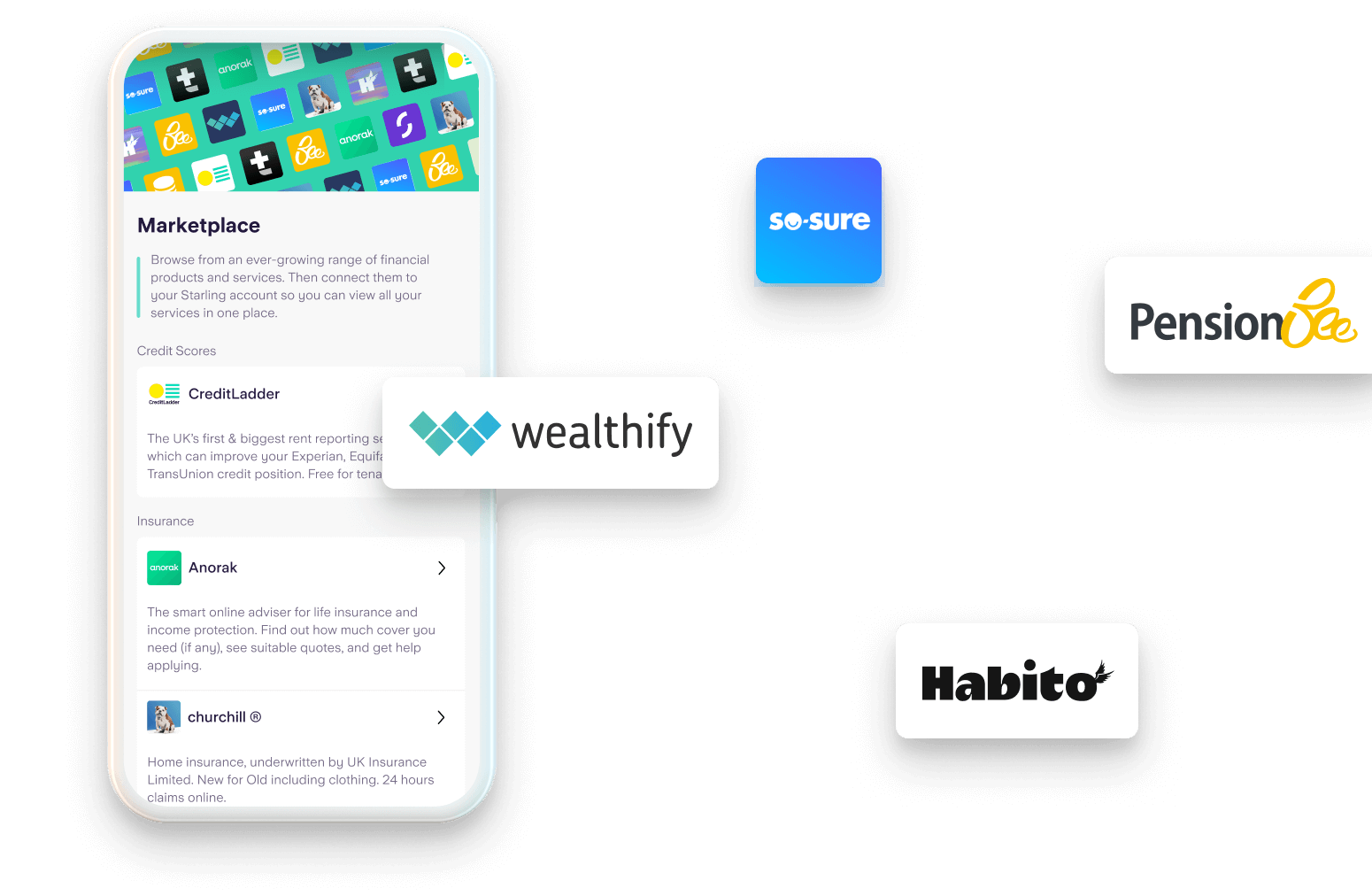

Think of Marketplace as a dedicated space to browse different financial products. You can then choose to connect them to your Starling account and view them all in one place and in real time.

Marketplace only has a fraction of the financial products available on the wider market. We receive commissions or a referral fee from some of the products we feature but this would have no impact on the cost to you. To make sure you choose a product that suits you best, do your own research to find out what else is out there before making a decision.

Make the most of Marketplace

Pick and choose services

It’s up to you which services to link to your bank account. And, because you can add (or remove) partners at any time, Marketplace can be adapted as your needs change.

Save time on admin

Because we already have your personal details, with your permission, we can often fill in sections of the application forms for you – so you don’t need to keep entering your information again and again.

Get real-time updates

To get technical for a second, Marketplace is made possible by application programming interfaces (APIs). These let you share your data securely with trusted providers, so you don’t need to refresh or swap apps to see updates.

Keep your details safe

All our partners have been vetted and we review their processes on an ongoing basis. When you’re in a partner's platform, the information and transactions you choose to share is entirely up to you, and it’s yours and the platform's responsibility.

There’s something for everyone

Whether you’re looking for a mortgage provider or a smart pension tool, start your search here.

Put your money to work

With the likes of Wealthify, you can put money aside in an ISA and track your account balance from within your Starling app.

Get insured

Life’s full of surprises, so make sure you’re always ready to take them on. Mobile, life and home insurance are all available via the Starling Marketplace. Providers include Anorak and So-Sure.

Reward yourself

Receipts pile up, store cards disappear – shopping can be hard work. But with our partners Tail, you can track receipts, collect points and even access rewards and cashback offers from your favourite retailers.

Buy a home

So, you’ve found the perfect home – now for the mortgage. Habito, the online mortgage broker, can search the market and find deals for you.

Boost your credit

If you rent, boosting your credit score can take time – which isn’t always something you’ve got. With CreditLadder, you can add monthly rent payments to your Experian credit history, giving you a better chance of getting better deals on things like mortgages and loans.

Take your pick from these services

The fact that Anorak is available through Starling is great. It’s ideal for me as I work all over the country. Being able to access Anorak on my phone, via the Starling app, made it quick, easy and very useful.”

Mark, Anorak and Starling customer

The Starling Promise

We make sure you don’t pay more for products on Marketplace than you would by going direct to our partners.