The cost of living crisis is hitting people hard across the UK. Sadly, criminals are taking advantage of the fact that many of us are currently feeling vulnerable and they’re using the opportunity to try and steal funds. Here, we explore some scams to look out for and ways to help stay safe.

SMS and text message scams (smishing)

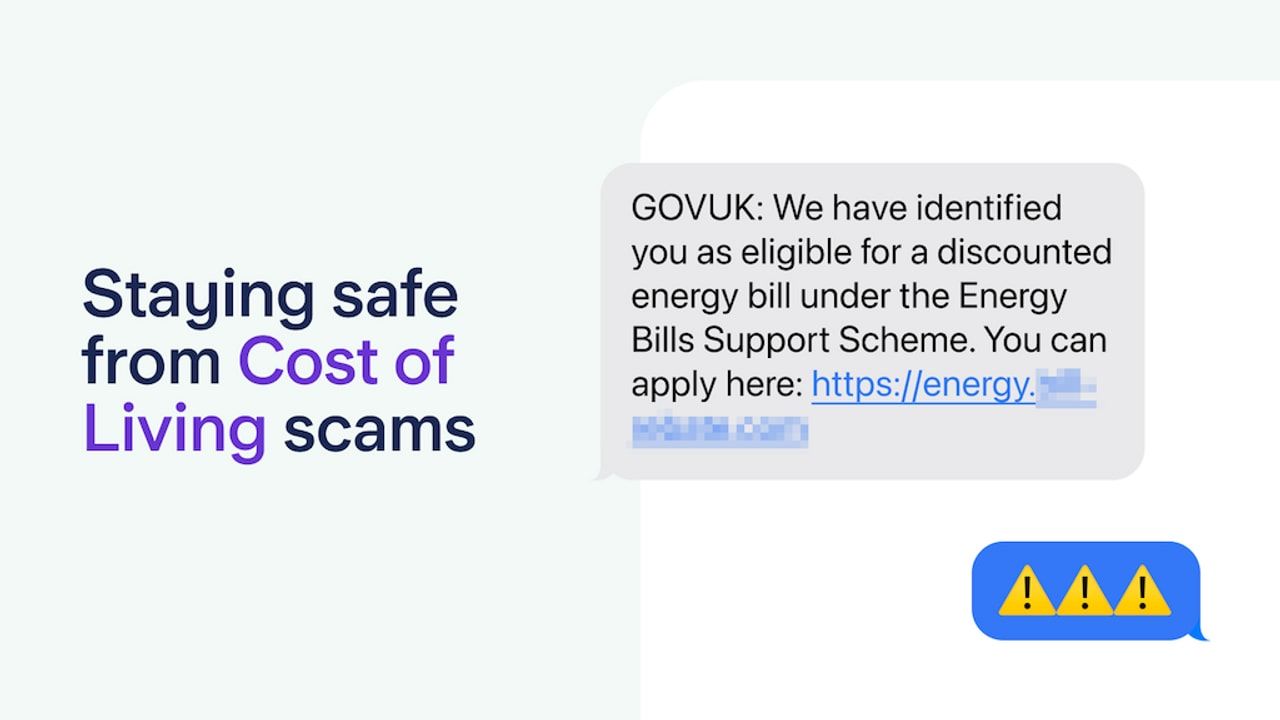

Scam texts impersonating delivery firms have been circulating over the last year or two, so it may come as no surprise that criminals are now using the cost of living crisis to revamp their tactics. Text messages with links to sites where you can ‘apply’ for discounted energy bills are being sent, appearing to come from the government. In fact, the websites are intended to harvest your information so that the criminals can steal your money or scam you later.

If you’re eligible for a grant, it’ll be applied to your energy account automatically. It’s likely that if more help is announced by the government, fraudsters will adapt their messages to include any new aid measures. Go directly to the government service and information pages to check for the latest on grants and benefits.

Always be cautious of texts containing links asking you for personal or financial information, and visit the organisation's website independently to avoid clicking on a dodgy link. You can forward any suspicious messages to 7726 to report the scam to your network provider.

Investment scams

Scammers present ‘investment opportunities’ online, with many being promoted on social media platforms such as Instagram and Facebook. They may even offer to double your money for you in 24 hours. Some scams are more sophisticated, impersonating genuine FCA (Financial Conduct Authority) regulated firms, using fake websites, email addresses and even making phone calls appear to come from a particular number (a trick called spoofing).

To avoid a scam, the most important thing you can do if considering investing is to check the FCA’s Scam Smart website to see if the company is legitimate. Always make sure that any company or financial advisor you consider investing with is registered by the FCA. It’s important to remember that returns on investments can go down as well as up - they’re never risk free.

Loan scams

Fraudsters are trying to take advantage of people who need a loan. They often pretend to offer loans to those who can’t obtain credit elsewhere, or claim to have lower interest rates than other companies. These loans may be advertised on fake loan comparison sites or on social media and may even impersonate a genuine credit provider. Once ‘accepted’ for the loan, you’ll be asked for an upfront fee, often referred to as a processing, insurance or security fee, which is something regulated lenders won’t do.

If you’re looking for a loan, make sure you research the company, ensuring that they are FCA regulated. More advice can be found in our loan scam blog.

Online shopping scams

Fancy a pair of designer trainers with 60% off? This sounds like a bargain, but it’s exactly how scammers advertise items on social media or fake websites, knowing that everyone loves a discount. These scams are extremely common, so it’s important to be vigilant. When buying from a website, make sure you carry out the checks listed in our online shopping scams blog to try and ensure it’s genuine.

If you’re buying from a marketplace (like Gumtree or eBay) or via social media, always attempt to see the items in person (or by video call) before and pay by card or using Paypal’s goods and services option for added protection. Do not rely on the number of social media followers/likes when looking at a merchant’s profile, as these could be fake - they’re very easily purchased. Lastly, trust your gut - if an offer seems too good to be true, it probably is!

Mobile phone contract scams

Another recent scam involves fraudsters calling people, impersonating mobile network providers (or claiming to be working for them) to offer exceptional deals on the latest phones. If they get you to agree to buying the latest iPhone, they then take all the personal and financial details required to apply for a mobile contract, using this to make a ‘real’ application on your behalf.

The sneakiest part is that they actually apply for the wrong phone model, so when it arrives, you reach out to them to find out why. The scammers insist that it’s a mistake and ask you to send the phone back - only the address they give you belongs to them, not the network provider. So you’re left to pay for a phone that ends up in the hands of a criminal!

If you receive a call from a network provider out of the blue, trying to sell you an upgrade, hang up and call them back on a number you find yourself on their website. This way you can verify who you’re talking to and enquire about the latest deals, safe in the knowledge that you’ll end up with the phone you actually want.

For more scam advice and updates on the latest trends, visit our friends at Take Five - a national campaign encouraging consumers to Stop, Challenge and Protect themselves from fraud.