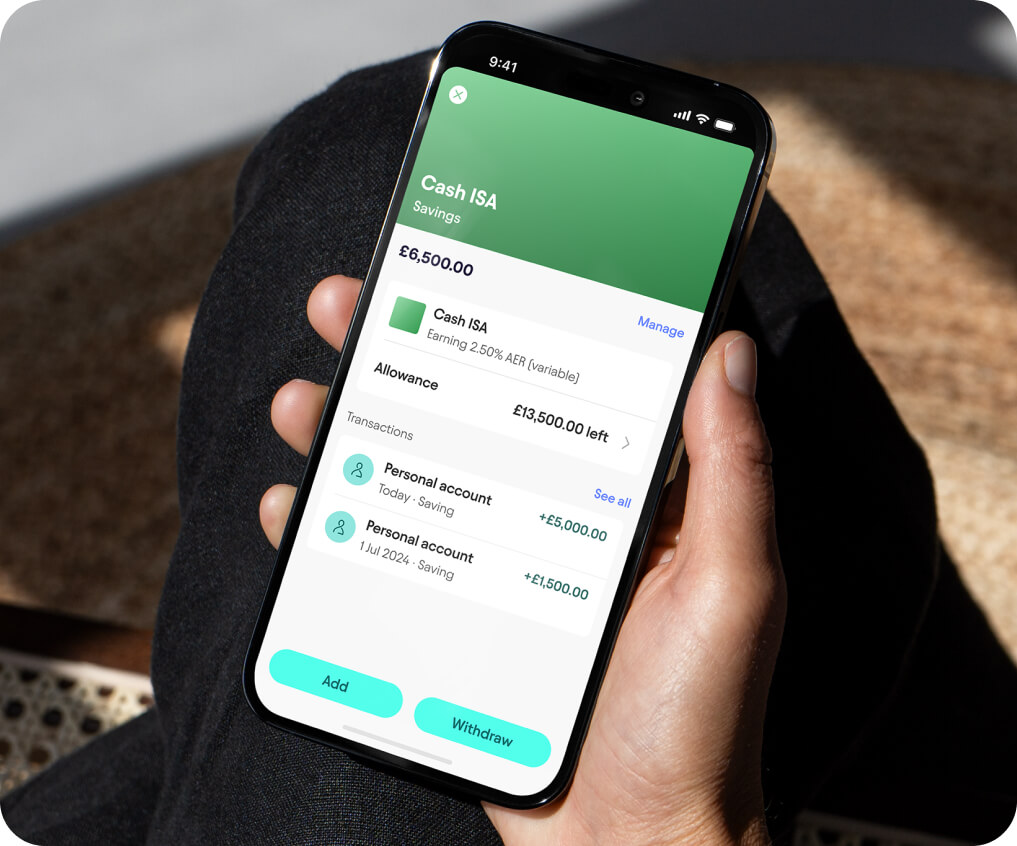

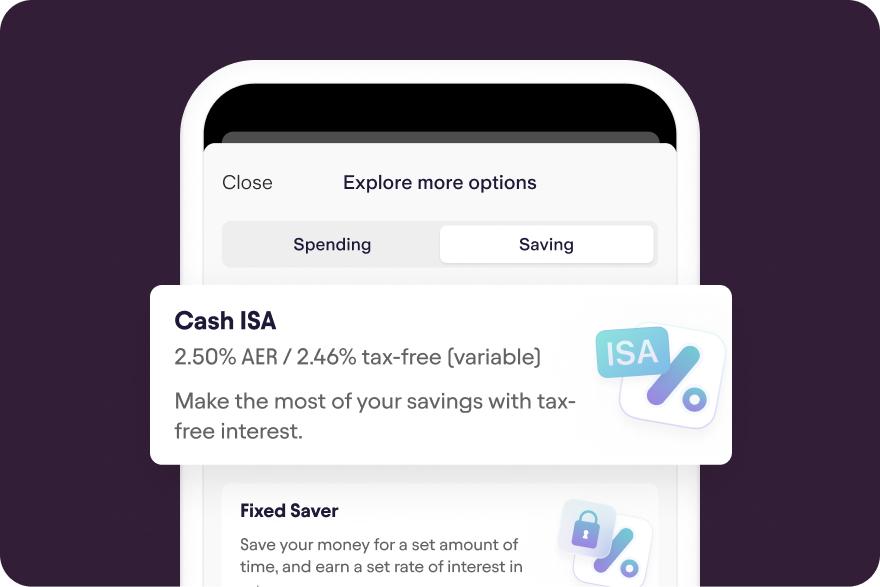

Make an unlimited number of deposits and withdrawals, without affecting your £20,000 annual allowance. Earn 2.50% AER (2.46% tax-free) variable* interest, paid monthly.

*18+, UK residents. Interest paid monthly. Starling personal current account required. Subject to eligibility. Tax free is the tax free rate of interest payable where interest is exempt from income tax. AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year. Any tax benefit you receive from an ISA depends on your individual circumstances and may change in the future.

Watch your money grow and grow.

Earn interest on your savings with our flexible Cash ISA.

No minimum deposit.

Open your account and start saving, with any amount.

Keep the allowance.

Take money out and replace it without affecting your allowance.

Money that grows.

Earn 2.50% AER (2.46% tax-free) variable interest. Calculated daily, paid monthly.

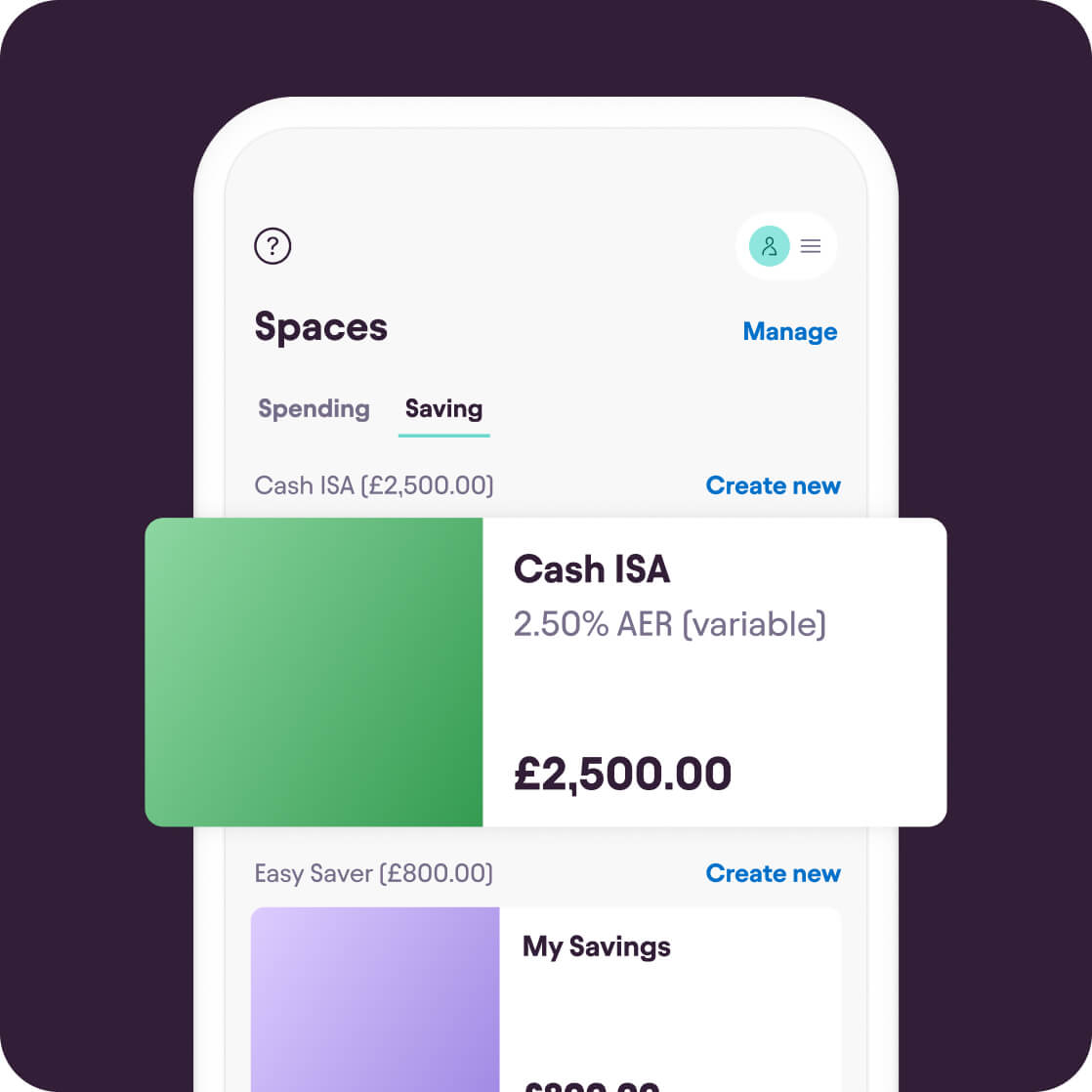

Everything in one place.

View and manage your Cash ISA and other Starling savings in our app.

What is a flexible Cash ISA?

A Cash ISA is a savings account where any interest you earn is tax-free. In the current tax year, you can contribute up to £20,000 to a Cash ISA.

With some Cash ISAs, each time you add money it counts towards that £20,000 total. If you add £10,000, take it out, then add it again you’ve used up your allowance.

But with flexible Cash ISAs, the £20,000 limit is a cap not a counter. You can take money out and add it back in the same tax year without affecting your annual ISA allowance.

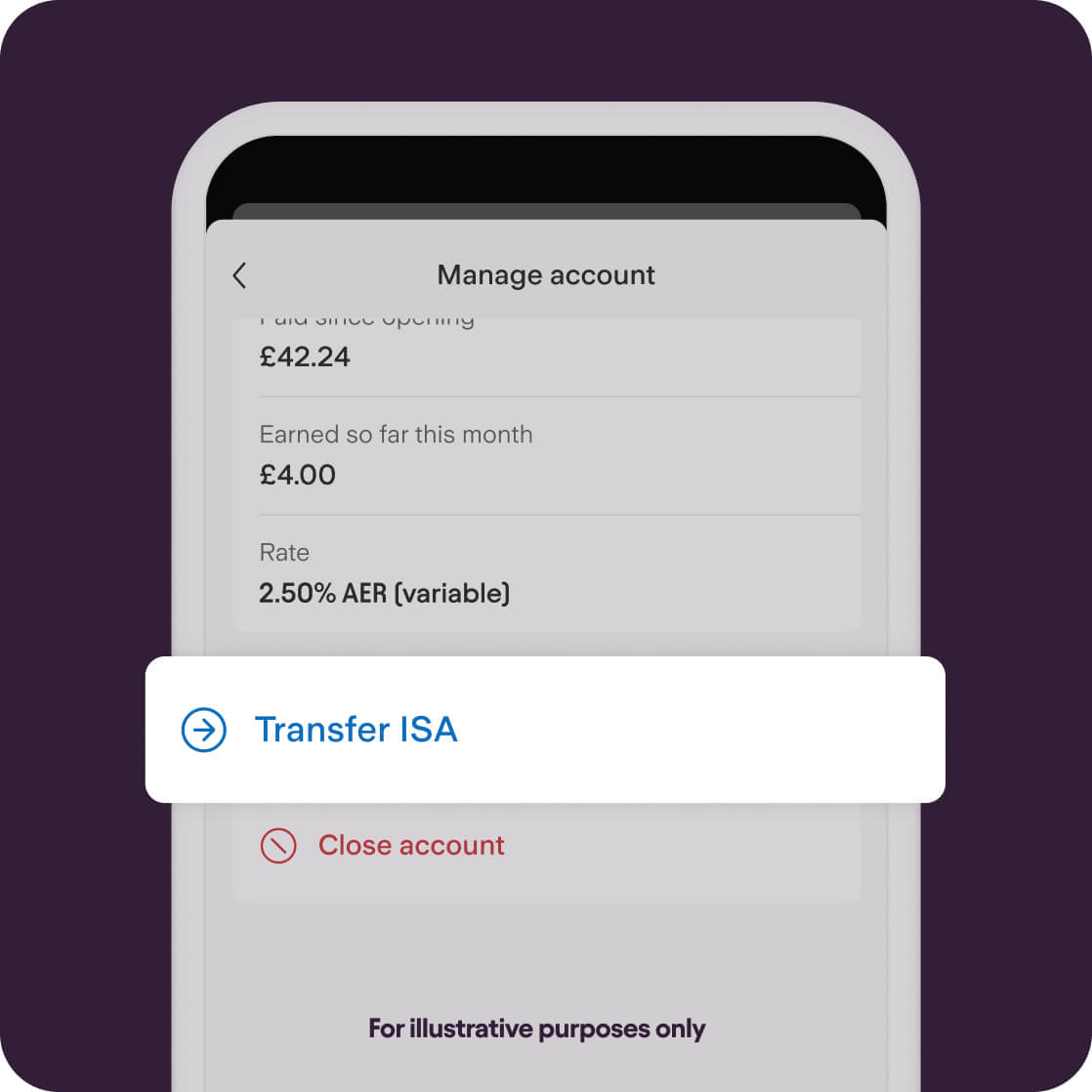

How to transfer a Cash ISA?

Moving your existing Cash ISAs to us is simple. And with all your money in one place, it’s much easier to see the big picture.

If your application for a Starling Cash ISA is approved, follow these steps:

Open your Cash ISA in the app.

Tap on ‘Manage’, then ‘Transfer ISA’.

Follow the steps and confirm your details.

Transferring part of your ISA balance to another provider isn’t currently available. For more about the types of ISA you can transfer, how long transfers take, and more information, head to our full FAQs.

Compare. Choose. Save.

You’ll need a personal current account to open a Cash ISA, Easy Saver, or Fixed Saver. Subject to eligibility.

| Features | Cash ISA | Easy Saver | Fixed Saver |

|---|---|---|---|

| Interest rate | 2.50% AER (2.46% tax free) variable | 2.50% AER 2.46% gross variable | 3.30% AER/gross interest fixed |

| Interest paid | Monthly | Monthly | End of term |

| Access to funds | Unlimited access | Unlimited access | No access for 12 months |

| Account term length | N/A | N/A | 12 months |

| Minimum and maximum deposit | No minimum or maximum deposit (£20,000 tax year limit) | £0 - £1m | £2,000 – £1m (Initial deposit only) |

| Number of each Starling account you can open | 1 | 1 | Up to 50 |

18+, UK residents. Interest paid monthly. Starling personal current account required. Subject to eligibility. Gross is the contractual rate of interest payable before the deduction of income tax at the rate specified by law; AER stands for Annual Equivalent Rate and illustrates what the interest rate would be if interest was paid and compounded once each year.

How to apply for a flexible Cash ISA:

Save tax-free in three simple steps.

New to Starling? You’ll need our personal current account before you can apply for a Cash ISA. Then, just follow the steps below to get a Cash ISA. Subject to eligibility, T&Cs apply.

Read the key information about this account in the summary box below.

Apply for a personal account.

To apply for any of our saving accounts, including the Cash ISA, you’ll need a personal current account first. They’re all managed together, in the app.

Head to the app.

Go to Spaces on the bottom menu, tap the Saving tab, then choose Cash ISA from the list. You may need to tap Show Options at the top to see them.

Complete your application.

Follow the steps and fill in a short application. We’ll let you know if your account is approved and ready for use. Enjoy your tax-free savings!

Summary box

Account name

Cash ISA