Letter from our CEO

Letter from our CEO

Letter from the CEO, No. 2, August 2019

Anyone who has ever seen the hardbacks stacked up in my office at Starling Bank’s London HQ will know that I’ve always taken inspiration from books. Non-fiction is my addiction. This year, I’ve browsed another shelf in the library and there’s now a different class of books taking up storage on my device. Gone are start-up guides; now the titles are all about high growth. I’ve also developed a passion for reading about the founders of ‘Great Companies’; but more on that later.

This change in my reading habits reflects the remarkable growth we’ve seen at Starling since my last CEO letter in August 2018. Having launched our app in 2017 and built momentum in 2018, we have entered hyper growth mode in 2019.

From scale-up to hyper growth

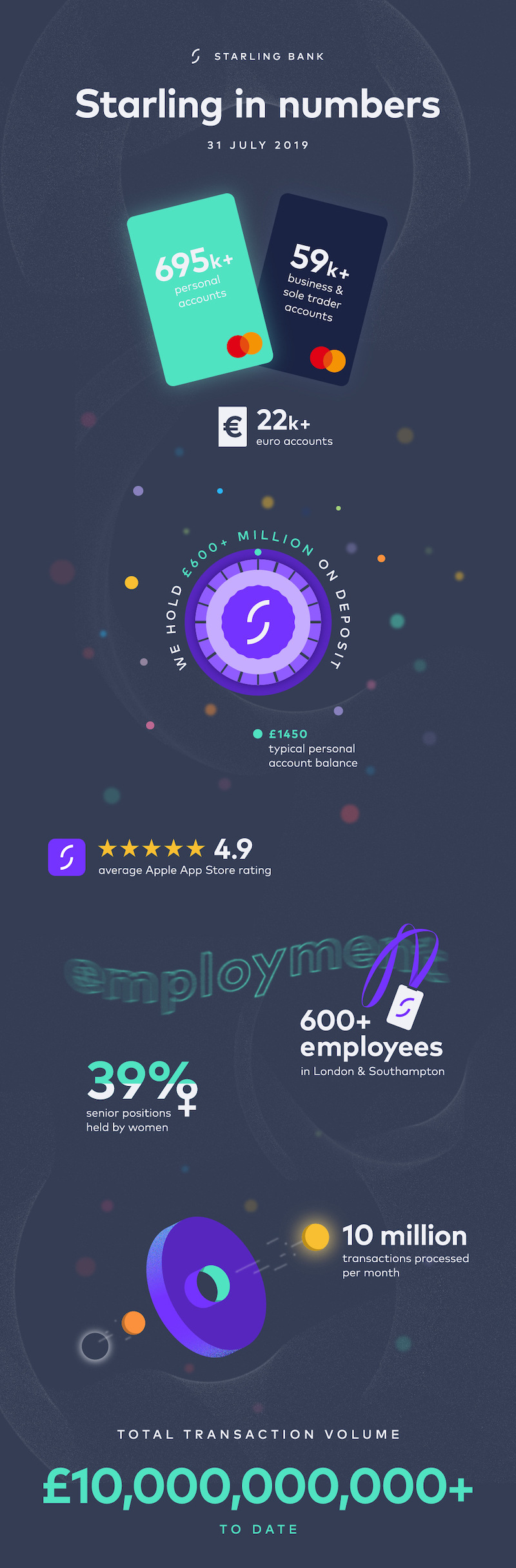

In November 2018, when we closed our financial year, we had 366,000 personal and 19,000 business accounts and we held £202 million on deposit. Now, just eight months later, we’ve surpassed 775,000 accounts in total: 695,000 retail current accounts, 59,000 business accounts for small and medium-sized enterprises (SMEs) and a further 22,000 retail euro accounts. We’re on track to hit one million accounts before the end of 2019.

Our total deposits, meanwhile, have surpassed £600 million and are expected to top £1 billion over the same period. We are now processing in excess of 10 million transactions a month.

Our early adopting customers were excited to be trying something new, dipping in and out of the app for their travel money or splitting the bill with friends. Now, over a 12 month period, a typical personal account customer will reach an average balance of more than £1,450, which is comparable to many of our high street peer banks. For our business account, over a similar time frame, the figure stands at more than £10,500.

People often ask us how many customers pay their salaries into their Starling accounts. For our personal account customers, 32% of active users deposit at least £1,000 into their account per month. Among customers who have been with us for two years, the figure is 41%. For business accounts, 61% of active users deposit at least £1,000 a month.

Counting on success

Since November 2018, our financial performance has continued to outperform our expectations with growth of 110% in our customer numbers and of 200% in our deposit base. This has resulted in a 150% increase in our annualised revenue run rate over the same period. We expect this to double by December 2019. We’re aiming to reach break-even in our UK business at the end of next year.

Expanding beyond the UK

Just like the very early adopters were slightly different from today’s new customers, so is our employee base. In the last 12 months, we’ve grown our workforce by 170%. We now employ more than 600 people in the UK, including 100 engineers and we expect our employee base to surpass 1,000 in the next year.

We’ve opened new offices in Southampton and will soon be in Cardiff too. Looking beyond the UK, we have opened an office in Dublin and are in discussions with the Central Bank of Ireland to gain an Irish banking licence. This is to enable our expansion there and to act as a springboard to our wider European expansion, starting in the Netherlands, France and Germany. We’re already looking for country managers.

A diverse outlook

In senior management, 39% of roles are now held by women, while on our executive committee we’ll have an even gender balance of women and men from 1 September. We firmly believe that diverse teams are stronger, safer and more effective. We are also wedded to the idea of Technology for Good and have made a public commitment to commission a regular independent audit of our algorithms and technological processes to ensure they are fair and free from bias and prejudice. We hope that others will do the same.

Strong backing for a new business model

With no branch network or legacy IT systems to maintain and with a lean and agile corporate structure, we have a highly capital-efficient business model. Our growing revenues from retail and SME banking give us breadth and stability.

To date, Starling has received £233 million in funding. This includes £75 million raised in a Series C round led by Merian Global Investors, including the Merian Chrysalis Investment Company, in February 2019. In Merian we found investors that have both experience of working with financial institutions and the talent and insight to add value strategically to the business.

Also in February (it was a busy month), Starling was awarded a £100 million grant from a fund created to increase competition in the market for SME banking. The grant will help us deliver a technology-driven financial proposition to the small and medium-sized businesses that make up the backbone of the UK economy. The award signalled a massive vote of confidence in Starling.

Continuous innovation

With backing on this level for our business accounts, Starling has committed to creating 398 new jobs in the UK. We’ve also undertaken to invest £94.8 million of the bank’s own money in building out our SME proposition. We are targeting a 6.7% share of the SME banking market within five years.

We’ve started a four-year programme of building a full suite of more than 50 digital banking products that will save time and add value so that our SME customers can get on with what’s important to them - running their businesses.

And because we understand that many SMEs want to manage their banking online as well as through their phone, we’ll be launching a web portal for the business account customers by the end of September. Looking further out, we’re also planning to provide specialist support to our SME customers via video link as part of a long list of new features.

Over the next four years, the Starling Marketplace for business accounts will expand to no fewer than 48 new partners, with the earliest of these including accountancy integrations and other innovative SME financial services.

Our appetite for innovation doesn’t stop there. In fact, it doesn’t stop, full stop. To date, machine learning and artificial intelligence have largely been used by banks for operational efficiency - to automate customer service, or to create risk-based financial models, for example. We’re changing that; we’re taking machine learning and AI and putting them in the service of the customer to create personalised customer experiences and tailored recommendations to best meet their individual needs.

Milestones: the SME bank

This time last year we had 10,000 SME customers. Growth has been so strong that, by July, we had already surpassed our target for the whole year. Average balances are around £10,000 (£6,000, last year) for limited companies and around £1,600 (£900) for sole traders.

Last year we had a 70:30 split between limited companies and sole traders. We’re proud to be picking up customers from the new economy - contractors, freelancers, gig economy workers, side hustlers - and now the split is 60:40.

During the year, we began offering overdrafts to SMEs and sole traders. In a further development, last month, in response to customer demand, we launched multi-owner accounts for businesses with more than one person of significant control. Customers asked, we delivered.

Milestones: the retail bank

Banking regulators have long been concerned about sneaky and confusing overdraft charges. In fact, in June the financial watchdog, the Financial Conduct Authority, outlined new proposals around overdrafts, including bans on fixed daily and monthly overdraft fees and on banks charging higher prices for unarranged overdrafts. Instead, it called for a simple, single interest rate charge to make overdrafts “simpler, fairer, and easier to manage”, to be introduced by April 2020. At Starling, we’re already doing it right. Our overdraft rate is a competitive 15% EAR and we’ve never gone in for fixed fees.

In the last 12 months we’ve launched a personal loan product from within the app that customers can apply for in advance of purchasing a big ticket item. Alternatively, they can use it to spread the cost of something after they’ve bought it. We’ve also launched accounts for 16 and 17-year-olds and a partnership with the Post Office, enabling our customers to deposit and withdraw cash at 11,500 PO branches. The PO counter service is also available to our SME customers.

Another innovation is our euro account, a product usually reserved for the private banking world. It allows customers to switch between sterling and euros instantaneously and enables them to make payments and bank transfers across Europe from within the Starling app. We’re already testing a function that will allow customers to use their Starling debit card to spend in euros as well as pounds.

A one of a kind Marketplace

Our Marketplace, offering access to a range of third party financial services, has added eight new partners in the last year, including Churchill Home Insurance and the accounting software providers Xero and FreeAgent. We don’t have any hidden mark-ups in the Marketplace, so customers pay the same as if they went direct to the provider. The advantage for the customer is the ability to manage their relationship with these services from one app. We earn our commission direct from the partner organisation.

Real humans

But success is not an entitlement. It’s something we need to earn from our customers every day. And that means understanding their daily lives. I talk to our customers all the time - one was so surprised to get a personal email from me the other day that he asked if I was a bot!

Right now everyone at Starling is aware of the pressures our customers may be feeling amid waves of social, political and economic uncertainty and anxiety washing over the country, the globe in fact. Here in the UK, it can feel as if the Brexit debate has sucked all the oxygen out of polite and sensible public discourse. We hope to do our small part to counter this and to bring a bit of calm and common sense by giving our customers the tools to have better control over their financial lives.

Bursting out of the fintech bubble

This is where my book The Money Revolution, published in June, comes in. The idea behind it is to demystify and democratise financial technology. It’s a jargon-free introduction to the ways that digital technology can help us manage our money and suggests practical solutions to everyday issues from budgeting, savings and investments to pensions, bill payments and travel money.

This really is what Starling is all about, helping people manage their finances in a digital, intelligent and intuitive way. Our customers tell us they like us for our ease of use and user-experience. But we must not be complacent. We must keep innovating and launching new products and features.

Another part of our mission involves taking Starling outside of the London fintech bubble. It’s gratifying to see that for most of the past year, our growth has been faster outside the capital than within.

Making a name for Starling

With the success of the fintech movement now so well established, it may be difficult to fully appreciate today just how radical Starling’s aim to reinvent banking was at the time I launched it five years ago. The growth in public recognition of our brand is testament to how far we have come on this front. In July 18% of adults in Great Britain were aware of Starling Bank, up from 12% in December 2018. In London, the figure stood at 33%, up from 17%. More than a quarter of small businesses (27%) in the country, were aware of the Starling brand. We intend to boost these numbers considerably with a television advertising campaign, our first time on TV, in October.

These achievements have been recognised externally. We are a member of Tech Nation’s Future Fifty cohort for 2019. At the Smart Money People Awards 2019 we were voted Best British Bank and Best Current Account for the second consecutive year and were also named Best Business Account, while Forbes ranked us the No.1 UK bank on their World’s Best Bank List for 2019.

Steering the rocket ship

Returning to the entrepreneurial literature that I consume at every opportunity, many of the books liken the high growth experience to hanging onto a rocket ship. Well, it does feel like that sometimes. The important thing is that we remain focused on what we are trying to achieve with Starling, particularly when weighing the competing pressures of profitability vs growth.

Lots of companies pursue growth and don’t care about profitability. Bootstrapped companies, created with backing from the founders’ own pockets, often go for profitability from the start as they’ve no alternative. At the other end are tech titans that pursue growth at all costs, even if it means, by their own admission, that they’ve never figured out a path to profitability. We, as usual, like to do things differently - the Starling way. Our ability to build technology and deliver product is our differentiator. And what we’re doing now is expanding our product range and innovation hand in hand with growing our businesses, with a clear path to reaching profitability.

What success looks like

Once in a while, people ask me why I am doing this and what success looks like. As with many businesswomen I suspect, it doesn’t come all that naturally to me to talk about hundreds of millions of customers and global success. My inclination is to under-promise and over-deliver. It feels arrogant talking about the vision of building a ‘Great Company’, but here goes anyway.

Great Companies do not just reach hundreds of millions of customers, make their investors rich and employ thousands of people. That definition might once have applied to General Electric, Ford and IBM. Great Companies today ought to be more than the near monopolies of Google and Facebook. They should have a social conscience and a mandate to address injustice and promote fairness, as well as having the global reach and influence that allows their voice to be heard. But I’m getting ahead of myself. Today, Starling is no longer a start-up and a lot more than a full scale-up. We are in rocket ship mode, looking forward to our future as a Great Company with fairness at its core.

This incredible journey would not be possible without our customers, our investors and the employees who grow and develop Starling week by week. I would like to thank them all.

Anne