PRESS RELEASE

Starling Bank is expanding its Business Marketplace offering with three new services for freelancers and SMEs

5th February 2020

London, 5 February, 2020: Starling, the leading digital bank, has expanded its Business Marketplace with the introduction of three new partners, placing a range of new services at the fingertips of its 100,000+ business customers.

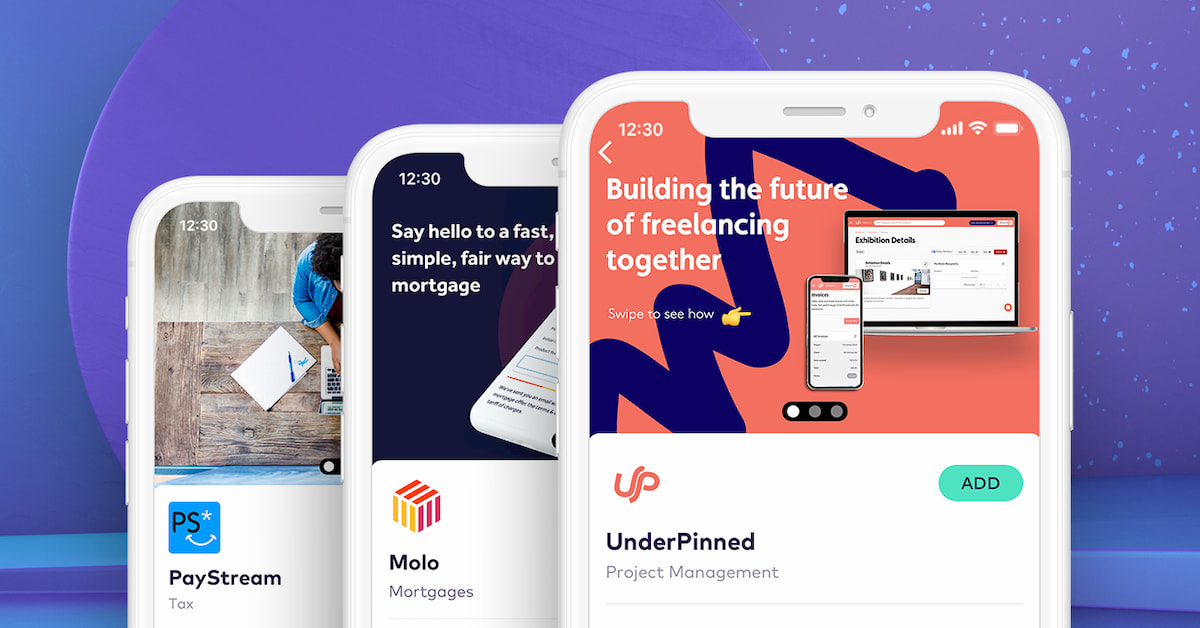

Among the new arrivals in the bank’s bustling Business Marketplace is online buy-to-let mortgage lender, Molo. And for the UK’s rapidly-growing population of self-employed workers, the Starling Marketplace just got more attractive, thanks to the addition of UnderPinned, the career-management platform for freelancers, and PayStream, which provides digital accounting services for contractors.

The entry of these three new partners takes the total number of integrations available in the bank’s Marketplace to 24, all of which link with customers’ accounts and data, and are accessible in minutes via a few taps of the Starling banking app.

Starling CEO and founder, Anne Boden said: “Today’s entrepreneurs have grown accustomed to operating in a world where digital services are crafted around their particular needs. They expect the services they are offered to match closely with their business types, locations, and customer demographics.

“We believe that the Starling Business Marketplace is exceptionally well-suited to meeting such expectations, by giving businesses access to a range of services within the app they use for their everyday banking.”

Molo’s goal is to make mortgages simple, streamlining the process to help people secure the property they want sooner.

Francesca Carlesi, co-founder and CEO of Molo, said: “Making easier, faster, fairer mortgages available to as many people as possible is something we’re truly passionate about, and having the support of Starling, an organisation creating such positive change in the industry, is invaluable. We’re excited for what’s to come and thoroughly look forward to working together.”

UnderPinned gives the UK’s 2 million freelance workers in-app access to its Virtual Office, providing digital tools to design high quality portfolios, proposals and to create e-contracts.

UnderPinned CEO and Co-Founder, Albert Azis-Clauson, said: “UnderPinned exists to help freelancers build sustainable and fulfilling careers and by joining the Starling Marketplace, we’ll be able to improve the working lives of thousands more freelancers through our online platform.

“We’re building a very different kind of business, with innovation and customer experience at its core, and we’re confident that this natural synergy will lead to a long-lasting and fruitful partnership.”

Paul Malley, PayStream’s managing director said: “What makes us unique is that we identify customer needs and then develop services to satisfy those needs. Our new IR35 review service is no exception and is our latest innovation, helping customers impacted by the IR35 tax rules as a result of the new off-payroll working legislation due to come in this April.”

The three new partners will sit in Starling’s Business Marketplace, which already includes a range of invaluable services for businesses, including accounting software packages Xero and QuickBooks and Legal Services provider Sparqa Legal.

Like all partners the new entrants are covered by the Starling Promise of no hidden mark-ups, so account holders pay the same as they would if they went direct to the provider.