Rachel Kerrone is Starling’s Director of Brand and Marketing and mum to three boys. Here she speaks with other parents about the best age to give pocket money to kids.

When should parents start pocket money?

When my youngest turned six, his present was his own bank card. My husband and I wrapped it up for him and gave him his own wallet. It’s probably not what most parents would give their six-year-old, but he was so excited. As soon as he opened it, he asked if we could go to M&S and when we got there, he chose some Percy Pig sweets. He loved being able to tap his card and pay for it himself - it made him feel so grown up.

My older two are twins and also have their own debit cards. Each week, we top up all three cards automatically. We give them £5 a week (the average pocket money amount in the UK) but we’ll cancel the transfer if they haven’t helped round the house – made their beds, done their homework, etc. It’s not linked to specific chores but it does depend on them generally being helpful!

The twins, who are 11, saved up their pocket money and birthday money for more than a year so that they could buy BMX bikes. They loved seeing their balance go up and up and being able to buy something substantial that they really wanted, although they were gutted when they checked their balance after buying the bikes! The younger one, who’s eight now, wants one too. I’ve said he can do more chores if he wants to earn extra pocket money. But he hasn’t taken me up on that… even though he’s desperate to make up the difference.

When I spoke to other parents about pocket money, I found that lots of them start giving their children pocket money at around five, although some wait a few more years. The parents I spoke to below were all part of Starling business customer Frankie Tortora’s freelance parent network, Doing It For The Kids (DIFTK). Here’s what I discovered:

Is linking pocket money to chores a good idea?

“We tried to introduce pocket money when ours were five and eight, and related it to chores,” says John Spurgin, a freelance web and app developer. “We drew up a ‘contract’ for each and they signed it.”

The next stage didn’t quite go to plan: “The chores didn’t get done, so they didn’t get paid. And annoyingly they don’t seem to care, as they still have a supply of cash in their money boxes from Christmas and birthdays.”

More recently, John’s eldest has shown more interest, but only after a bit of negotiation. “He asked for £10 to help with cutting the grass over the summer, I offered him £2 and we settled on £5. But there have been times where he hasn’t negotiated quite as well, and has asked for £2, which I’ve accepted straight away and later told him I would have settled on £5, if he’d pushed.”

The case for handing out weekly pocket money

Some parents choose not to link pocket money to chores, but make it clear that their child can receive extra money if they do extra tasks around the house. This is Jo Shock’s technique. Jo runs Streamlines Virtual Support, through which she supports others with one-to-one client management. She started giving her son pocket money when he was five.

“At first he didn’t really get what it was for, but he’s nearly six now and he’s begun to understand more about value, so the timing has worked quite well. We’ve taken him to the secondhand toy shop a few times with his pocket money as a good way for him to learn what he can and can’t afford.”

Jon Richards, who runs the graphic design business Obladee, also gives his five-year-old a regular amount each week. “It’s not related to household chores, but we’re clear that we all live in the house together and we’re all expected to help keep it nice.”

Andrew Miller, a freelance software engineer, does a similar thing. “I introduced pocket money to our first child just after he turned four. It’s currently £1 a week in change.”

Tips and tricks to encourage saving habits

The reason Andrew gives the £1 pocket money in change is because they have “four jars: one for collections at church (10% - 10p), one for savings (20% - 20p), one for spending and one related to extra chores/good and bad choices.”

The fourth jar is filled with marbles, rather than coins. “When that jar reaches a certain line, we treat him at a café or give him a larger toy that we go shopping for.”

How much pocket money should I give my kids?

There isn’t a right answer to this. It’s totally up to you! It depends on what you can afford, how much you buy for them and what you expect them to buy for themselves, such as clothes.

Jon Richards relates the amount he gives his children each week to how old they are. “We give them 50p per week based on age, so our five-year-old gets £2.50 a week and our seven-year-old gets £3.50.”

Accountant Emma Bail doesn’t give her seven or nine-year-olds pocket money on a regular basis but gives her 16-year-old £20 a week. Emma runs Evolve Accounting. “We give the younger ones money if we do a day out or go on holiday. And we encourage them to make purchases independently, although our nine-year-old has a learning disability so she needs more support.”

Remember to make pocket money equal

If you’re struggling to decide how much to give your child, chat to fellow parents. Not only can this give you some guidance, it can help you make sure what you give is fair - our #MakePocketMoneyEqual research found that boys receive an average of 20% more pocket money than girls.

Cash or card?

Some parents, like Andrew, deliberately give pocket money in coins - it helps teach children how to add up and things like the number of coins needed to make £1. You can also try doing this through games: “We have a game called ‘Pop to the Shops’ which is great for helping them with coins,” says Jon.

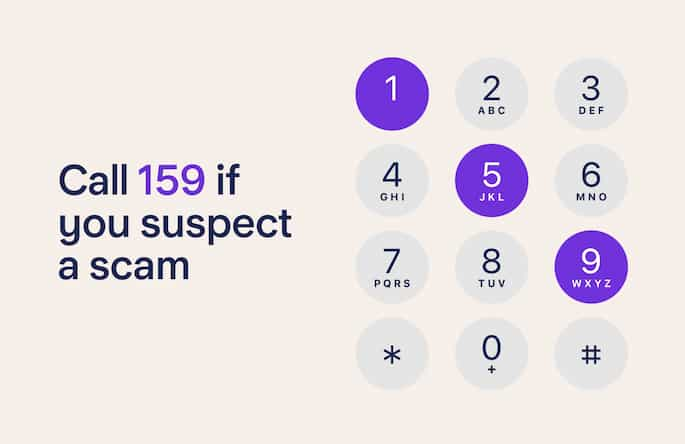

You may find it easier to use a digital solution for pocket money, like Kite, our debit card for kids. Your child will receive their own debit card, made from recycled plastic, which you can top up on a weekly or monthly basis with an automatic transfer through the Starling app.

I use Kite for my own kids – they love being able to check their balance on our app and have their own cards. I love that it’s set up from our joint account. The responsibility doesn’t just fall on one parent, we share it.