PRESS RELEASE

Micro-businesses spend ten weeks a year trying to sort their finances

8th January 2020

New report, Make Business Simple, has been created to shine a light on the practices of UK’s 5.6 million micro firms and help them cut down on financial admin time

Research shows that micro-firms (0-9 employees) are spending 19% of their time on this type of work – equating to 15 hours a week

A third (33%) say that financial admin negatively impacts their personal life and one in ten (11%) say it keeps them up at night

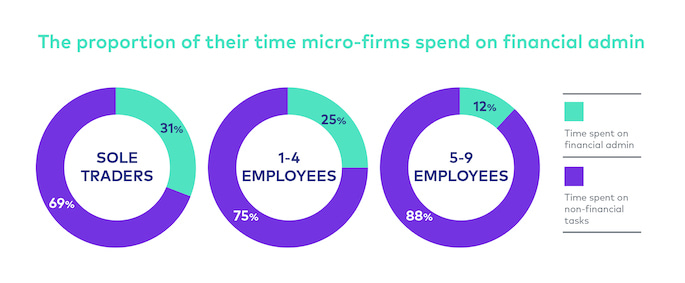

Smaller firms are disproportionately impacted, with sole traders spending almost a third (31%) of their time sorting finances

LONDON, 8 JANUARY 2020: UK micro-businesses spend ten weeks of the year working on financial admin, according to a new report, Make Business Simple, published today by digital bank Starling. The report has been created to shine a light on the practices of the UK’s 5.6 million micro-firms, which make up 96% of the business population, and encourage them to embrace new ways of cutting down time spent on financial admin.

By studying more than 1,000 UK micro-businesses, Starling Bank found that the average firm clocks up 79 hours of labour each week, of which 15 are spent on finance admin tasks - a considerable 19% of total time, equating to just under ten weeks of the working year. The research also found that the smallest firms are disproportionately impacted by this kind of work, with sole traders spending almost a third (31%) of their labour time on financial admin work, and companies with 1-4 employees devoting a quarter (25%) of their time to this area.

Micro-businesses in the study recognised this as an issue, with more than quarter (27%) stating that they spend too much time on financial admin, rising to almost half (46%) among firms with 5-9 workers. When asked what effect is has on the rest of the business, one in ten (10%) believed it hampers growth while a fifth of micro-firms (21%) say that if they could reduce time spent on finances, they would divert the labour towards sales.

Firms in the study also recognised the impact of finance-related work on life outside the business, with a third (33%) claiming that it affects their personal life, one in ten (11%) stating they have been kept up at night thinking about finance work and 12% admitting it negatively affects holidays.

The most time-consuming finance task is accounting, which takes micro-firms 1.7 hours each week, equating to more than one week a year spent solely on keeping the books. Accounting was also seen as the most stressful part of running a business and was more likely than any other task to eat into downtime, with a third (32%) of micro-firm leaders stating this is the case.

When asked what could save time in this department, one in five (19%) firms felt that being able to see and access all of their finances in one place could be the solution, while one in six (16%) recognised the potential benefit of having an accounting system integrated with their bank account.

Starling CEO, Anne Boden said: “The importance of micro-businesses can’t be overstated. They make up the vast majority of enterprises in the UK, employ almost nine million of us and generate nearly a trillion pounds in revenue each year.

“In our new report, Make Business Simple, we wanted to get to know these companies better and identify ways in which we could unlock more of their potential. What our findings unequivocally show is that micro-businesses are spending a huge amount of time on financial admin work.

“We have developed our business account with this challenge in mind. By offering businesses a digital bank account with smart money management tools as well as a range of services that can be linked to their bank account and easily accessed, we hope to reduce the burden caused by finance work, freeing up more time for business leaders to focus on growth.”

Commenting on the report, one Starling Business Account customer, photographer Aina Gomez said: “I didn’t get into business to do finance-related admin, but without it, you are doomed. I’m still learning. I’ve purposely put myself through some training, but I can still say that this is the worst part of running a business. However, I realise how key of an issue it is and keep pushing to learn how to do it better.”

Notes to Editors

About Make Business Simple

Starling Bank created the Make Business Simple report to shine a light on the practices of the UK’s 5.6 million micro-businesses, in particular, looking at the time they spend on finance administration work and the impact that this has on the business and life outside of it. The full report is hosted on the Make Business Simple landing page, alongside advice and an interactive business quiz, all of which can be accessed here.

To generate the data referred to in this press release, Starling Bank commissioned research agency Opinium to carry out a survey of just over 1,009 micro businesses in the UK in October 2019. This included sole traders and companies with 1-9 employees.

Read the Make Business Simple report.

How we worked out that micro-firms spend almost two and a half months on financial admin

In our research with Opinium, we found that the average micro-business works 79 hours per week, of which 15 are spent on financial admin – equivalent to 19%. 19% of 52 weeks = 9.9 weeks (average working week of 79 hours)