PRESS RELEASE

Starling Bank first challenger bank to be granted approval to offer customers full range of financial products

27th November 2017

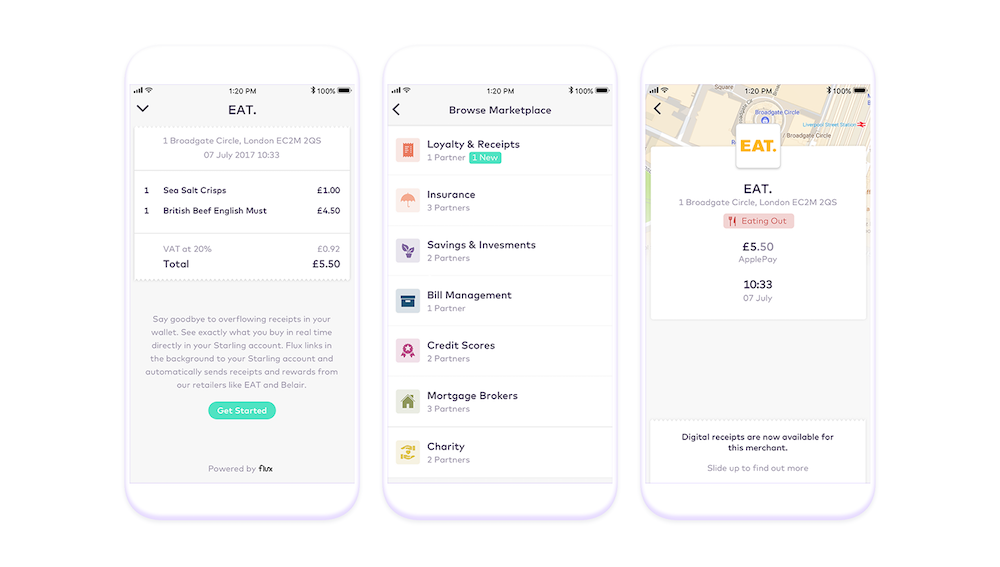

The Starling Marketplace will be a “app store” for financial products all in one place

Customers will be able to access loans, mortgages, isa’s and other investment products through the Starling Bank app

Starling Bank is the first mobile bank to be granted approval from the Prudential Regulation Authority and the Financial Conduct Authority to offer customers direct access to a wide range of financial products, including loans, mortgages, Isa’s and other investment products, all from within its app.

This is the next step in the Bank’s plan to use Open Banking regulations to give financial control back to its customers, and builds on existing partnerships with financial companies such as Moneybox, Yolt and Yoyo wallet.

This announcement is the latest in a number of firsts for the bank, including being the first to offer apple, android and FitBit pay to consumers.

The announcement provides a glimpse of what the upcoming Open Banking framework will mean for consumer banking and demonstrates the real-life, tangible benefits that open and permissioned sharing of data can bring.

Starling Bank CEO, Anne Boden, said:

“This is a significant milestone in Starling's strategy to develop a market leading current account and debit card with a Marketplace “app store” that enables our customers to view and select other financial services solutions provided by selected third parties.“I founded Starling to empower consumers to take control of their financial life, and this license will allow us to provide customers with easy access to products offered by other financial technology companies from within the Starling app. This gives customers transparency and choice – something which the big banks have kept from them for too long - and having an open API enables us to accommodate a huge diversity of customer requirements through a selection of financial services providers.

“Following today's regulatory approval we will soon be introducing new financial service providers to our customers.”