Our fourth straight

year of profitability

Download our report for 2025, or view our highlights below.

Download our reportStarling Group

We’re loved by millions of people

4.6m

customer accounts now open

79%

of core accounts are active

63

Our industry-leading product NPS score*

Which? recommended, six years in a row

*Third-party data; tied for first.

Our revenue grew to

£714m in 2025

We now hold over £12bn of customer deposits

And our customers spent over £21bn on their cards this year

Overall, the Group continued to perform strongly, with an underlying pre-tax profit of £281m

Innovation is at the heart of what we do

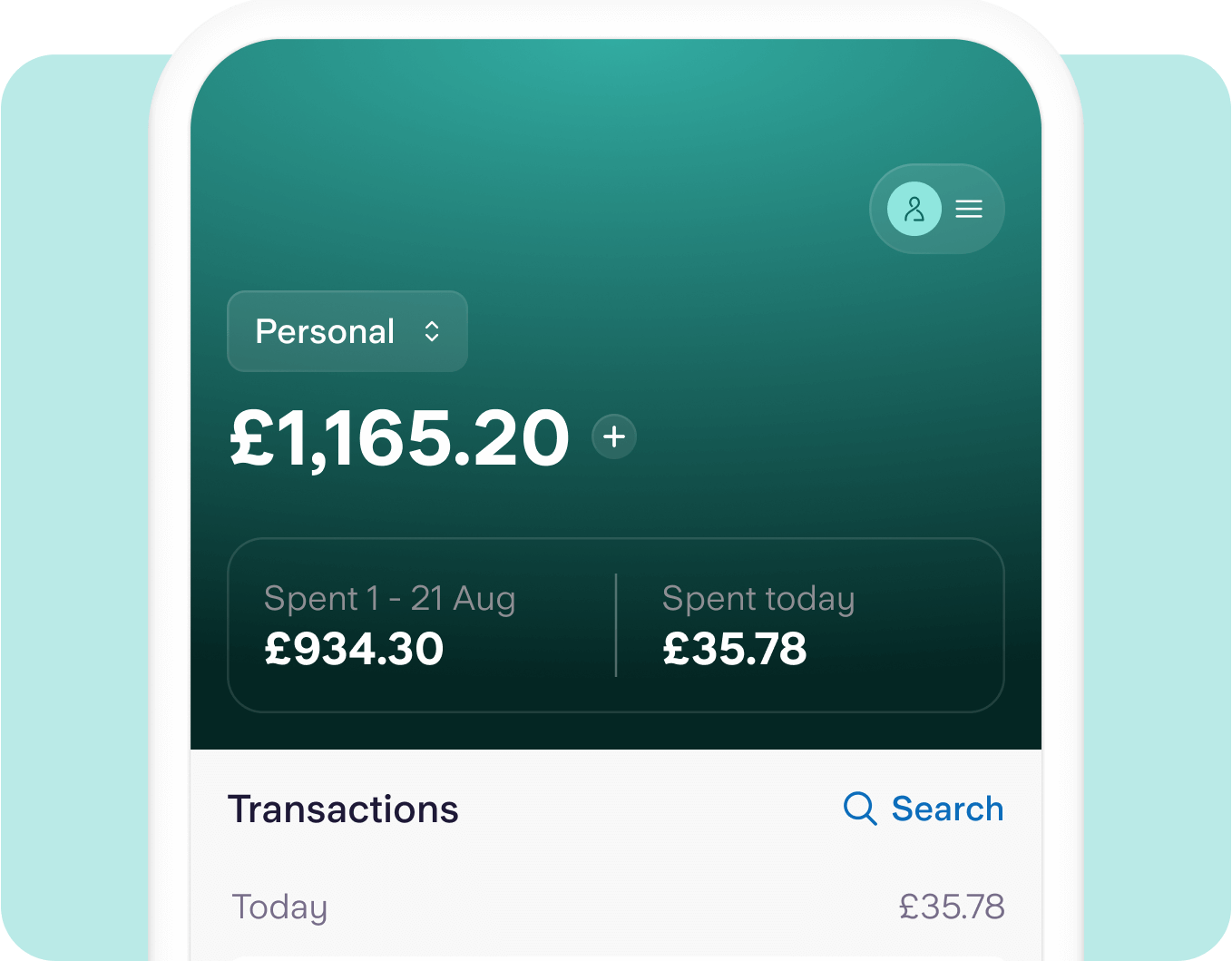

We launched our Easy Saver account, offering customers a competitive interest rate with market-leading flexibility.

Easy Saver at a glance

As of 31 March 2025

Open accounts191k

Total deposits£1.5bn

Average deposit£8.1k

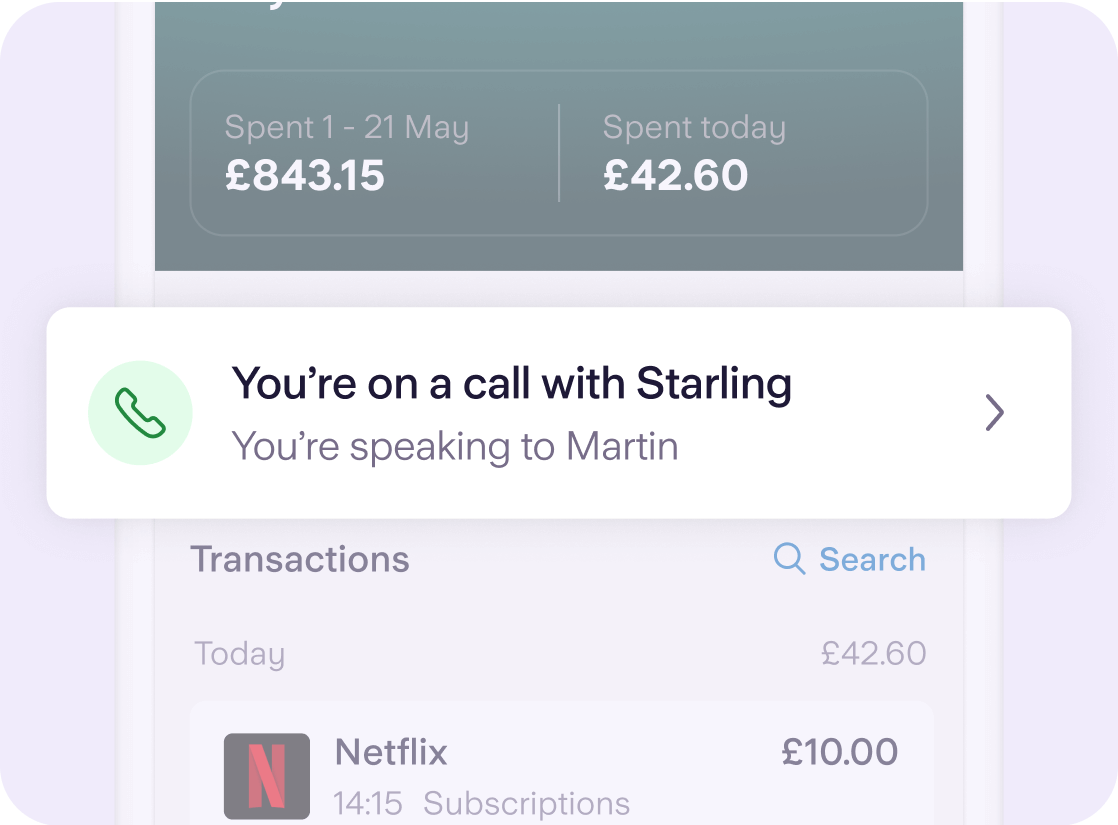

Our new Call Status Indicators, which tell customers if we’re on the phone to them, has reduced bank impersonation fraud by 73% since launch.

We’re using AI across our business, with real benefits for customers

- 8,000 hours have been saved per month, with AI being used to summarise customer calls.

- 60% reduction in the average time taken to answer a customer call, thanks to agents having more time.

- 50% reduction in chats being referred to specialist teams, as AI is helping agents solve issues.

1 2023 and 2024 relate to the calendar years.

Engine saw two SaaS clients launch this year...

…and they're achieving notable scale already.

This year at Starling

£714m

Revenue(2024: £682m)

£223m

Statutory profit before tax(2024: £301m)

17.9%

ROTE(2024: 31.5%)

3.0m

Active core accounts(2024: 2.9m)

£8.7m

Engine revenue(2024: £2.3m)

£218.7

ARPAC(2024: £241.6)

£42.4

Cost to serve(2024: £48.1)

4.12%

Net interest margin(2024: 4.34%)

A note from our Group CEO

“We were able to achieve a fourth straight year of profitability, and to attract more customers, by remaining best-in-class at meeting the needs of our customers. Our ambition is global, and with Engine we are now poised to bring our proprietary technology to a global addressable market of some £100bn.”

Raman Bhatia

Group Chief Executive Officer